Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaFOMC will share its Meeting Minutes on April 7, at 21:00 MT time.

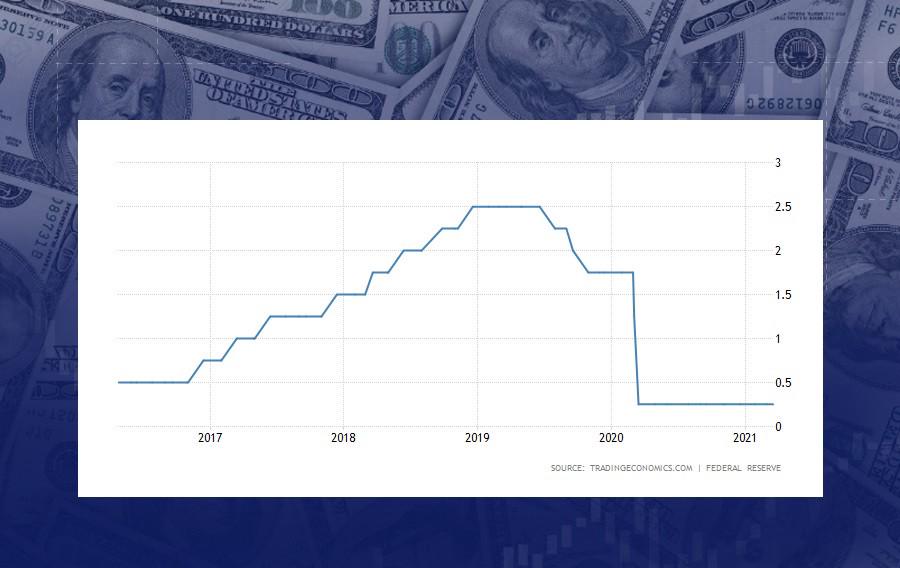

The Fed Chairman Jerome Powell informed that if the situation in the US evolves as per the current dynamic, no rate hike is expected until 2023 – that’s when the US economy is expected to fully recover. While the inflation rate target is 2%, it is currently at 1.7%, and Mr. Powell made it clear they want to see the actual rate not just reach the target but be steadily slightly above it. Noting the difficulties of the labor market and the overall situation, it will take a while to manifest, too.

The bulk of the rate-related information has been already released in the last session. Therefore, investors will be looking for details of what the US Fed has, and possibly, for some new additions – especially if the latter change the overall tone of the Fed’s comment. Generally, any positive data that point to a strong US domestic recovery would support the USD.

Instruments to trade: GBP/USD, EUR/USD, USD/JPY, USD/CAD