Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

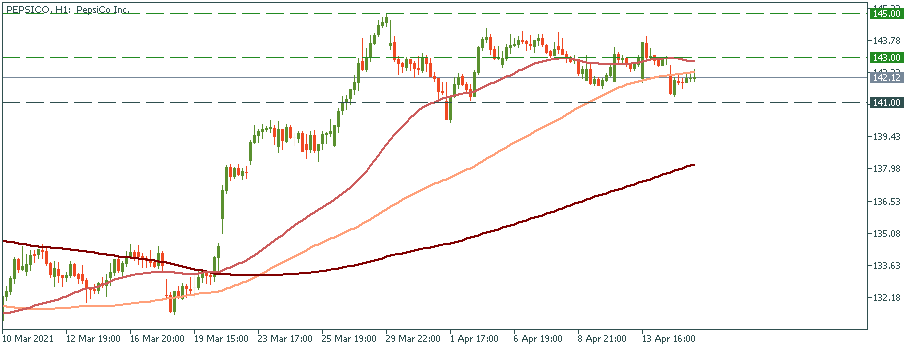

Personal areaThe EPS of $1.21 beats the expectation of $1.12; the revenue of $14.82bln beats the expectation of $14.55

The figures brought by PepsiCo are better than observers thought so the move will be likely bullish for this stock. However, the difference between the forecast and the actual data is not that big, that's why bulls won't be likely to push it much - most probably, the stock will rise above the 50-MA into the channel $143-145.

The EPS of $0.86 beats the expectation of $0.66; the revenue of $22.9bln beats the expectation of $22.1bln.

The Bank of America's data by far exceeded the expectation, so bulls will likely push the price above the all-time high of $40.30 which is just 1% away from the last price when the market closed yesterday - $41 may be a possible target.

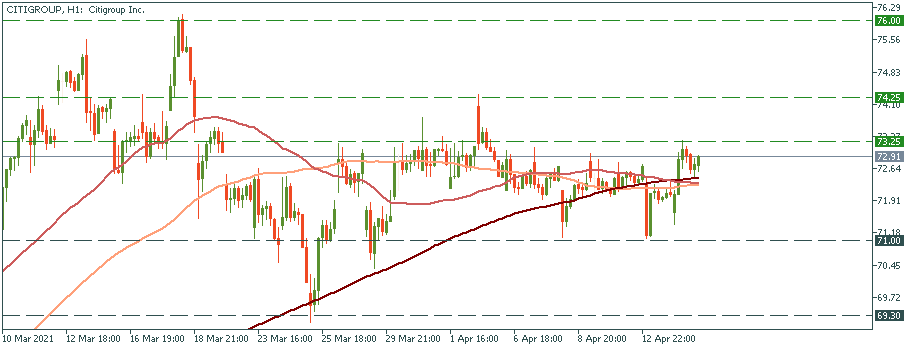

The EPS of $3.62 beats the expectation of $2.24; the revenue of $19.3bln beats the expectation of $18.82bln.

For Citigroup, most observers expected a pretty weak performance. Now, as the bank reports stronger data, its stock may well surge above the local highs of $74.25 and pick up a new uptrend towards $76.00.