Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaUnited States CPI results will move the dollar!

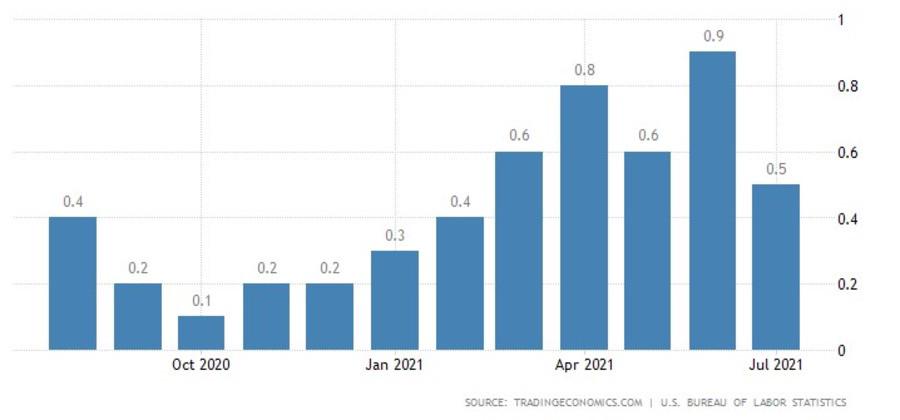

United States’ Bureau of Labor Statistics will release monthly CPI and core CPI on September 14, 15:30 GMT+3.

United States’ Bureau of Labor Statistics will release monthly CPI and core CPI on September 14, 15:30 GMT+3. The Consumer Price Index measures the average change in prices that consumers pay for a basket of goods and services. The CPI statistics cover a variety of individuals with different incomes, including retirees, but does not include certain populations, such as patients of mental hospitals.

Investors, traders, banks, and governments are watching CPI data because it is the most widely used measure of inflation. If the inflation rate is high (or higher than expected), banks will probably raise interest rates in order to slow inflation. Almost every release of CPI has been accompanied by massive movements in USD-related assets and USD currency pairs.

June saw an unusually high MoM CPI data and it has caused a surge in USD.

How to trade on the CPI data?

Due to the importance of CPI data, it may influence all USD pairs greatly. Furthermore, you can watch after other events related to USD and combine them to catch an even greater price movement.

Check the economic calendar

Instruments to trade: EUR/USD, GBP/USD, NZD/USD, USD/JPY.