Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe US Fed provides a Statement and a Press Conference on April 28, at 21:00 MT time.

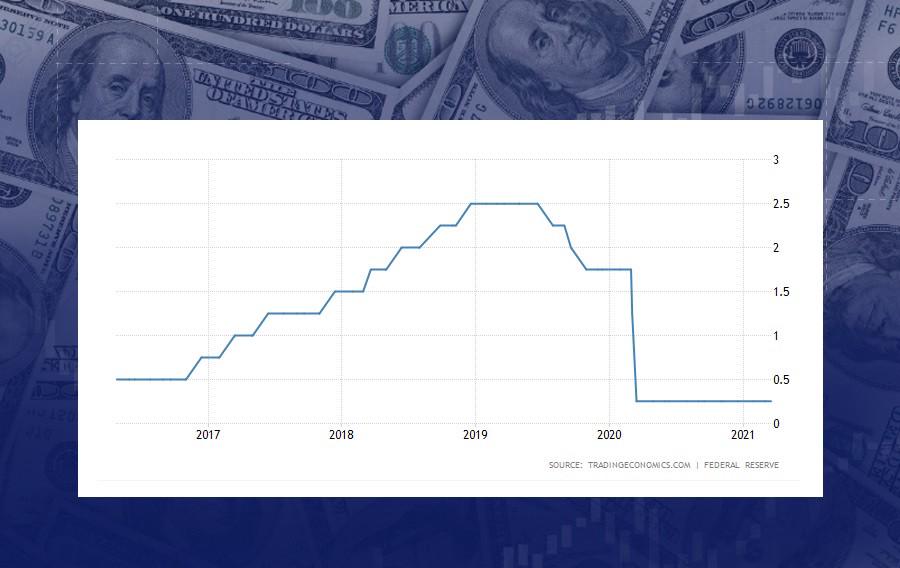

FOMC is the primary source of potentially impactful information about the economic outlook in the US. Lately, we have become accustomed to the fact that the interest rate will be kept steady in the nearest future – that’s why it’s not what observers will be looking at. Rather, the details of the Fed’s message about the dynamics of the US economic recovery will be the key element. If they are encouraging, the USD is likely to rise. Otherwise, if there are doubts about the steadiness of the economic recovery process in the US, the US dollar may lose value.

If optimistic projections of a steady economic recovery ahead in the US are confirmed, the USD will likely gain value on traders’ risk-on moods. A more pessimistic outlook would press on the US dollar.

Instruments to trade: EUR/USD, GBP/USD, AUD/USD, USD/CAD