Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThis week, Warren Buffett's Berkshire Hathaway Inc. revealed three stock acquisitions that it kept in secret. The holding company bought the stocks of American energy corporation Chevron, insurance brokerage Marsh and McLennan, and Verizon Communications Inc. It also increased investments in AbbVie Inc by 20%, Bristol-Myers Squibb Company by 11%, and Merck &Co, Inc by 28%. The announcement pushed the stocks of these companies up. At the same time, Warren Buffet's company cut its holdings in Apple by 6%. Another big change made by Berkshire Hathaway is a 59% cut in exposure to Wells Fargo &Co.

The stock of Apple reacted negatively to this news. Within a few days, it dropped from the 137.4 level to the support at 127. Despite this fact, it's worth mentioning that Apple is still the largest investment of Berkshire Hathaway Inc. Thus, the downfall may be short-lived.

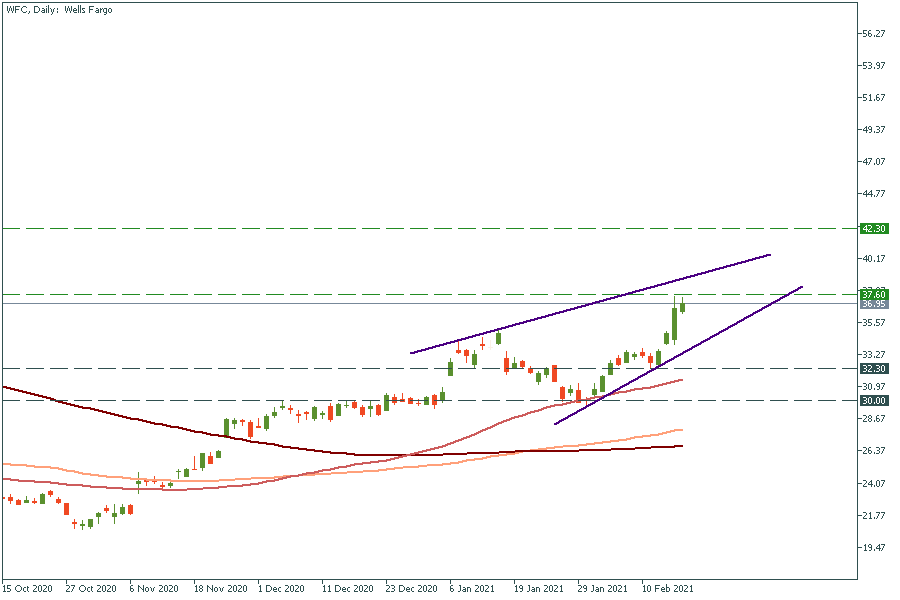

As for Wells Fargo stock, the change in Mr. Buffett's portfolio did not affect its performance. The stock surged to 37.6 on Wednesday, driven by the news about Wall Street’s lone bear, J.P. Morgan analyst Vivek Juneja, who said WFC is no longer a sell and changed his stock rating from underweight to neutral.