Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe most important events to trade on

Every trader knows that economic data have a great impact on the Forex market. To become a successful trader, you need to follow economic indicators and Forex news. This way you will be able to keep up with the recent events and get clues about currencies’ movements.

All economic data releases are gathered in the economic calendar. There are a lot of different economic indicators there, so if you are a beginner trader, you won’t know where to look first. Don’t worry though! We chose the most significant events that you should definitely follow to predict the behavior of currency pairs you trade.

We offer to start with central banks’ meetings. Meetings are important not only because a central bank announces the interest rate, but also as it gives clues on the future monetary policy.

During the meeting, the central bank often presents its outlook on current and future economic conditions. If the bank sees them as encouraging, traders will expect future rate hikes and, as a result, a stronger currency. Vice versa, a weaker economic outlook will make traders sell a currency. Moreover, both interest rate and economic outlook should be taken into consideration.

Example

Let’s look at an example of the correlation between the central bank’s speech and the currency’s movement. On September 14, 2021, the Governor of the Reserve Bank of Australia said that interest rates are unlikely to rise before 2024. As a result, the Australian dollar dropped by 400points against the USD.

Let’s turn to economic indicators.

GDP. GDP or Gross Domestic Product can be called the most important indicator of a country’s economic health and the broadest measure of an economic activity.

It is worth noting that in many advanced economies there are three versions of the GDP release – advanced, preliminary and final. An advanced GDP moves the market the most.

Any increases in GDP growth leads to an increase of a currency’s exchange rate. Vice versa, if the GDP data is weaker than anticipated, a currency will fall.

Example

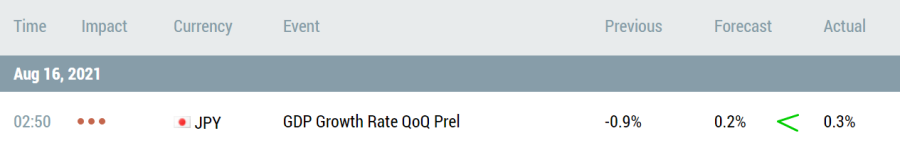

Japan revealed better-than-expected GDP growth on August 16.

As a result, USD/JPY fell by 245 points in 3 hours after that release, and then the pair continued tumbling further. The whole drop was 490 points. Wow!

US Inflation Rate (CPI). There are two different names for one term. You can meet both of them in calendars and articles. CPI or consumer price index represents average prices paid by consumers for a basket of market goods. As a result, changes of this index identify periods of inflation and deflation. Moreover, the data displays how effective the government’s economic policy is. There are two types of CPI: CPI and Core CPI (excludes the volatile energy and food prices) that are published at the same time. Traders pay a higher attention to the CPI data.

As you know the interest rate of a central bank depends on economic growth and inflation. That is why central banks pay great attention to CPI releases. If the CPI growth is close to the inflation target of a country or higher, a central bank will likely lift up its rate and a currency will rise as well. Alternatively, a currency will depreciate.

Example

The US revealed worse-than-expected inflation numbers on September 14.

The US dollar has weakened and EUR/USD rocketed by 320 points in 30 minutes after the release.

PMI. As we talked about GDP, it is worth mentioning PMI. PMI or Purchasing Managers’ Index is an indicator that measures the economic health of manufacturing sector. The aim of the Index is to provide information about the current business conditions to analysts, purchasing managers, decision makers. Furthermore, it is used as a leading indicator of GDP growth or decline. Plus, central banks use these data when formulating monetary policy.

If a PMI goes down in a given country, investors may expect a dovish mood of a central bank. Moreover, they may reduce their exposure to the country’s equity markets and increase it into other countries’ equities with rising PMI reading.

Example

On June 23, Euro Area has published strong PMI numbers. Actual reports were better than forecasts.

As a result, EUR/USD has jumped by 415 points!

NFP. NFP or Nonfarm Payrolls is an economic indicator that displays the change in the number of employed people in the United States during a previous month, but it excludes the farming industry. The indicator is highly important as it gives clues on consumer spending that accounts for a majority of overall economic activity.

It is released at the first Friday of a month and causes great moves in the Forex market as the USD is a part of many popular currency pairs.

If the actual figure of the payrolls is like it was predicted, the USD movement will depend on the additional data such as the unemployment rate and average hourly earnings. The latter is a measure of inflation and has a big impact on the policy of the US central bank, so its role is becoming more and more important.

Example

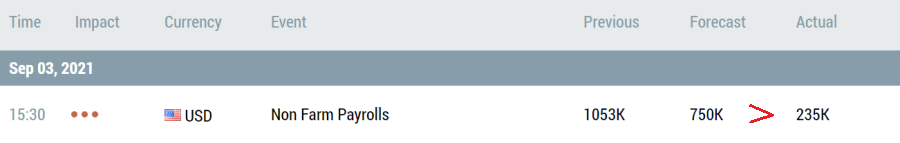

The US has published the poor Non-farm payrolls on September 3. Only 235,000 Americans were employed in August, while the market expected 750,000.

As a result, the USD weakened, and EUR/USD surged by 380 points in 30 minutes!

We presented the most important events that will give you chances to boost your profit. Follow economic calendar events and market movements, build your trading strategy based on these events and earn more!