Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaEUR/USD seems weak. The pair is likely to reach the lows of August 19 at 1.1670, if it breaks through the psychological mark of 1.1700. On the flip side, if it manages to jump above the recent high of 1.1740, it may rally to the 50-day moving average of 1.1775.

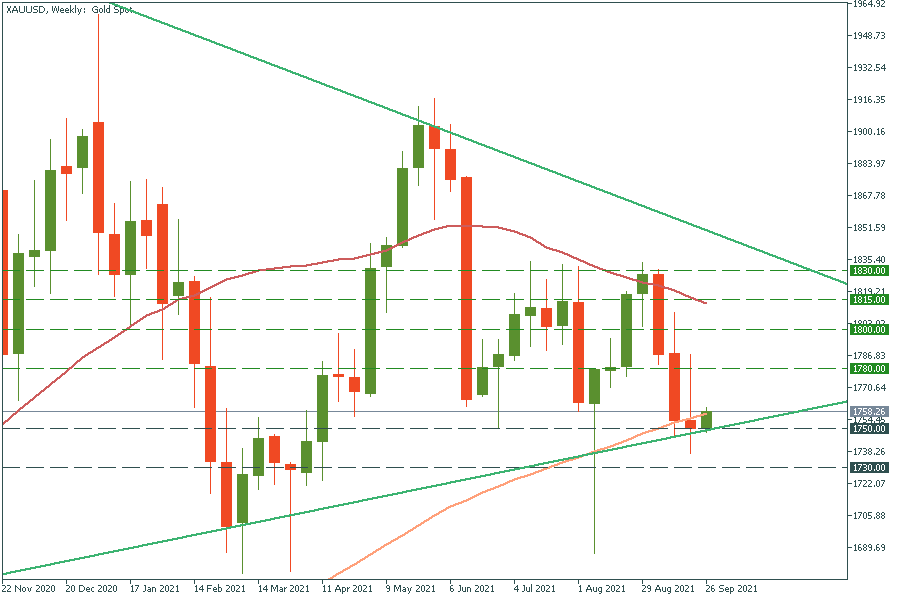

Gold has reversed up from the strong support level of $1750. It lies at both the lower line of the triangle pattern and the 100-day moving average. It may reach the resistance level of $1780 soon if the uptrend continues. The jump above it will push the pair up to the psychological mark of $1800.

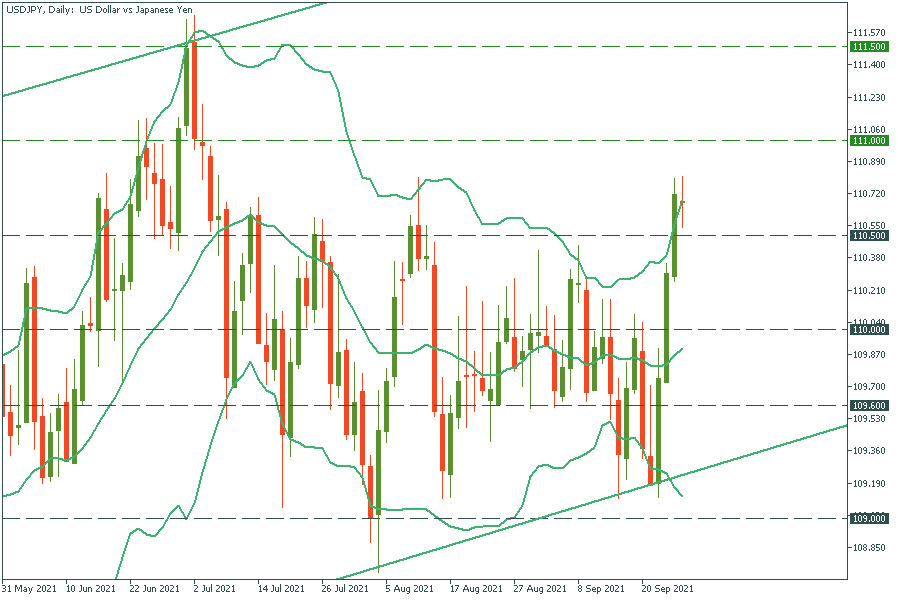

USD/JPY has jumped above the resistance level of 110.50 and pulled back. Indeed, the rally was quite fast and the pair needs a break. It can be just a short sell-off before further growth to 111.00. Support levels are 110.50 and 110.00.