Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaEUR/USD has started falling after touching the strong resistance level of the 50-day moving average and the 50% Fibonacci retracement level at 1.1700. It is getting closer to the support zone of 1.1650-1.1660 near the 38.2% Fibo level, which will be hard to cross. We may expect the pair to trade sideways near this level. However, if it manages to drop below it, the way down to 1.1610-1.1600 will be open.

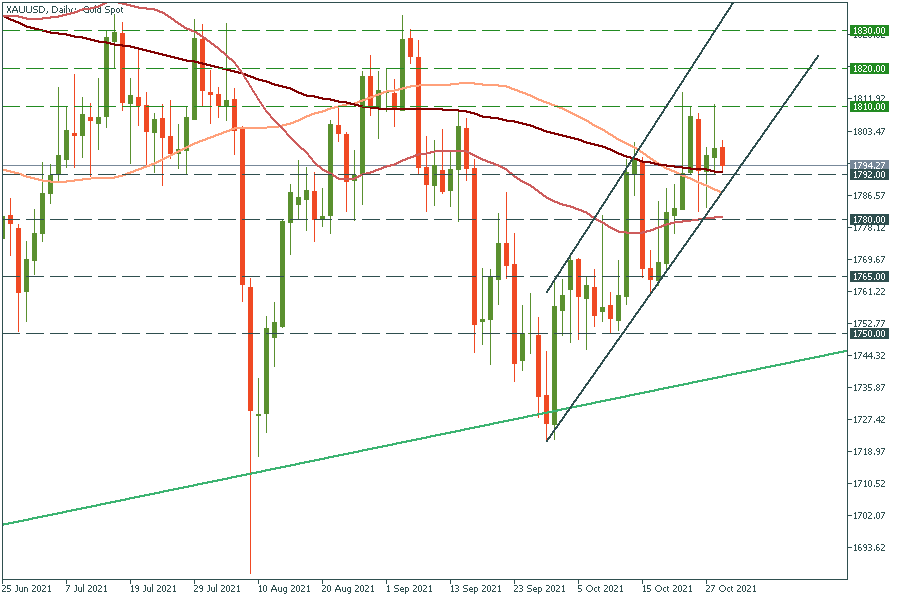

Gold is moving inside the ascending channel. Gold got closer to the lower line of the channel which also lies at the 200-day moving average of $1792. The metal should struggle to cross it and reverse up back to the recent high of $1800-1810.