Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in this region. Are you already registered with FBS and want to continue working in your Personal area?

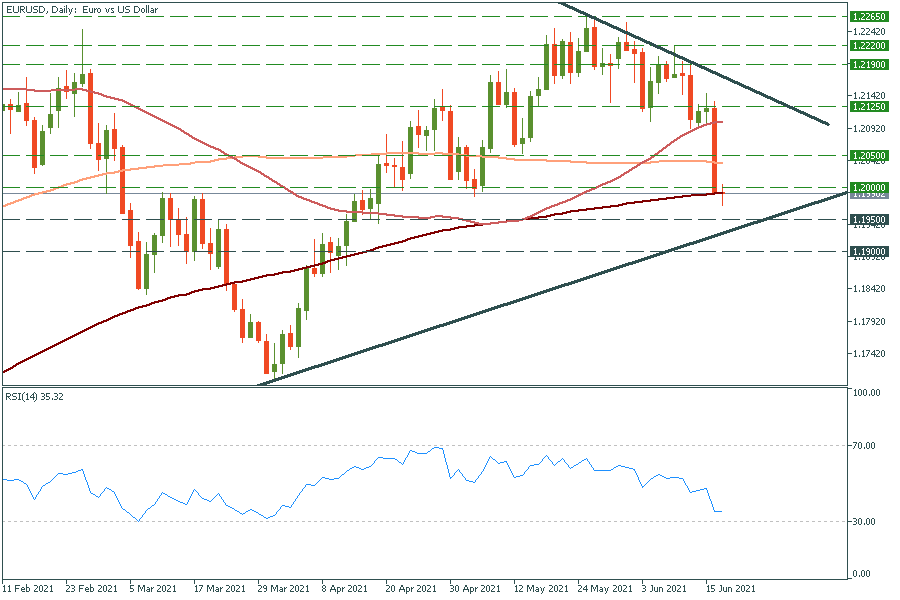

Personal areaEUR/USD dropped enormously! The pair has just broken below the psychological mark of 1.2000 and the 200-day moving average. Now it is getting closer to the lower trend line at 1.1950, which the pair may struggle to break. The RSI indicator is below 30,00 on the 4-hour chart, signaling the pair is oversold. Thus, we might expect the reverse up soon. The move above 1.2000 will drive EUR/USD back to 1.2050.

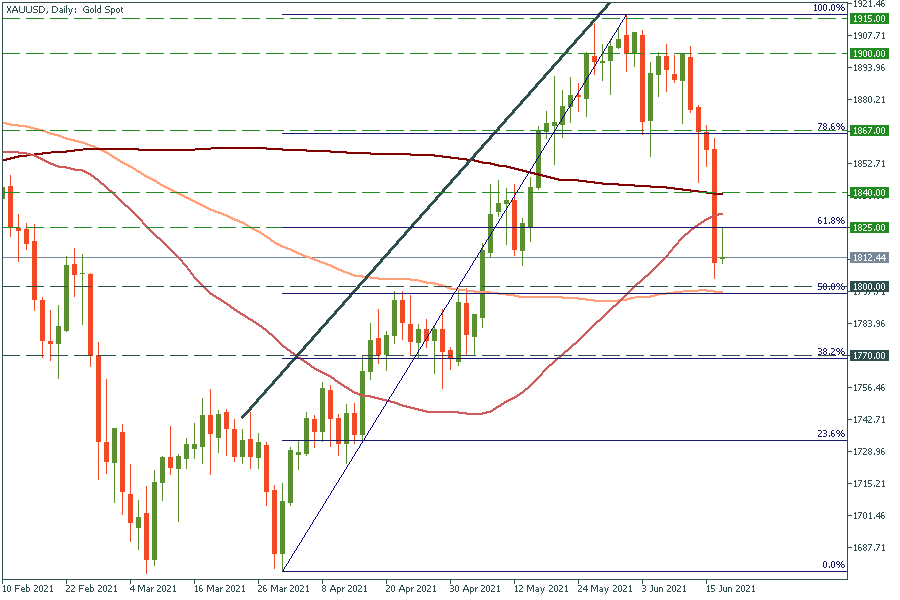

It’s quite an interesting situation on the gold chart! XAU/USD has broken the 61.8% Fibonacci retracement level and pulled back to it. The long upper shadow tells us that the price is going to reverse down. The move below the 50.0% Fibo level of $1800 will push the metal to the next level at $1770.

S&P 500 has reversed down and touched the lower trend line at 4175. It’s a perfect opportunity to buy such a credible stock index at a lower price! The move above Tuesday’s high of 4260 will drive the stock index to the psychological mark of 4300. Support levels are at the 50-day moving average of 4175 and the mid-May lows of 4115.