Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaPayPal brought an EPS of $1.22 vs. $1.01 and revenue of $6.03 vs $5.90 beating the market expectations. Also, the CEO of the company announced that they are moving towards a digital wallet that’ll allow crypto asset transfers. Nevertheless, the forecast-beating data and the new market expansion plan were not enough to push the stock through the local resistance level or even make it come closer to $275. The price is trebling above the local support of $245, below all the MAs, and doesn’t seem exactly bullish at the moment.

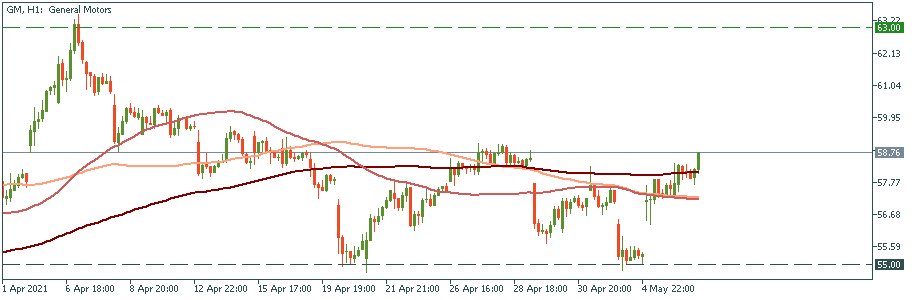

General Motors performed far better than PayPal against the forecasts. The estimation of the market was an EPS of $1.04 and revenue of $32.67. While the actual revenue was $32.47, the EPS resulted to be $2.25 –more than twice as much as the market expected. That impressed observers enough to make the stock bounce off the local lows of $55 and make it cross all the MAs challenging local highs. The all-time high of $63 is now a feasible target for bulls.

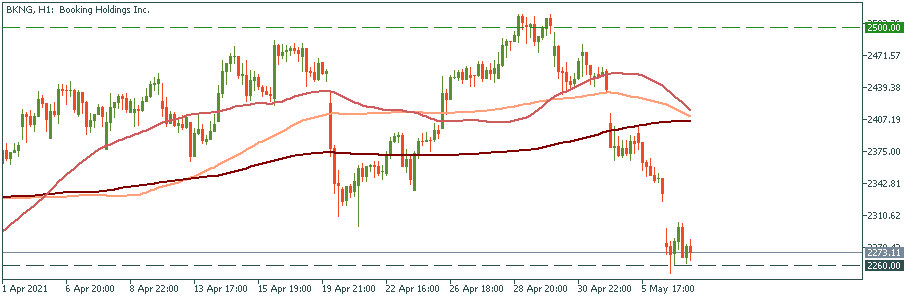

Booking Holdings was having a different struggle during the first quarter of the year. As the travel was most hit by the virus, observers were expecting a loss in line with the industry-wide damage. Booking managed to report losses less than the market estimates: an EPS of -$5.26 was brought against the expectation of -$5.97, and revenue of $1.24B beat the forecast of $1.2B. Despite the positivity of the report, the stock price did not rise nor did it even stay afloat around $2340 when the report was out. Instead, it dropped to $2260 reflecting the disappointment of investors and presenting a fragile short-term outlook.

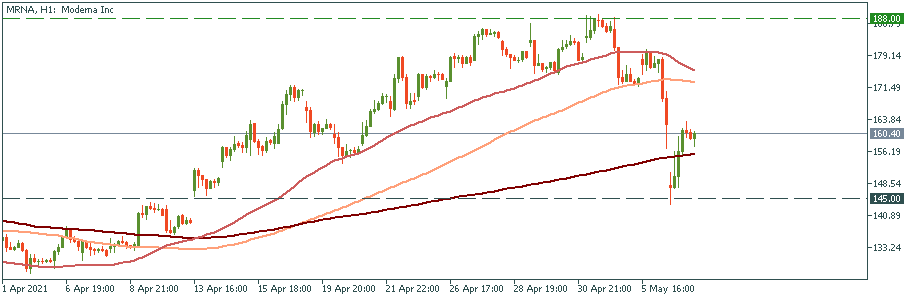

Moderna’s plunge was spectacular. It beat the EPS expectation of $2.6 with the actual figure of $2.84 but revenue missed the target: $1.94B vs a greater forecast of $2.23B. Apparently, the disappointment was big enough to make the stock price plunge to $145 erasing gains of the last three weeks. Although it quickly recovered some of the losses rising to $160, the resistance zone of the all-time highs of $188 is far away once again.