Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaWhat is tapering? It is a process of cutting bond buys or increasing interest rates by the central bank. It is positive for the national currency, that’s why tapering tends to push the currency up. Traders also say ‘the central bank made a hawkish decision’ in this case. By the way, we have a glossary with the key trading terms. ‘Hawkish’ is one of them, check it out!

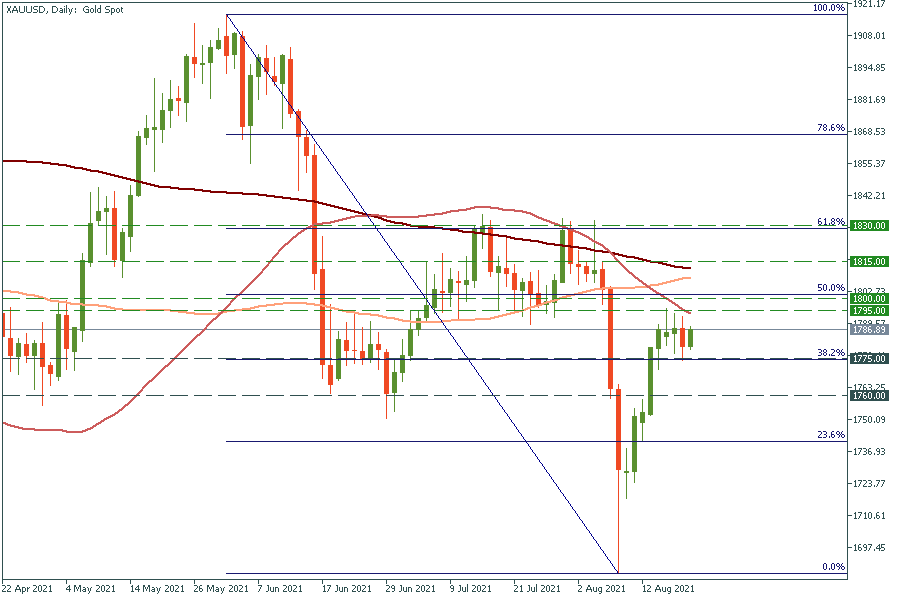

Gold is moving sideways between the 38.2% Fibonacci retracement level of $1775 and the 50-day moving average of $1795. Traders await eagerly the breakout. if gold crosses the resistance zone of $1795-1800, the way up to the 200-day moving average of $1815 will be open. On the flip side, the move below the $1775 support level will press the yellow metal further down to the next round number of $1760.

USD/JPY keeps moving inside the ascending channel. Now, the pair is stuck between two moving averages: 50- and 100-day. The USD weakened today after a long rally, so we might expect USD/JPY to break below the 109.60 support. If it happens, the pair will fall to the recent lows of 109.20. In the opposite scenario, the breakout above the 50-day MA (the red line) of 110.20 will open the doors to the early August highs of 110.60.