Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaGBP/USD is edging higher inside the ascending channel. If the BOE reduces asset purchases, the pair may break above 1.4000, which will open the way up to the high of February 24 at 1.4150. In the opposite scenario, the move below the recent low of 1.3800 will press the pound down to the lows of early April at 1.37000.

The Bank of Canada has already cut its bond-buying recently. Just look how the Canadian dollar gained on that hawkish move. USD/CAD is going down and down. Besides, the CAD was supported by rising oil prices as Canada is one of the world’s largest exporters. CAD/USD is getting closer to the psychological support of 1.2200, where the falling may stop as the RSI indicator has almost gone below 30.00, signaling the asset is oversold. If it then reverses up and breaks through yesterday’s high of 1.2310, the way up to the 50-day moving average of 1.2520 will be open.

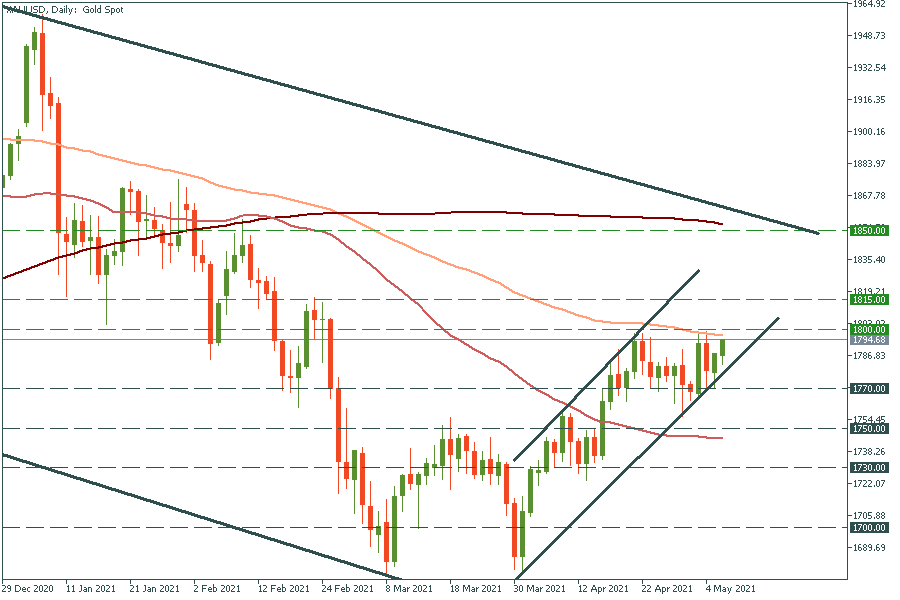

Gold is approaching the key psychological level of $1800 and it looks like it’s ready to break it. The move above it will drive the metal up to the high of February 23 at $1815. On the flip side, if XAU/USD falls below the level of the recent lows at $1770, it will fall to the next support of $1750.