Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaUnited States Purchasing Managers’ Index Will Move The Dollar

United States Institute for Supply Management (ISM) will release services Purchasing Managers' Index (PMI) on October 5, 17:00 GMT+3.

United States Institute for Supply Management (ISM) will release services Purchasing Managers' Index (PMI) on October 5, 17:00 GMT+3. PMI is an index of the prevailing direction of economic trends in the manufacturing and service sectors. The PMI is based on a monthly survey of purchasing managers across many industries, covering the relative level of business activity, and offering one of the most relevant insights into the companies’ view of the economy.

The value and movements in the PMI and its components can provide useful information to business decision-makers, market analysts, and investors, and is a leading indicator of overall economic activity in the US. The Services PMI provides advanced insight into the services sector, giving investors a better understanding of business conditions and valuable information about the economic backdrop of various markets.

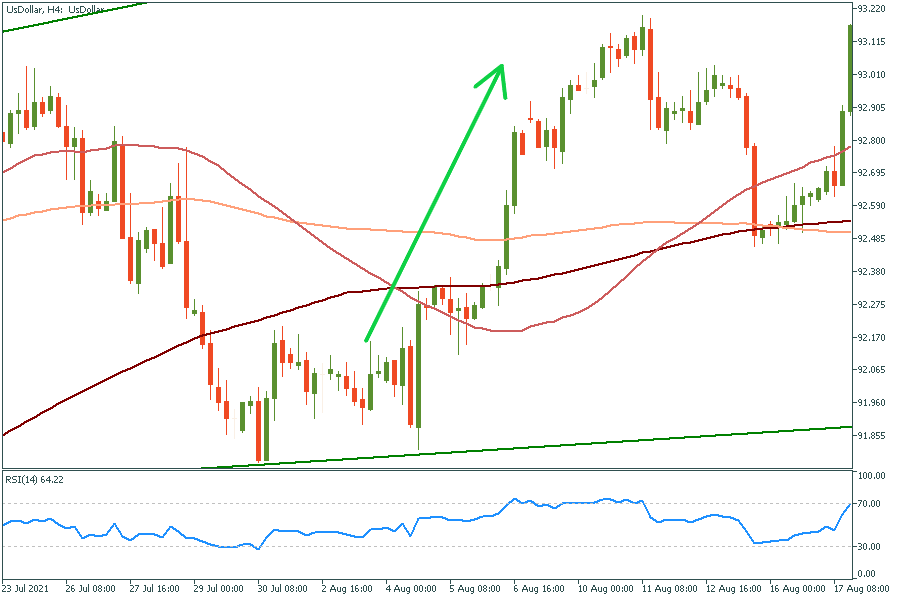

In August 2021, better than expected Service PMI data boosted the dollar significantly.

Because of the comprehensive nature of the index, usually it affects all USD-related pairs. Don’t forget about the gold, XAU/USD may experience a sharp movement if the index will beat expectations.

Check the economic calendar

Instruments to trade: EUR/USD, GBP/USD, XAU/USD, USD/JPY.