Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThis article describes the strategy known as ‘Method Jarroo’. It is based on the concept of price action but with some unique features. Are you interested? Then, let’s explore this strategy!

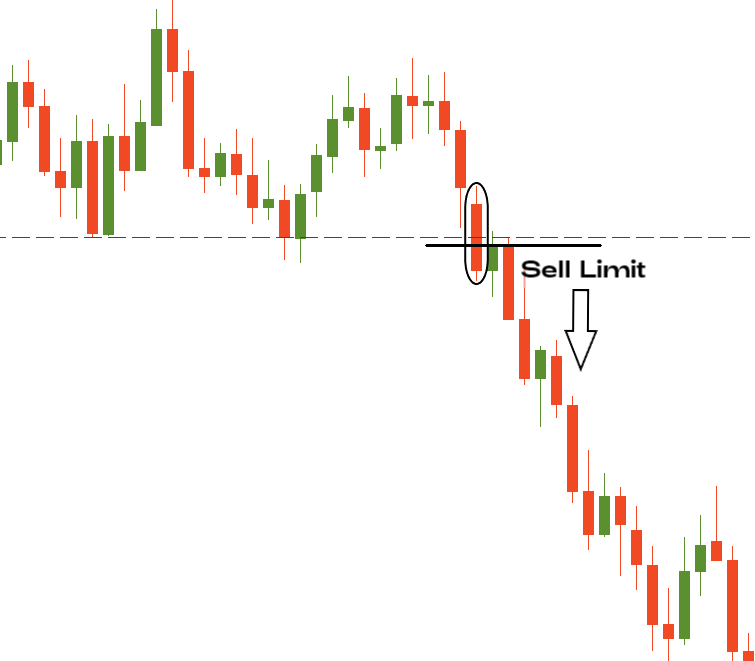

The levels above the price will be called resistance levels, below – support levels.

If you forgot or don’t know what pending orders are, read our article with a clear explanation called “Traders’ secret weapon: pending orders”.

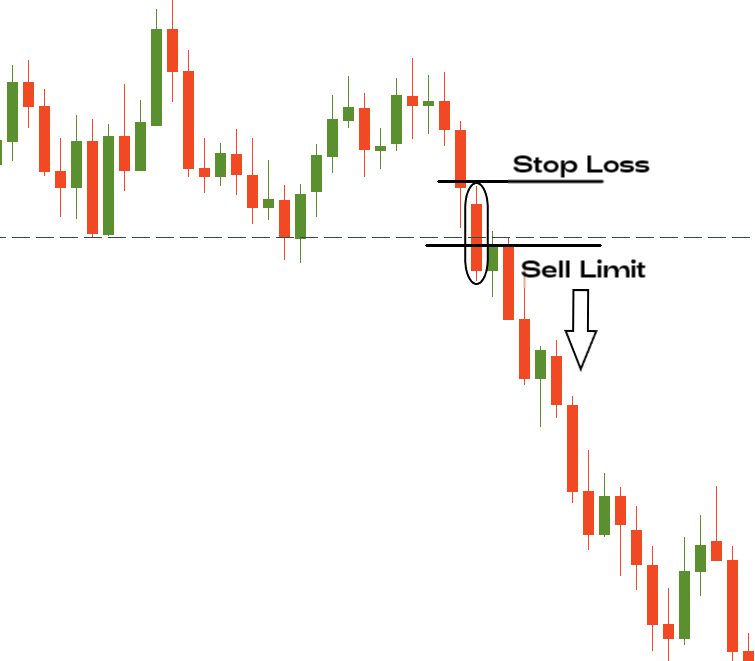

If the candle is too large, you can place the Stop Loss just slightly below resistance / above the support level.

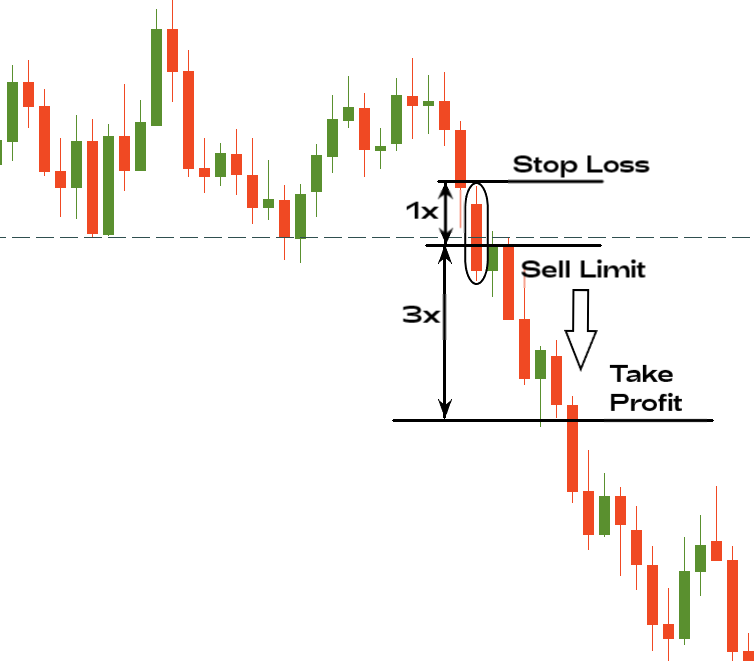

To place Take Profit, you’ll need to find the nearest levels of support and resistance as well. It should be greater than the Stop Loss by 2 or 3 times. For example, if you put the Stop Loss 30 pips higher than the current price level, you should consider placing Take Profit 90 pips lower than the current price.

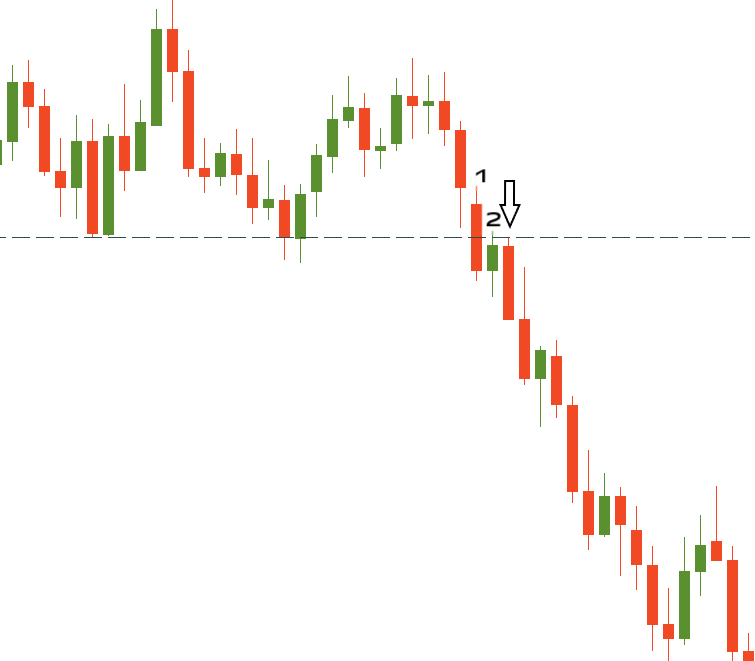

According to risk management rules, a trader should use no more than 1-2% of the deposit to open one order. Besides, there is a more conservative way to use this strategy. After the signal candle appears and breaks the support/resistance level, a trader shouldn’t open the pending order as written above. Instead, he/she should wait for the next candlestick to occur in the chart. Then, if this next candlestick doesn’t break the critical level back, a trader should place a pending order.

Great! You’ve just learned a pretty hard strategy! If you want to try it, use the Demo account!