Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaEUR/USD has bounced off the 200-day moving average of 1.1815. If the pair manages to rise above the resistance of 1.1950, the way up to the 100-day MA of 1.2030 will be clear. Support levels are 1.1815 and 1.1775.

GBP/USD is heading upwards as well. If it jumps above the high of March 5 at 1.3900, it may rise to the next resistance of 1.3950. Support levels are 1.3800 and the 50-day MA of 1.3750.

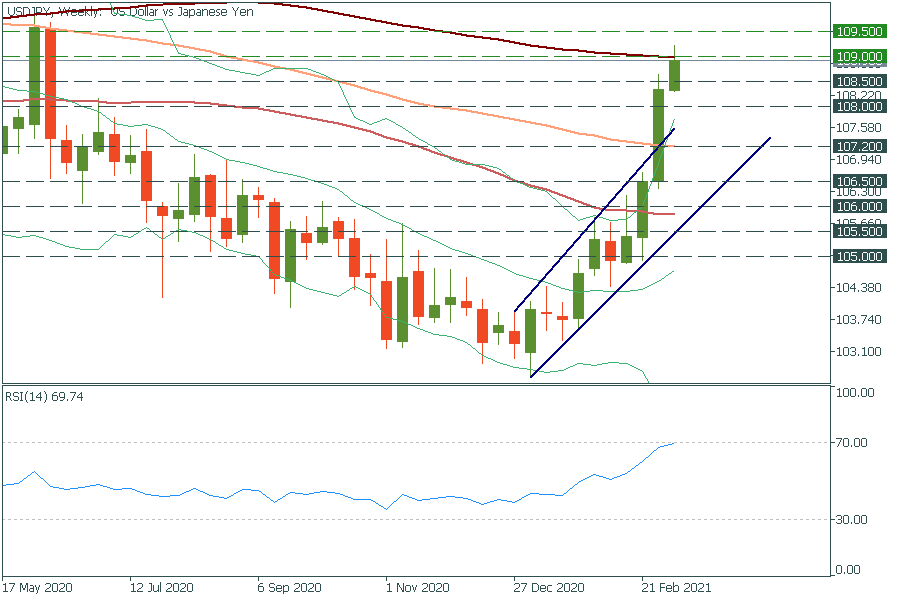

USD/JPY’s rally is unstoppable! It has broken the 200-day MA of 109.00. Therefore, the way up to the high of May 2020 at 109.50 is clear. However, the RSI hit the 70.00 level, indicating the pair is overbought. Besides, the price has surpassed the upper line of Bollinger Bands a few days ago. Therefore, we may see a pullback soon. Support levels are 108.50 and 108.00.

Gold has been dipping in both the long and short terms. Gold may rise to the resistance of $1,700, which it can struggle to break. But if crosses it, the way up to the high of March 2 at $1,740 will be open. Support levels are $1,675 and $1,650.