Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaDo you remember the growth of Tesla stock in 2020? Or how about GameStop soaring 10 times in mere weeks? This is neither an “organic growth” nor a market manipulation. These events are called “Short squeezes” and I will show you how to find one and earn on it!

A short squeeze is a stock market phenomenon, something that happens to investors and traders who have acted on the assumption that an asset (a stock, usually) is going to fall — and it rises instead. Here's how it happens.

How does a short squeeze happen?

Additional pressure on the short seller can come from the original owner (broker) of the stock who can force the trader to return the stock at any time, especially if a trader doesn’t have enough margin to collateralize his or her positions. The downsides of a short squeeze are significant, making shorting a stock a very risky strategy for all but the most experienced traders.

It can get enormously huge! We’ll tell about the most interesting ones.

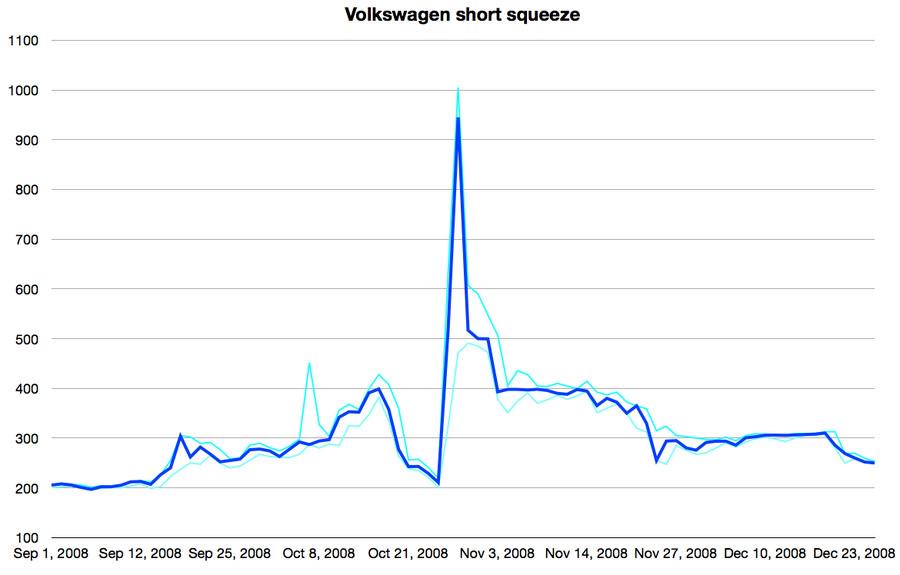

For a brief moment in October 2008, Volkswagen was the most valuable company in the world, at more than €1000 per share. And it all started with a surprise announcement by rival car manufacturer Porsche. Porsche and Volkswagen had a long history of working together, and Porsche had consistently maintained a minority stake in Volkswagen. But on 26 October 2008, Porsche revealed that it had gained control of 74% of Volkswagen’s voting shares by buying up almost all of the company’s circulating stock.

Of course, by October 2008 the world was in the grip of the global financial crisis, and short-selling was rampant. The Porsche Volkswagen short squeeze was only possible because so much Volkswagen stock (approximately 12.5%) was on loan to short-sellers at the time of the Porsche announcement. When the market opened the following day, those short-sellers raced to exit their positions to minimize their losses, buying more stock and inflating the share price even more.

On 27 October 2008, Volkswagen’s shares opened at €348 and closed at €517 – a rise of almost 150%. By Tuesday, the stock peaked at €999 per share, while short-selling costs were estimated to be in the tens of billions.

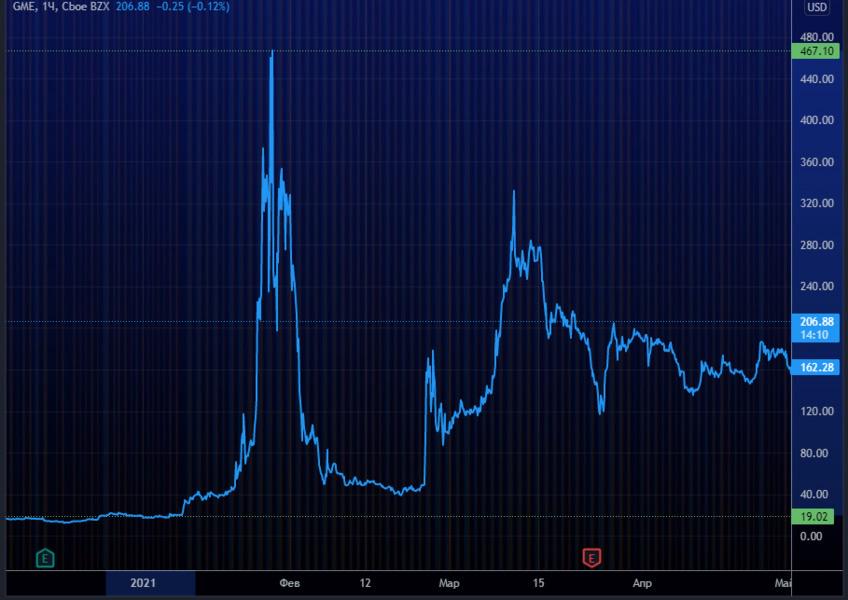

One of the greatest short squeezes in history started on a SubReddit, where hundreds of thousands of retail investors banded together to drive the price of GameStop shares up to an all-time high of almost $500. Before the surge, GameStop’s stock had been valued at $17.25.

At the time, approximately 140% of GameStop’s public float had been sold short, so as the rally gained pace, these short sellers were forced to cover themselves by buying as much stock as possible, thereby contributing to the surge.

Low-cost, light-touch investment apps such as Robinhood allowed retail investors to buy stock in tiny amounts, meaning that anyone could join in the GameStop movement. Meanwhile, Reddit users shared investment tips and strategies in layman’s terms, introducing many people to the world of investing for the very first time.

On 28 January 2021, Robinhood intervened and halted the purchase of GameStop shares and other securities, saying that they could not meet the collateral requirements to execute the deals. This decision has sparked several investigations and ongoing criticism from traders on Reddit that isn’t going to stop anytime soon.

GameStop's stock price has gained 2350% in two weeks.

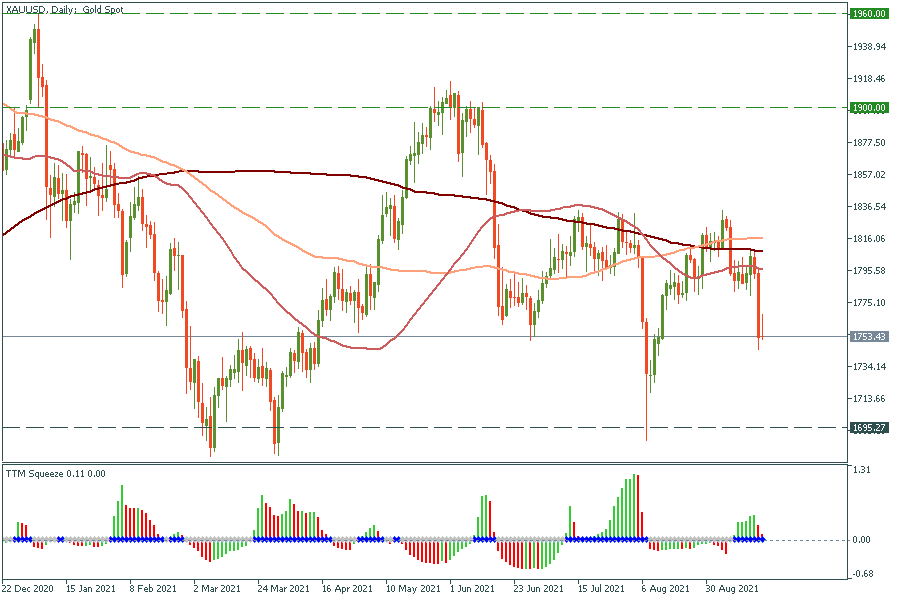

You can check the news regularly in attempts to catch short squeeze, or you can use tools, that do the work for you. One of such tools is TTM Squeeze Indicator. It’s a volatility and momentum indicator, which capitalizes on the tendency for price to break out strongly after consolidating in a tight trading range. It uses Bollinger Bands and Keltner channels to identify the probability of a big bullish move.

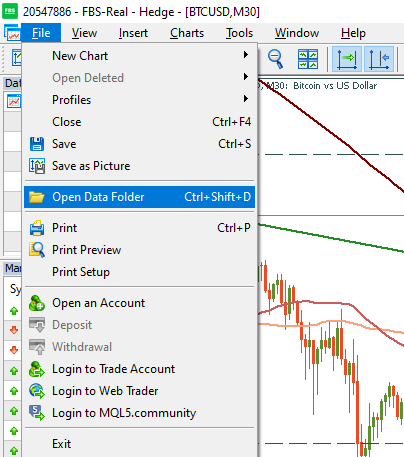

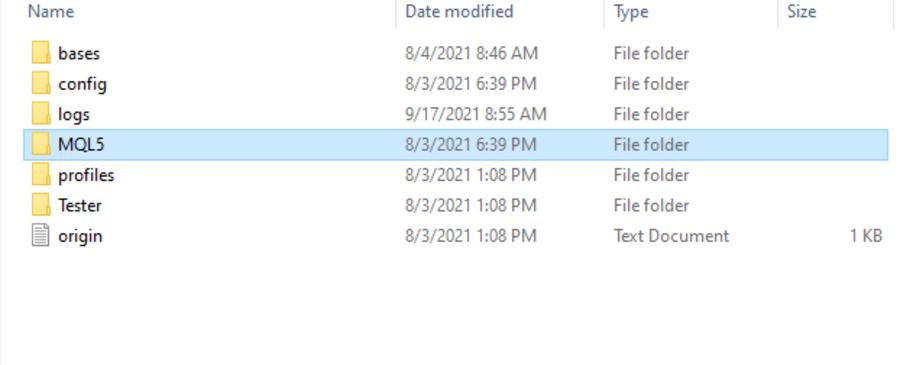

You can download and install it by yourself, here’s the link. Unzip the file, and then go to your MT4 or MT5, click “File”; “Open data folder”, “MQL4 (MQL5)”, “Indicators”, move indicator file here.

Then restart your MetaTrader and go to the “Insert” folder, choose “Indicators”, “Custom” and click on “TTM Squeeze”. Congratulations, you just made a step towards earning on short squeezes!

The TTM Squeeze indicator also uses a momentum oscillator to show the expected direction of the move when the squeeze fires. This histogram oscillates around the zero line, increasing momentum above the zero line indicates an opportunity to purchase long, while momentum falling below the zero line can indicate a shorting opportunity.

As you can see on the chart, this indicator gives lots of false signals, so we need to somehow filter them. You can look for short interest for stocks online or check the news by hand. Both ways are appropriate because you already have made the first step and now you know, what to look for.

Source: https://www.highshortinterest.com/