Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

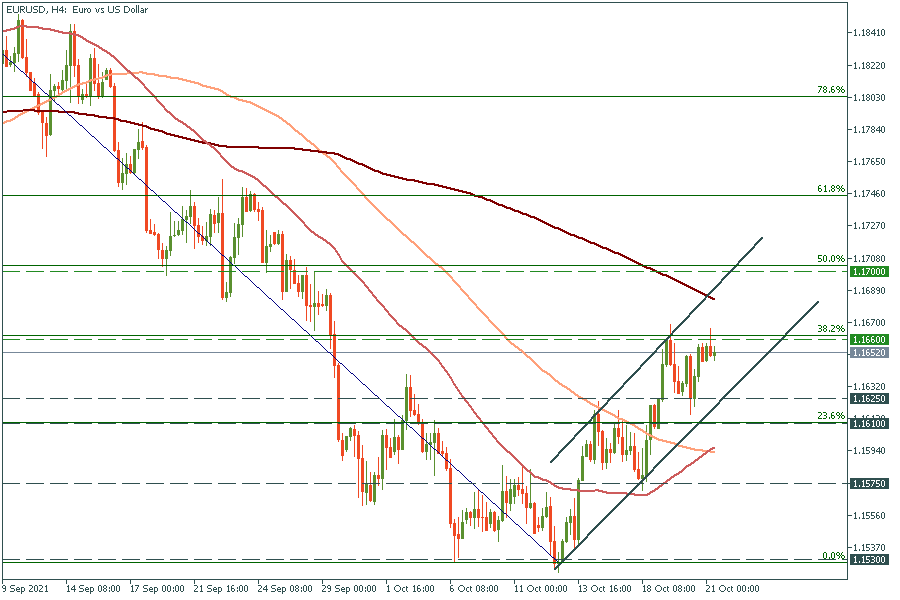

Personal areaEUR/USD keeps attacking the 38.2% Fibonacci retracement level of 1.1660. If it manages to break this significant resistance level, the doors to the 50% Fibo level of 1.1700 will be open. The US data at 15:30 GMT+3 (jobless claims and Philly Fed Manufacturing Index) can affect the pair and set the new track. While tomorrow, the EU PMI reports in the morning will be the main driver of the EUR/USD pair. Support levels are the low of October 20 at 1.1625 and the 23.6% Fibo level of 1.1610.

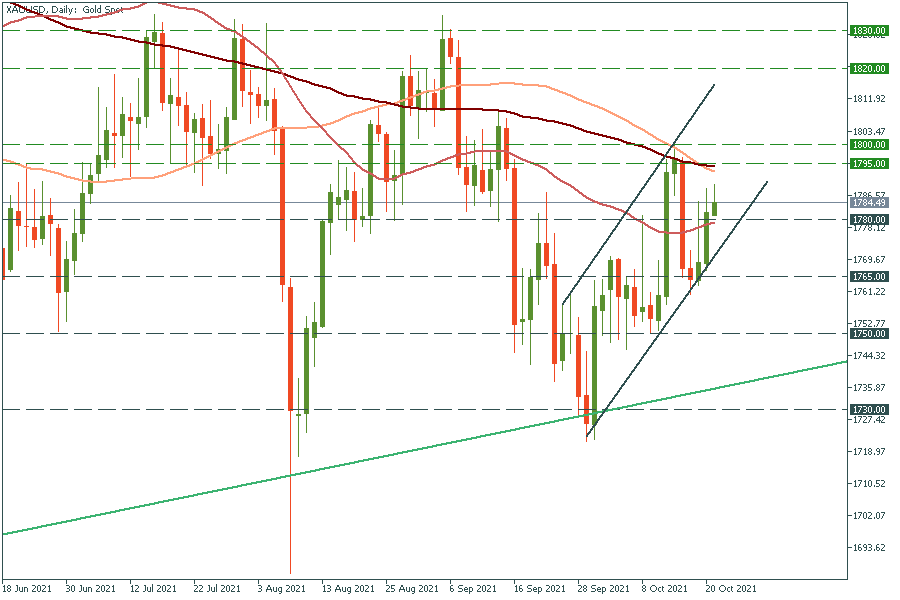

Gold has gained from the weak greenback. It is edging higher inside the ascending channel. The resistance zone of $1795-1800 looks strong as there are the 100- and 200-day MAs and the psychological level of $1800. It will be hard to break it on the first try. Thus, we might expect a reverse down. Support levels are the 50-day MA at $1780 and $1765.

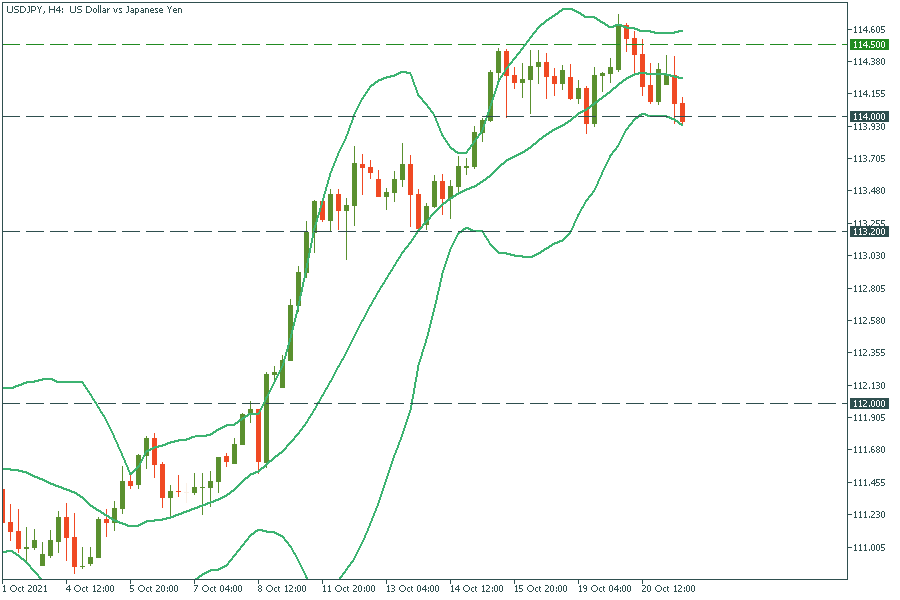

USD/JPY moves sideways between 114.00 and 114.50. Now, it has approached the bottom of the channel, which it may fail to cross and reverse up. On the flip side, if the pair closes below 114.00, it may drop to the low of October 13 at 113.20.