Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

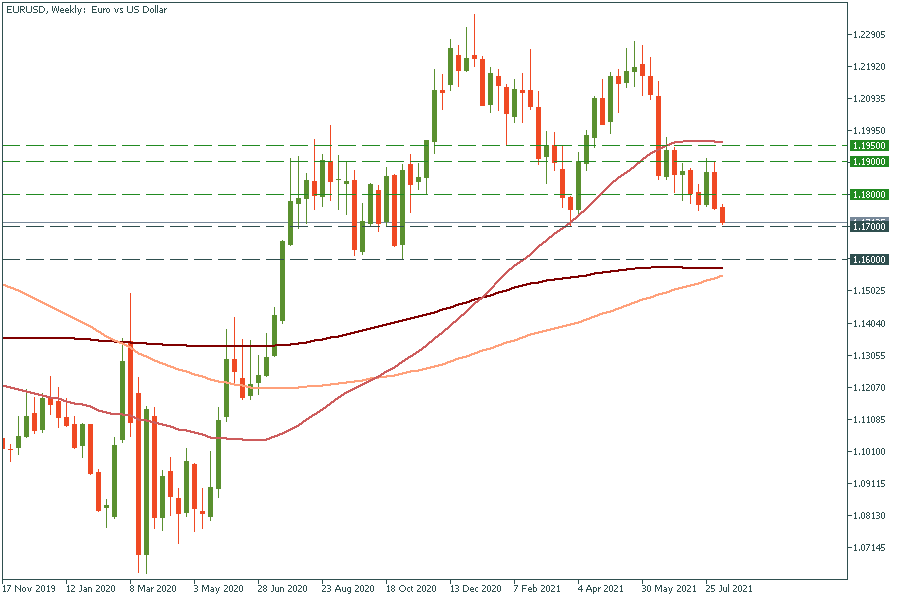

Personal areaEUR/USD is sharply falling. It gets closer to the psychological mark of 1.1700. It may struggle to cross it on the first try as it has failed to break it in March. However, if it manages to break it, it will drop the November lows of 1.1600 – just above the 200-week moving average. The 200-week MA may stop the pair from further falling. Resistance levels are the psychological mark of 1.1800 and the high of August 4 at 1.1900.

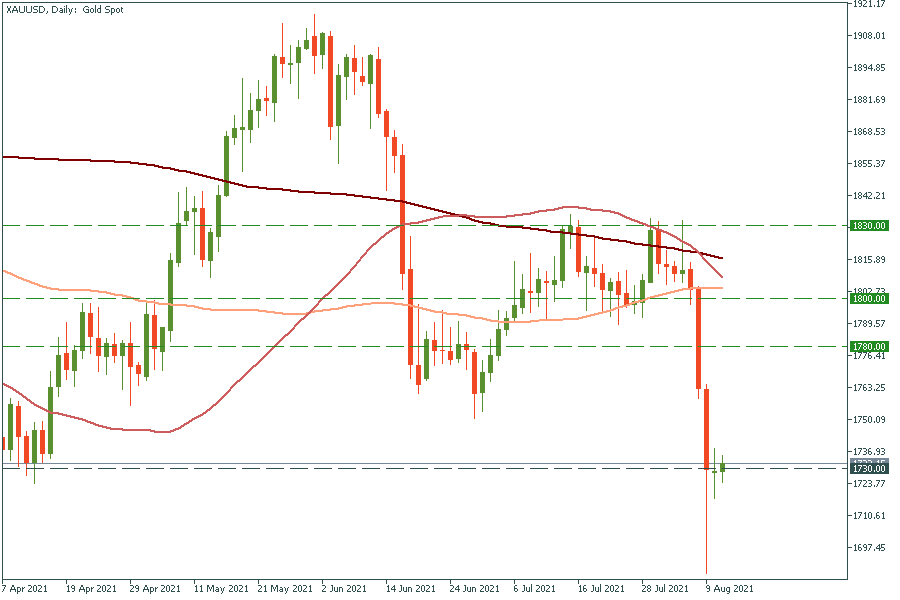

Gold has reversed up from the $1730 support level which lies at the 100-week moving average. The jump above the high of late June at $1780 will push the pair to the 100-day moving average of $1800. On the flip side, the move below $1730 will press down to the recent low of $1680.

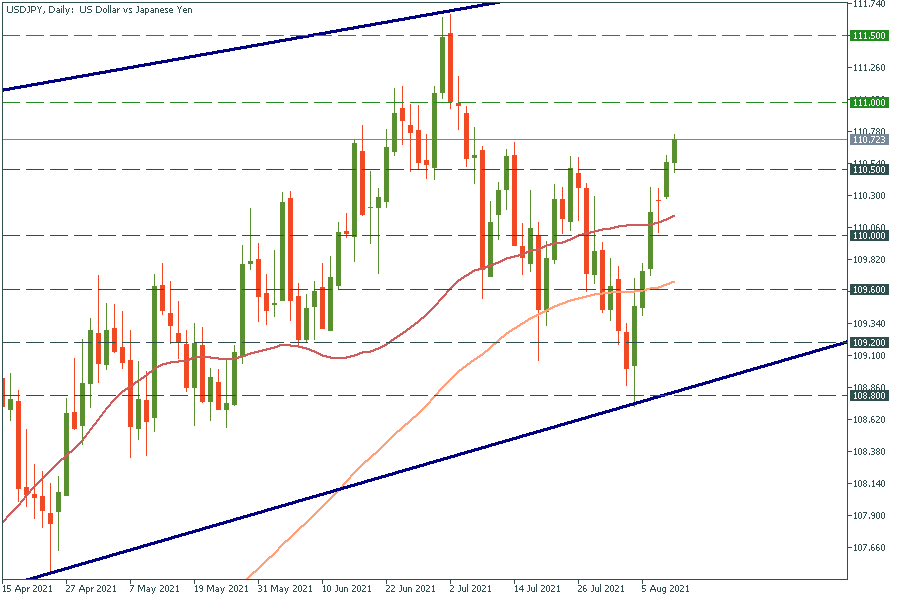

Our forecast was right and USD/JPY is edging higher to the psychological mark of 111.00. The breakout above it will push the pair up to the high of July 2 at 111.50. However, we should be ready for a pullback from 111.00 at first. Support levels are 110.50 and the 50-day moving average of 110.00.