Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

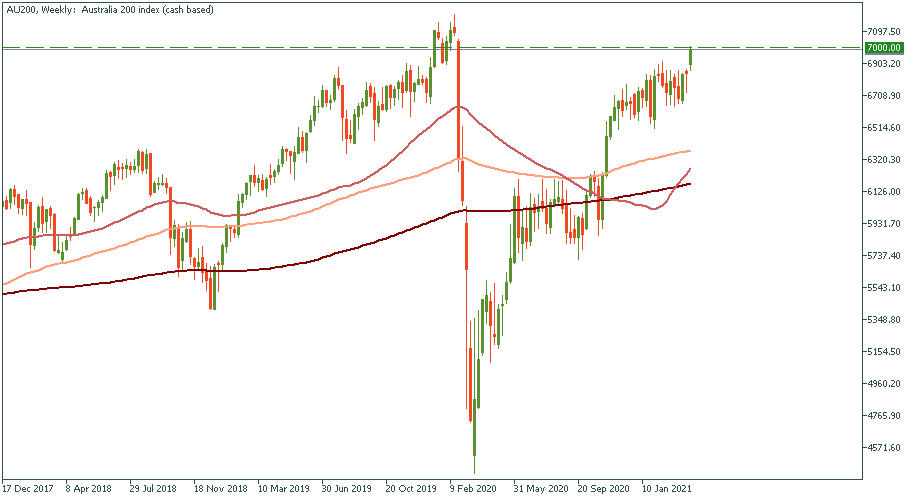

Personal areaFor the first time since January 2020, the S&P/ASX 200 is right at the gates of 7000. It was around there a while ago, though, but right now, it seems to be the moment of the final breakthrough. The 15-month high is about to get broken!

Apart from just being a nice round number, 7000 is the mark where the Australian stock market was when the virus hit over a year ago. Crossing this mark would signify that the country’s economy has made a firm step towards complete recovery. Therefore, it’s important psychologically as much as fundamentally.

Mainly, that’s because the Australian economy is in a stable recovery with no major headwinds ahead. That’s supported by the highly accommodative monetary policy of the Reserve Bank of Australia, committed to aiding the economy wherever and whenever there is the slightest need for that. While the inflation and employment indicators are still far away from their respective targets, the dynamics observed in both fields are positive.

Indirectly, the global, and particularly, American economic recovery are helping that, too. We remember that back in 2020, Australia was one of the first countries that started its way out of the depression because China, its major trade partner, was heading there as well. However, the US wasn’t there yet – that was one of the main reasons for the slowdown in Australia observed through summer and up until the very end of the year. Now, with the American market recovering fast, Australia has an upbeat outlook, too.

In MT5, you go to Symbols, open the CFD Cash folder, and find AU200 – it corresponds to ASX 200.