Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

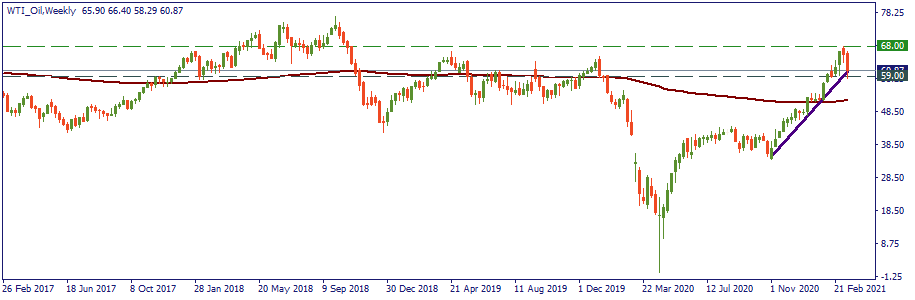

Personal area$68 per barrel was the highest mark for WTI oil since October 2018 - a 2.5-year-high! Staring in November 2020, it was almost a straight line from around $30 to this mark.

Observers say the bullish rally was too quick. There were a lot of mid-tern factors that lifted it - from a failed missile attack on Saudi Arabia's main oil production facility to OPEC+ recent decision ton the supply cuts and Texas's winter taking away February's due supply from the US. These factors helped lift the price but did not necessarily stabilize it in the long-term. Strategically, global economic recovery is the main impact factor for the oil price.

In the meantime, most economists agree that nothing stands in the way of oil rising again. At the end of the day, the recovery is on the way, and the virus keeps gradually subsiding.

Therefore, a cautious approach to trade oil would suggest the following.