Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

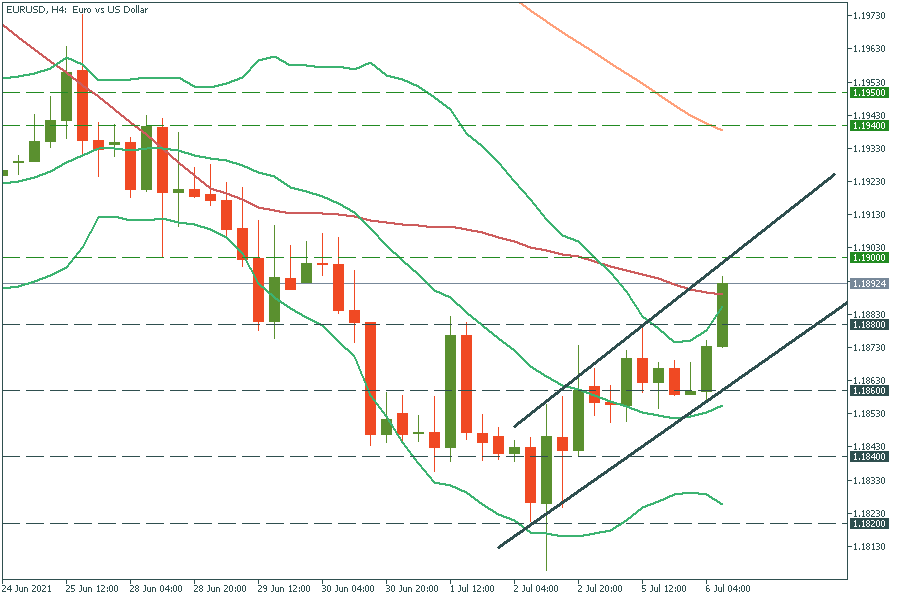

Personal areaEUR/USD has surged above the 50-period moving average and edging higher to the psychological mark of 1.1900. It may struggle to cross this resistance level on the first try, that’s why we can expect a short pullback to the 1.1880 support before the further rally up. When the pair crosses 1.1900, the way up to the next resistance zone of 1.1940-1.1950 will be clear.

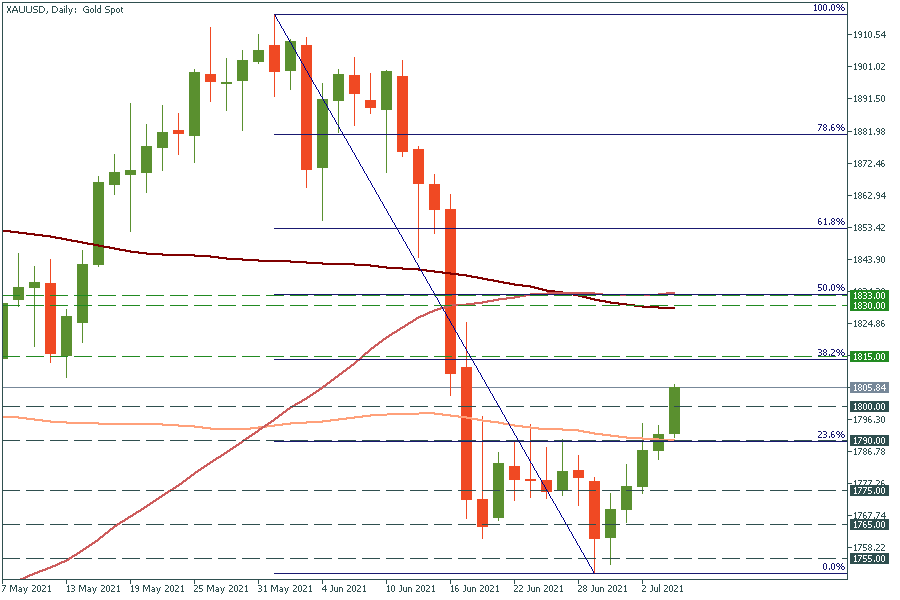

Gold (XAU/USD) has broken above the psychological mark of $1800. It’s likely to reach the 38.2% Fibonacci retracement level of $1815. If it breaks above it, it will jump to the key resistance zone of $1830-1833, which will be hard to break on the first try. Support levels are $1800 and $1790.

Finally, let’s analyze NZD/USD. As mentioned above, the New Zealand dollar surged due to the optimistic business survey. However, if we look at the chart, we would notice that the pair has approached the key level of 0.7100, which it has failed to cross a few times already. Thus, the pair is likely to reverse down from it. Support levels are the lows of late June at 0.7050 and the 50-period moving average of 0.7020.