Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

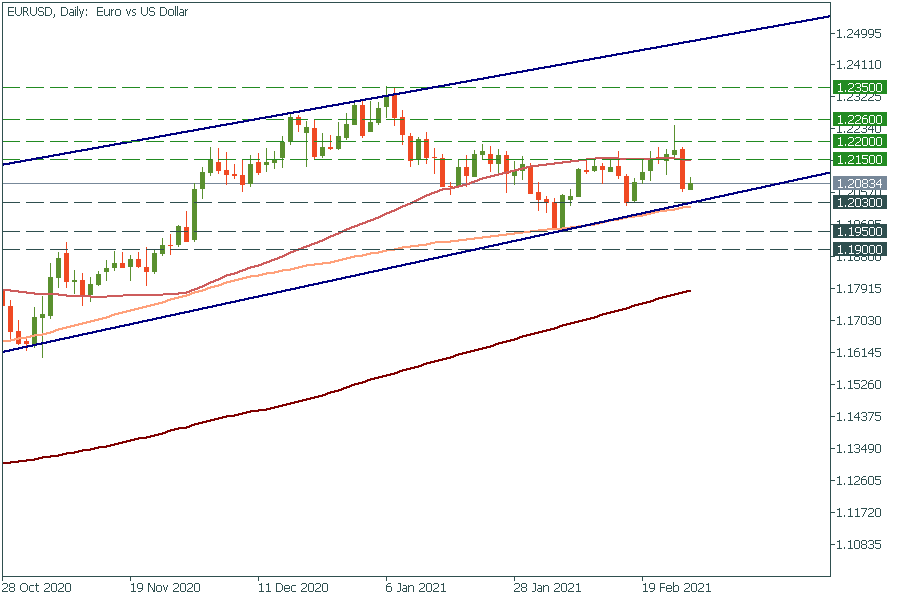

Personal areaEUR/USD has been trading in an ascending channel since mid-summer. It is trading in the lower part of the channel, therefore, it’s likely to move upwards. If it manages to break the 50-day moving average of 1.2150, the way up to the next resistance of 1.2200 will be open. Support levels are 1.2030 and 1.1950.

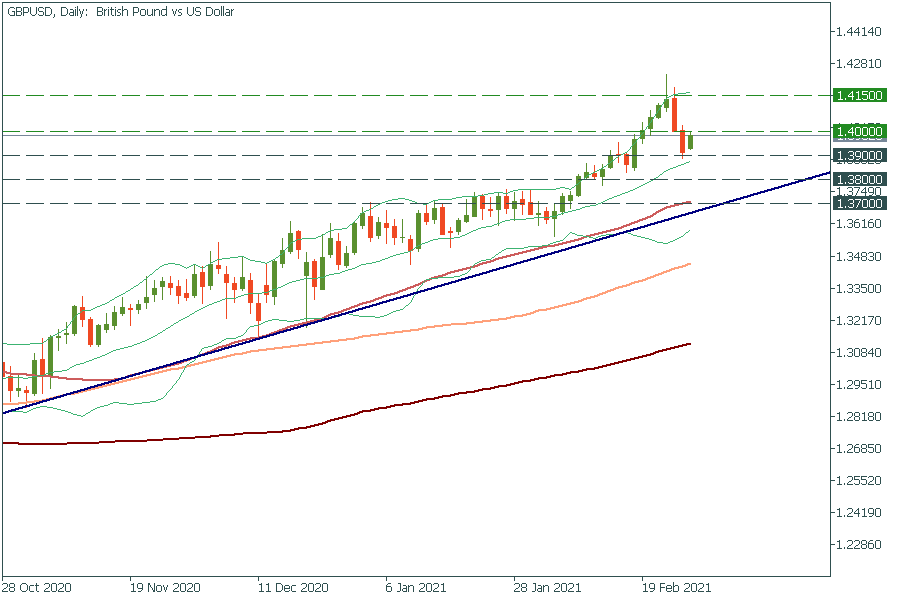

GBP/USD is just below the key psychological mark of 1.4000. If it jumps above it, the doors towards the high of February 24 at 1.4150 will be open. On the flip side, the move below the middle line of the Bollinger Bands at 1.3900 will press the pair down to 1.3800.

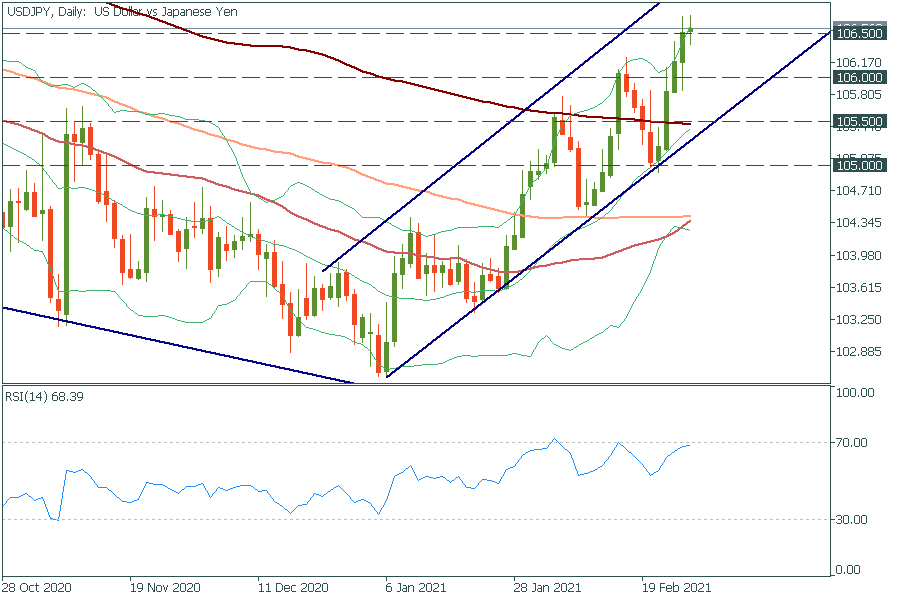

USD/JPY has crossed the resistance of 106.50, clearing the way to the next resistance of 107.00. However, if we look at the RSI indicator and the Bollinger Bands, we’ll notice that the pair has already entered the overbought area, thus, a soon pullback down is expected. Support levels are 106.50 and 106.00.

Finally, let’s discuss the aussie. AUD/USD has bounced off the 50-day moving average of 0.7700. If it manages to break above the high of February 16 at 0.7800, it may jump to the next resistance of 0.7910. On the flip side, the move below 0.7700 will drive the pair down to the next support of 0.7660.

Follow ISM Manufacturing PMI at 17:00 MT time!