Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaSomething more Important than NFP

For a long time, traders considered American Non-farm Payrolls (NFP) the most important release in the market. However, the situation has changed. Now US CPI moves financial markets.

For a long time, traders considered American Non-farm Payrolls (NFP) the most important release in the market. However, the situation has changed. Now US CPI moves financial markets.

United States Bureau of Labor Statistics will release monthly CPI and core CPI on December 10, 15:30 GMT+2. The Consumer Price Index measures the average change in prices consumers pay for a basket of goods and services. The CPI statistics cover a variety of individuals with different incomes, including retirees, but do not include specific populations, such as patients of mental hospitals.

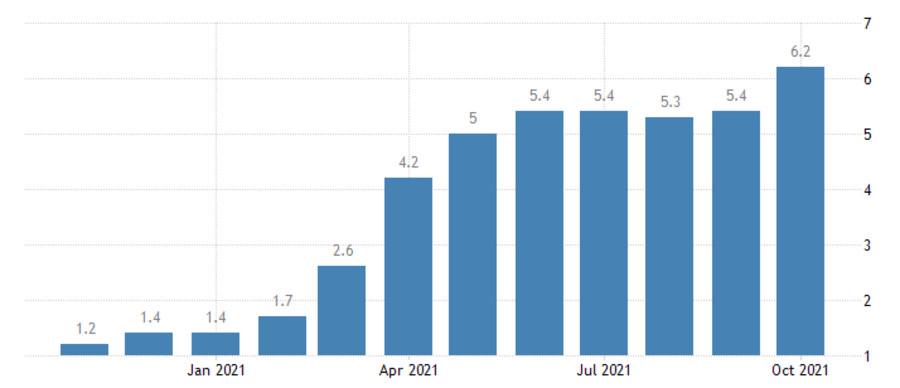

For a decade, the US maintained the inflation rate relatively low (around 1-2%). However, in 2021 it hit 6.2%, a 13-year high.

Moreover, US consumer prices jumped in October at the fastest pace in three decades as inflationary pressures spread further throughout the economy, putting the Biden administration on the defensive and increasing prospects that the Federal Reserve will raise interest rates next year.

Concerns over another wave of Covid-19 may affect tapering plans. But in sight of a relatively slow tapering process and rate hike that is still far away, inflation in the US may reach 10% in several months. Almost every release of CPI has been accompanied by massive movements in USD-related assets and USD currency pairs. For example, last month showed an unusually high increase in inflation. The USD rose versus other currencies and fell against gold. The metal soared 4500 pips after the release.

Due to the importance of CPI data, it may influence gold and USD pairs. Gold is considered a hedge against inflation, but high numbers increase the chance for rate hikes so that the metal may fall against the greenback.

Check the economic calendar

Instruments to trade: XAU/USD, EUR/USD, NZD/USD, USD/JPY.