Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

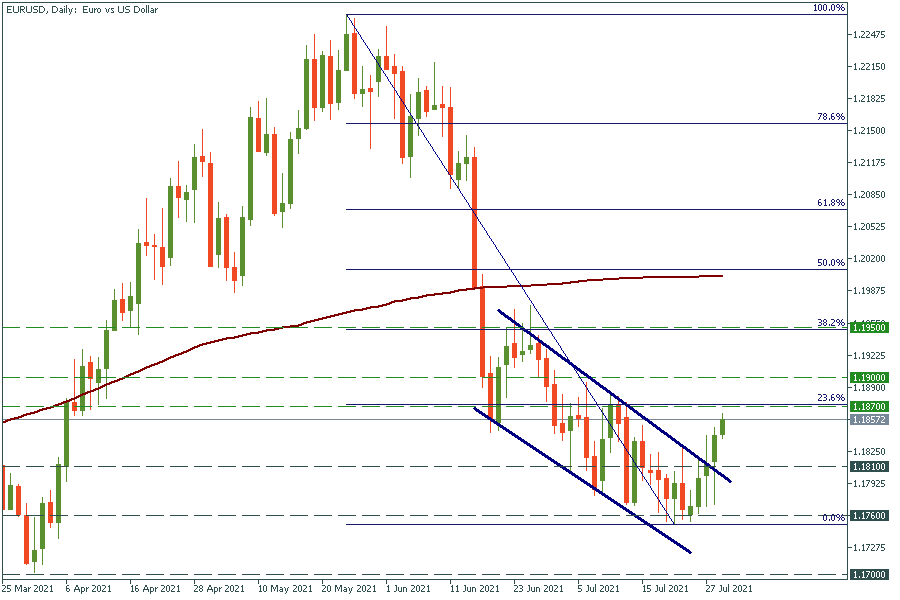

Personal areaEUR/USD has broken above the upper trend line after the Fed’s dovish comment. The pair is getting closer to the 23.6% Fibonacci retracement level of 1.1870. The pair is likely to struggle to cross this resistance level. Be ready for the reverse down! Support levels are at the recent lows of 1.1835 and 1.1810. On the flip side, if the pair manages to cross 1.1870, it may rocket to the psychological mark of 1.1900.

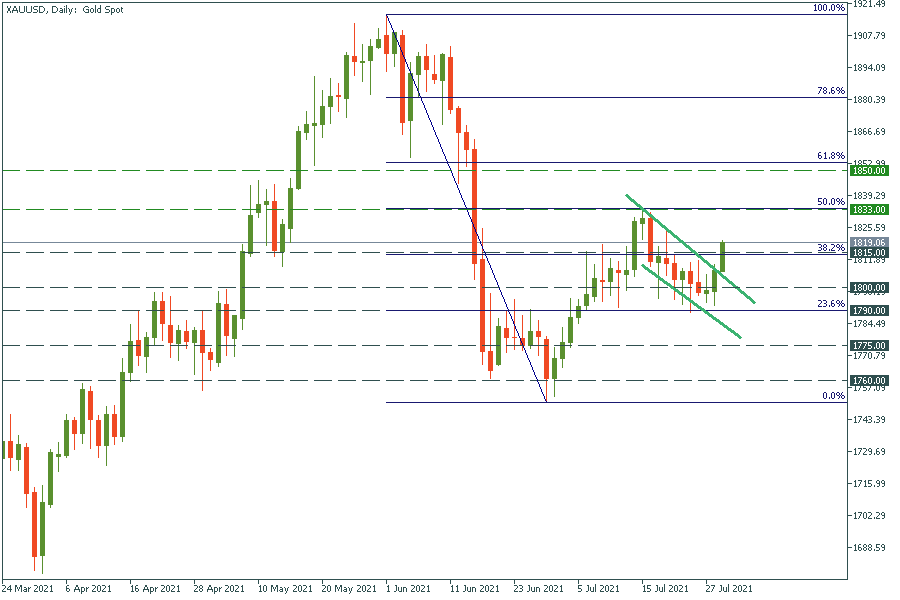

A similar situation has occurred on the gold chart. XAU/USD has closed above the 38.2% Fibonacci retracement level of $1855. Thus, there is a high probability that the price will rise further and reach the 50% Fibo level of $1833. Support levels are the psychological mark of $1800 and the 23.6% Fibo level of $1795.

The Canadian dollar gained from the rising oil prices. As a result, USD/CAD dropped. The pair is getting closer to the 1.2450 support level. If it manages to cross it, USD/CAD may fall to the low of July 30 at 1.2380. Resistance levels are the recent highs of 1.2600 and 1.2750.