Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaBank of Canada (BOC) will make a statement on December 8, 17:00 GMT+2.

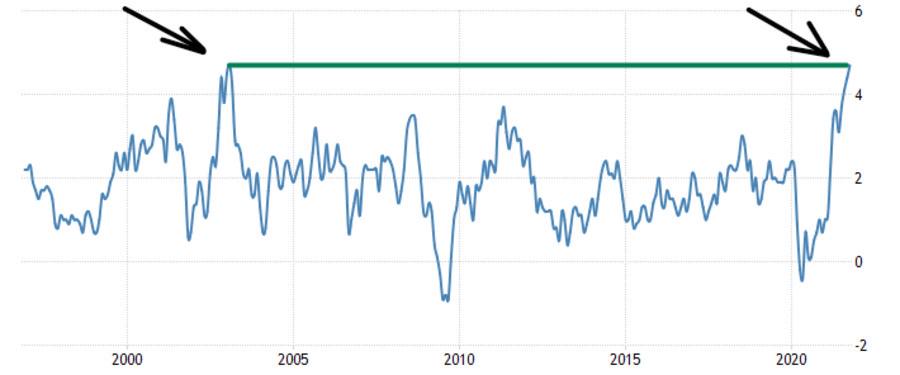

Bank of Canada (BOC) will make a statement on December 8, 17:00 GMT+2. A month and a half ago, BOC surprised investors by abruptly ending its bond-buying program and pulling forward its expected timeline for interest rate rises. As a result, there was a heavy sell-off in Canadian government debt. As for inflation, consumer prices in Canada rose at their fastest rate in 18 years in September 2021, as the country continued to grapple with global supply chain issues.

The annual inflation rate hit 4.7% in October, its highest level since February 2003. It’s logical to hike rates to slow inflation. The Bank of Canada last month signaled it could start hiking rates as soon as April 2022.

Analysts expect BOC to leave the rates on current levels. If the bank doesn’t do something unexpected (hike rates), Loonie will remain weak and may experience a decrease against USD and JPY.

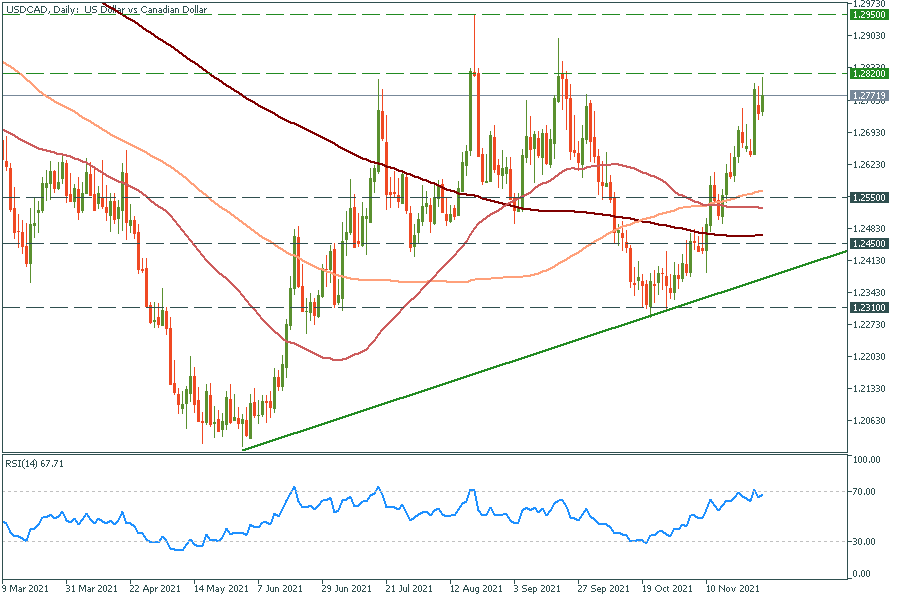

USD/CAD daily chart

Resistance: 1.2820; 1.2950

Support: 1.2550; 1.2450; 1.2310

The main affected pairs are USD/CAD and CAD/JPY.

Check the economic calendar

Instruments to trade: CAD/JPY, USD/CAD, CAD/CHF