Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaEUR/USD has dropped back to the 50% Fibonacci level at 1.2150 after breaking it. It should be just a natural sell-off ahead of the further rally up to the 61.8% Fibo level at 1.2200. EU speeds up vaccinations, so it may help the euro to rise. Support levels are at the recent lows of 1.2100 and 1.2030.

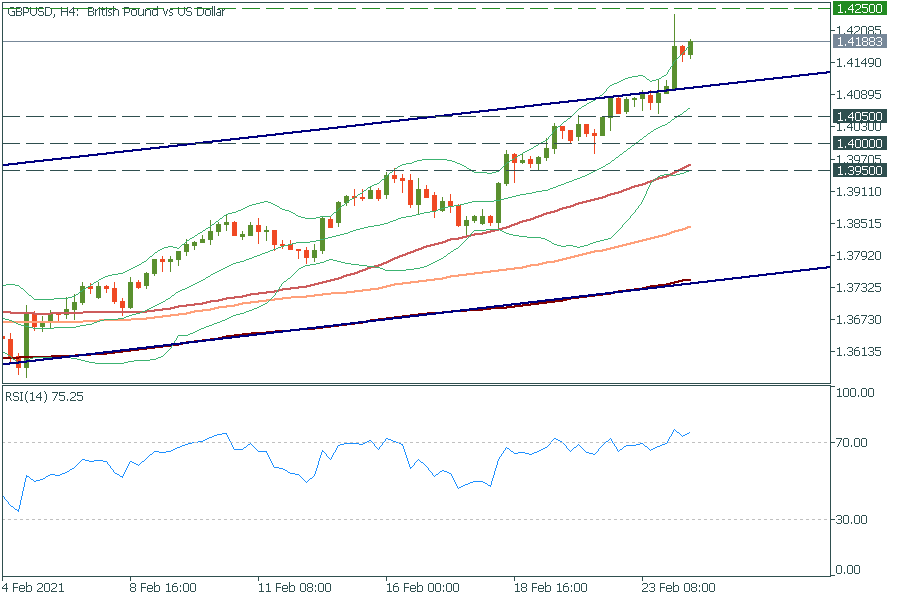

GBP/USD has broken the ceiling of the channel established in November. The way up to the next resistance at 1.4250 is clear now. However, the RSI indicator in combination with the Bollinger Bands point to the overbought zone. Thus, we could see a drop to the recent low of 1.4050 soon. The next support will be at 1.4000.

USD/JPY has approached the 200-day moving average of 105.50. If it manages to break it, the way up to the next round number of 106.00 will be open. Support levels are Monday’s low of 105.00 and the low of February 9 at 104.50.

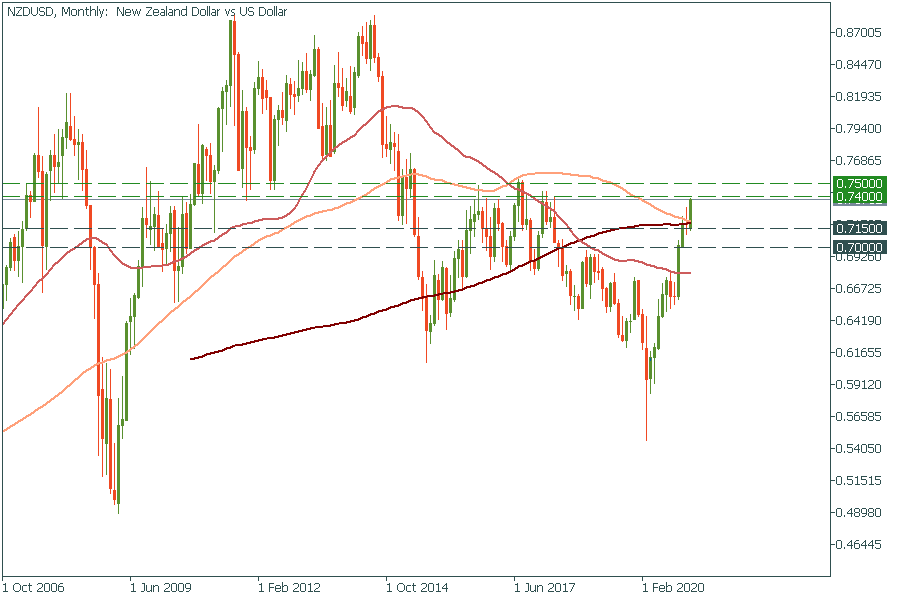

NZD/USD is heading to 0.7400. If it manages to break it, the way up to the next round number of 0.7500 will be clear. In fact, if we look at the monthly chart, we’d notice that 0.7500 is a key level that was support, but now plays as a resistance. Since the price retraced back to this level, it is likely to reverse down. Support levels are 0.7150 and 0.7000.