Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

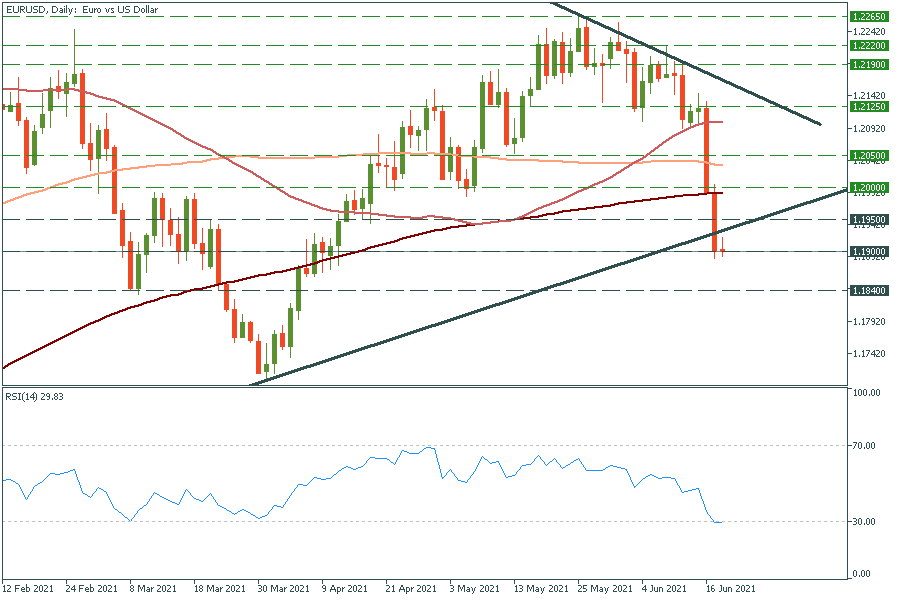

Personal areaEUR/USD has dropped out of the lower trend line to the support level of 1.1900. The RSI indicator has touched the 30.0 level indicating the pair is oversold. Thus, the pair should reverse up from the current levels. The move above the 1.1950 resistance level will lead the pair to the 200-day moving average of 1.2000. If the current bearish momentum remains, EUR/USD may fall to the low of March 8 at 1.1840.

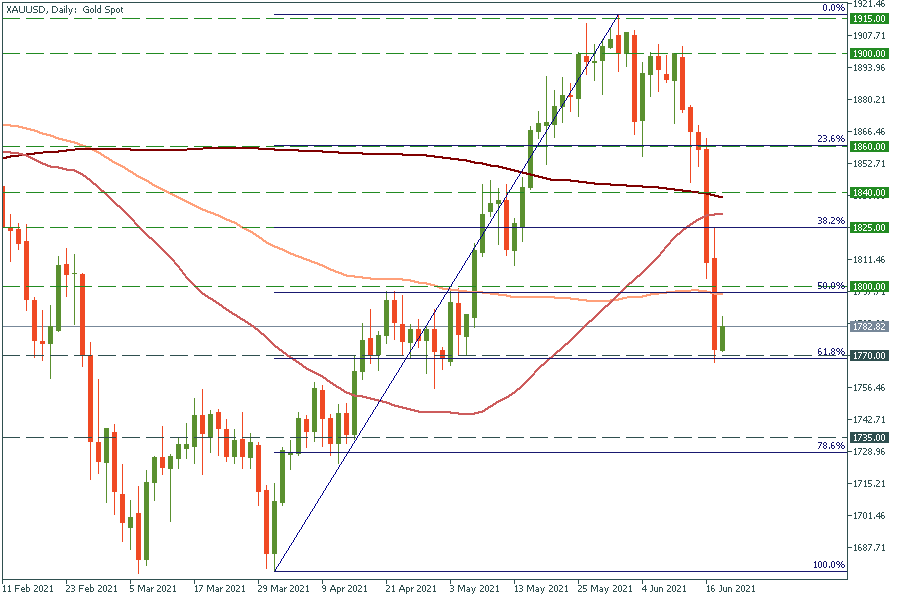

Gold has bounced off the 61.8% Fibonacci retracement level of $1770. The yellow metal is edging higher to the 50% Fibo level of $1800. It’s unlikely to cross this level on the first try as it has failed to do so in late April – early May. Support levels are $1170 and $1735.

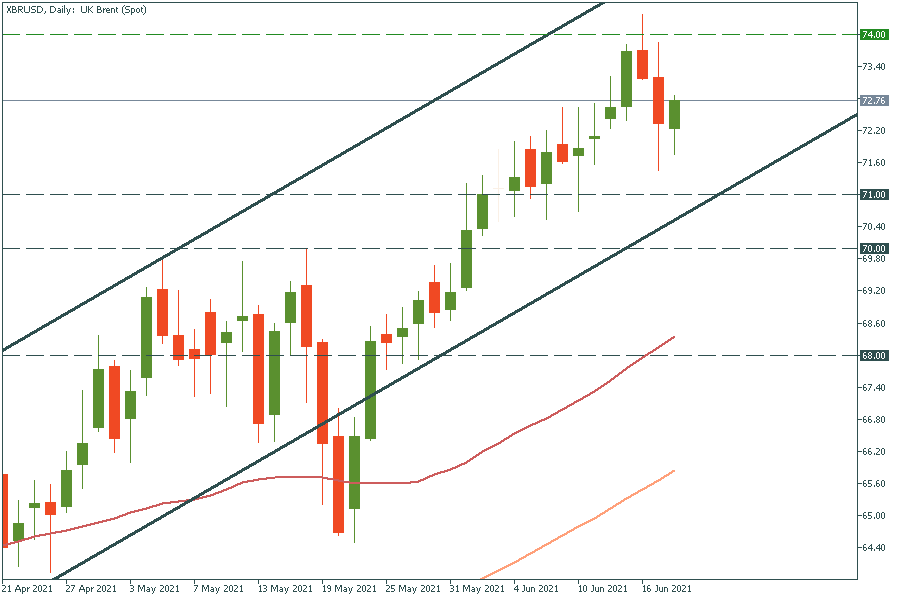

XBR/USD (Brent crude oil) is moving inside the ascending channel. The breakout above mid-June of $74.00 will push oil to the next round number of $75.00. Support levels are $72.00 and $ 71.00.