Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

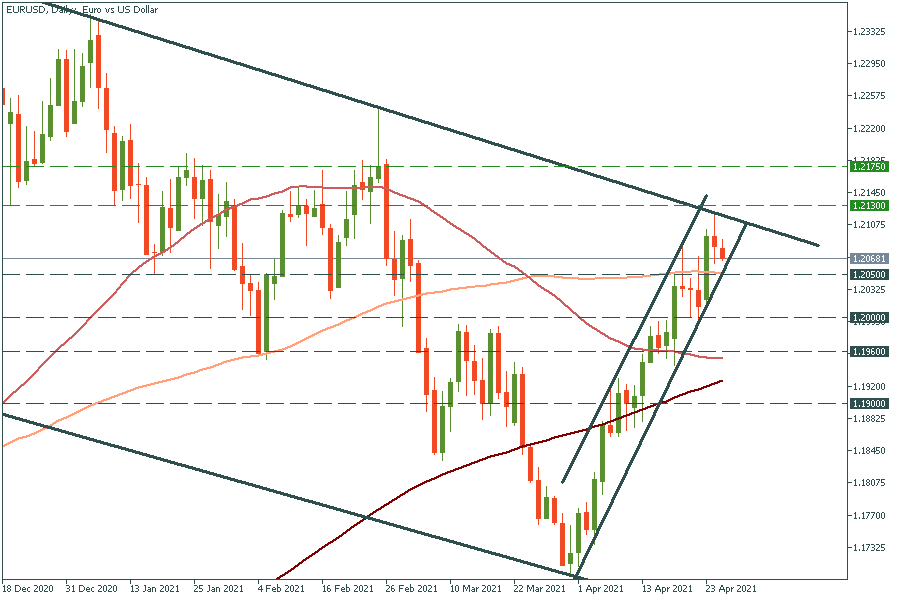

Personal areaEUR/USD has been moving inside the ascending channel in the short term, but in the long term, it is still inside the descending channel. If it manages to break its upper long-term trend line at 1.2130, the way up to the high of February 25 at 1.2175 will be open. On the flip side, if it breaks the 100-day moving average of 1.2050, it may fall to the key psychological mark of 1.2000.

USD/JPY tried to recover its recent losses, but the 50-period moving average and the upper trend line at 108.25 stopped it from further rising. Therefore, the reverse down is likely. If it falls, it may meet support levels at the psychological mark of 108.00 and the low of April 26 at 107.70. Resistance levels are April highs of 108.50 and 109.00.

GBP/USD is making efforts to break the 1.3900 resistance. If it manages to do so, it will open doors towards the high of April 19 at 1.4000. In the opposite scenario, the move below the low of April 23 at 1.3825 will drive the pair down to the low of April 9 at 1.3680.

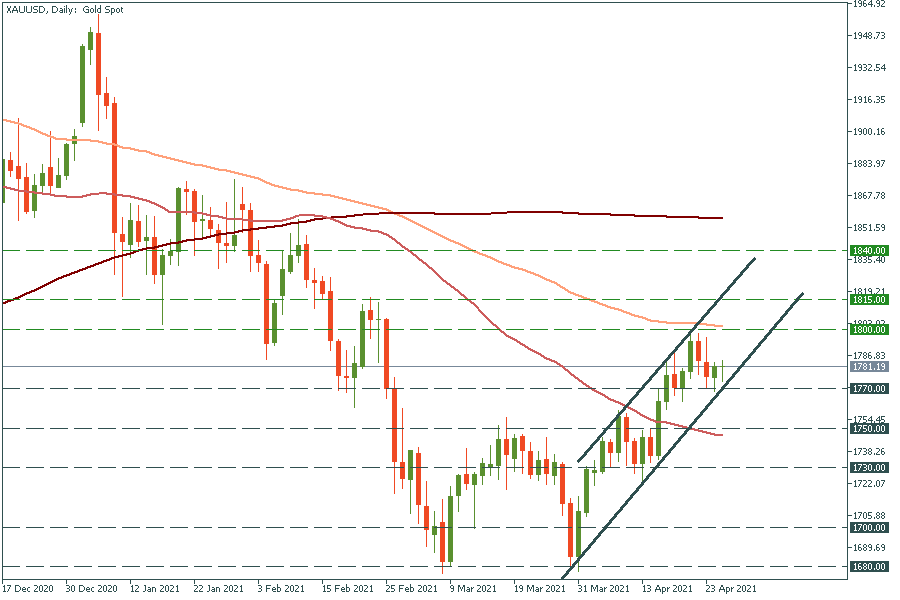

Gold is rising inside the ascending channel. If it breaks the 100-day moving average of $1800, the way up to the high of February 23 at $1815 will be open. On the flip side, the move below the lower trend line of $1770 will press gold down to $1750.