Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

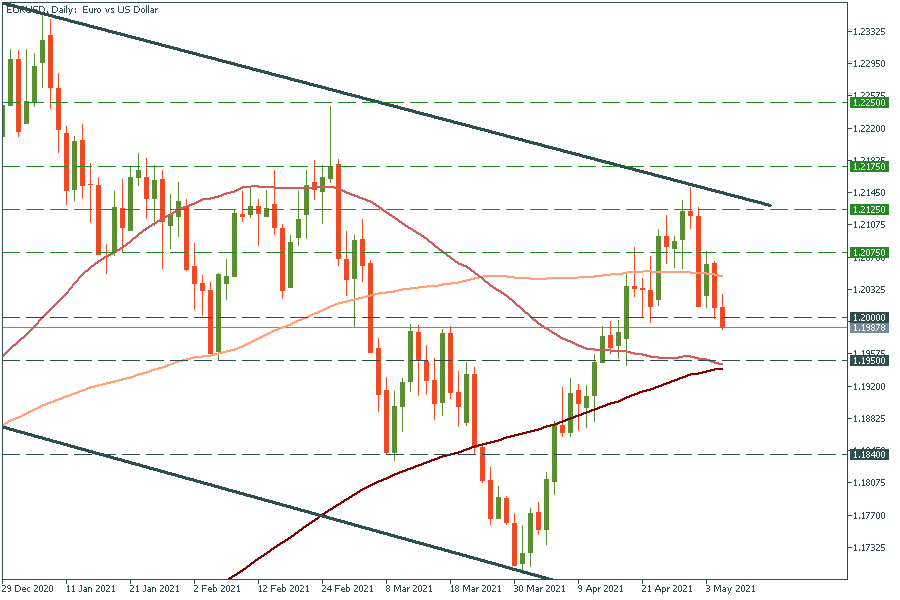

Personal areaEUR/USD has just crossed the psychological level of 1.2000. This breakout will drive the pair down to the intersection of the 50- and 200- moving averages at 1.1950, where the falling should stop. On the other hand, the jump above Monday’s high of 1.2075 will drive the pair to the upper trend line of 1.2125.

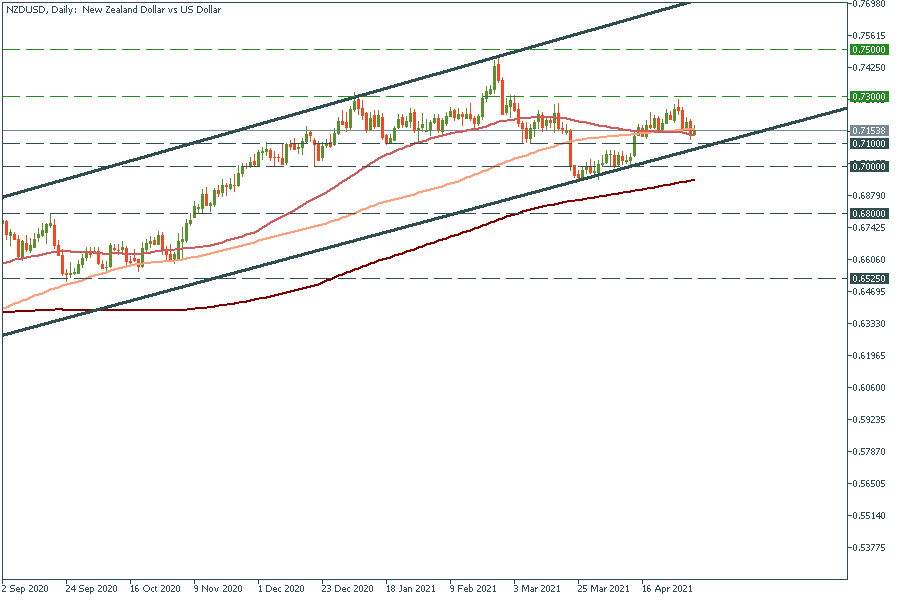

NZD/USD is trending up inside the ascending channel. If t manages to break April’s high of 0.7300, it may rally up further to the next round number of 0.7500. On the flip side, if it drops below the lower trend line at 0.7100, it may fall to the psychological level of 0.7000. This scenario is the least possible as it has failed to cross this support line for over a year.

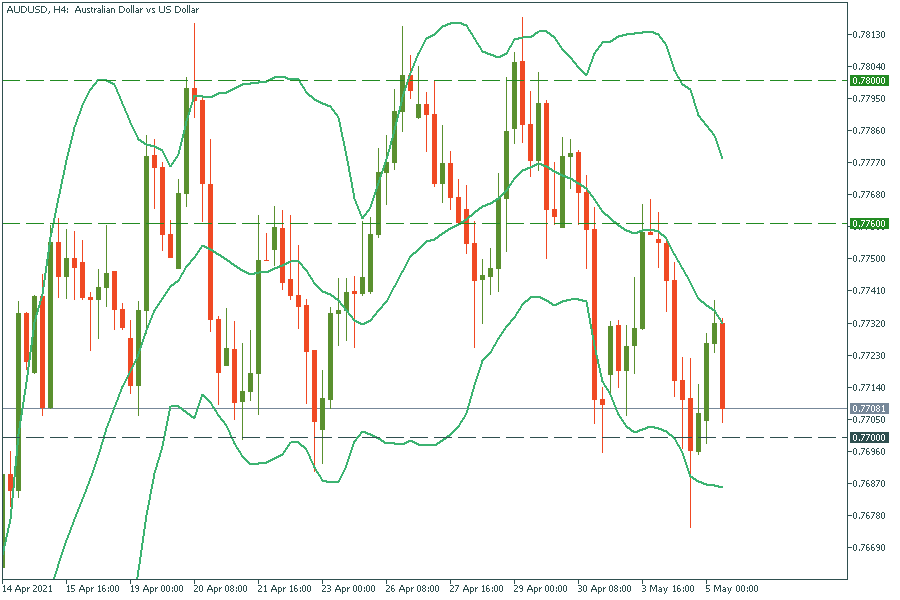

AUD/USD has been moving sideways between 0.7700 and 0.7800. Thus, this time it’s likely to bounce off the 0.7700 support again. If this is right, on the way up the pair will meet the resistance at Mondays’ high of 0.7760.

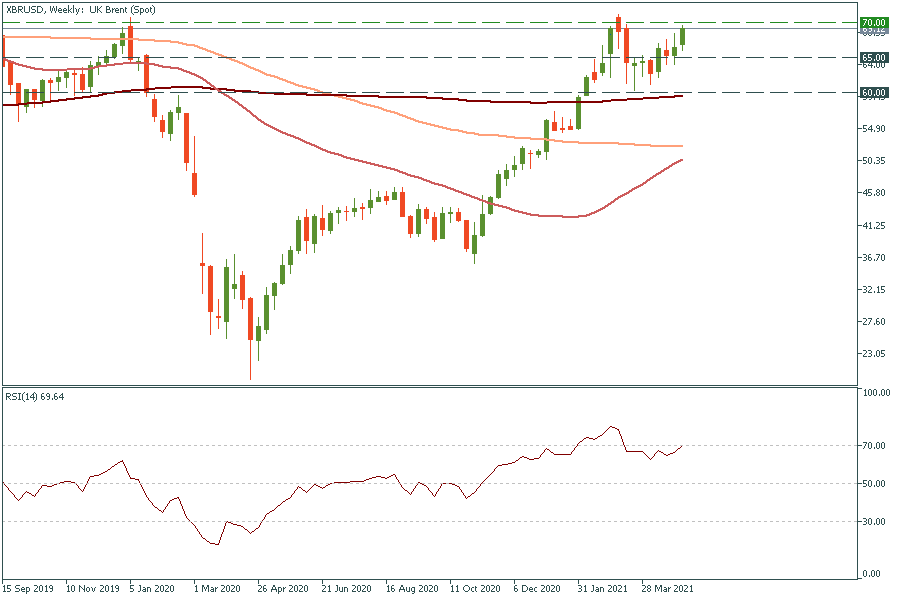

Finally, let’s discuss crude oil on the example of XBR/USD (UK Brent oil). If it manages to break above the $70.00 milestone, the way up to $75.00 will be open. However, it’s unlikely to rally for so long as on the weekly chart, the RSI indicator has approached the 70.00 level, signaling the asset is overbought. Therefore, we might expect the reverse down from $70.00. On the way down, the oil may struggle to cross support levels at the recent low of $65.00 and the 200-weekly moving average of $60.00.