Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

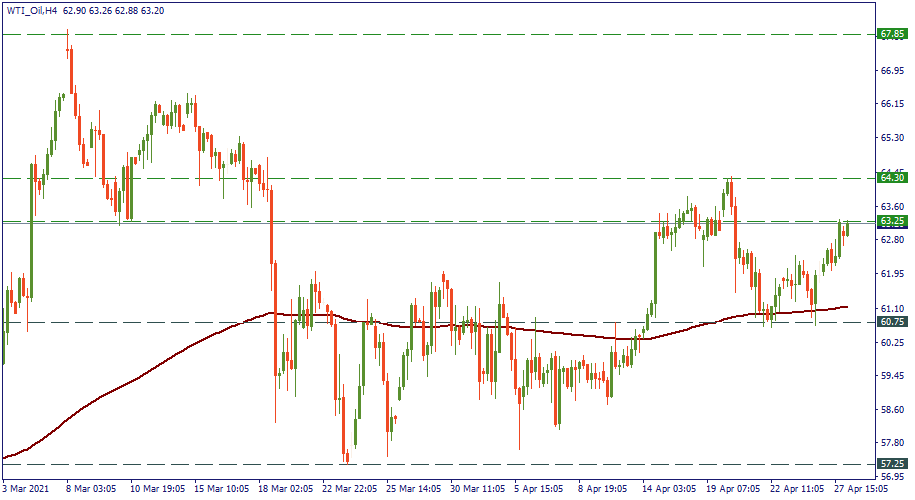

Personal areaOPEC+ had a teleconference on Tuesday and confirmed a positive global demand outlook. That allowed the cartel to proceed with their plan to gradually increase the oil supply by 2mln barrels per day over the next three months.

The market saw that as positive news and an indication of the global oil demand recovery. Eventually, the WTI oil price spiked above $63 per barrel.

OPEC+ is interested in a stable oil market. Although the decision was made not without inner discord in the cartel, Saudi Arabia would unlikely proceed with the supply increase if there was no solid ground for that plan. Hence, global observers can take that as a confirmation that things are really going better on a global scale - at least, as far as oil is concerned.