Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaEUR/USD has approached the low of August 19 at 1.1670. The euro looks weaker than the US dollar, that’s why the downtrend is likely to continue. If it manages to break through this support level, it will drop to November lows of 2020 at 1.1630. Resistance levels are 1.1700 and 1.1740.

Gold has formed the triangle pattern. If it drops below the lower line of the triangle and the candle closes below it, it will fall to the August low of $1730. After that, the metal may plunge to the psychological mark of $1700. Resistance levels are $1780 and $1800.

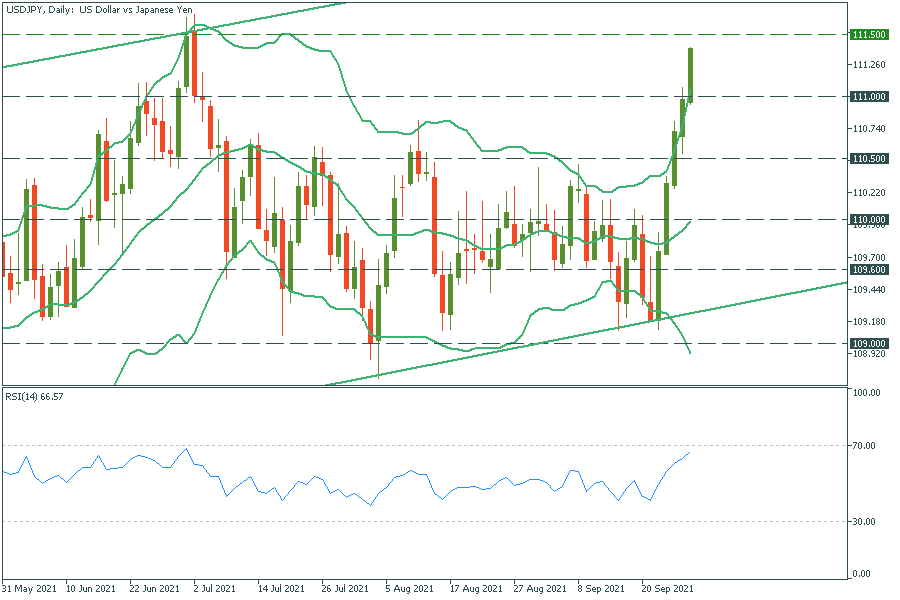

USD/JPY is rocketing like crazy. It has been making large green candles for 5 days in a row. The 111.50 should be a strong resistance level, which the pair may struggle to cross and pulled back to 111.00. The RSI is getting closer to the overbought zone, and the pair has already jumped above the upper line of Bollinger Bands. Be ready for reverse down.