Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

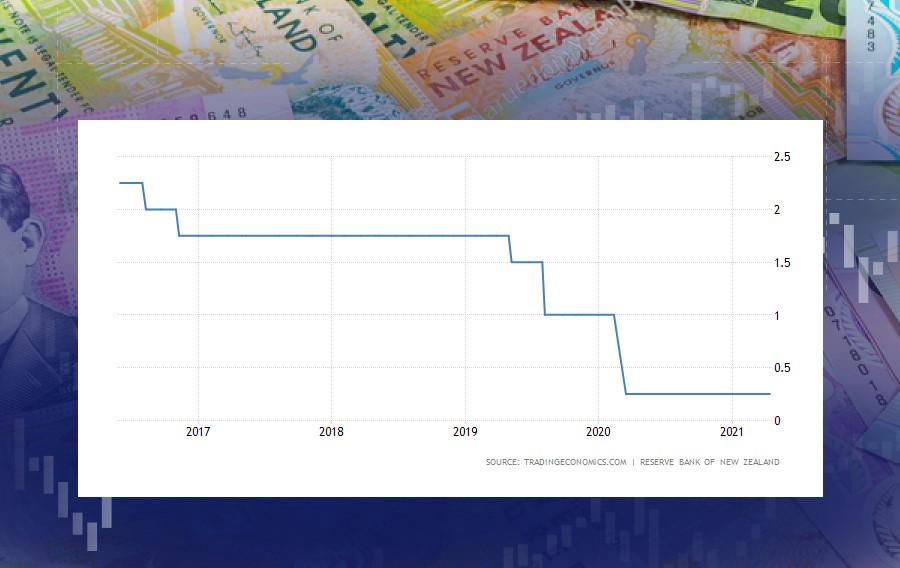

Personal areaThe Reserve Bank of New Zealand will conduct a meeting on May 26, at 05:00 MT time. During this event, policymakers will discuss the effectiveness of a current monetary policy and possible adjustments to it. Based on their conclusions, they will publish a monetary policy statement – a document that will contain economic forecasts and possible changes to the bank's interest rate. As the regulator keeps the official cash rate at the record low of 0.25%, the main question for traders is when the bank plans to hike it? According to ANZ, a famous Australian multinational banking and financial services company, the RBNZ may go hawkish as soon as August 2022. Additionally, the forecasts for GDP, employment, and inflation are expected to be revised up. At the same time, analysts don't see any sign of changes to the quantitative easing program.

The markets will likely react to any change in the tone of the bank.

Instruments to trade: NZD/USD, NZD/JPY, AUD/NZD