Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaBy this time, you have already learned some basics. Now it’s time for trading strategies! Today we will discuss three most popular and useful ones. After reading the article, try them out on a demo account. These strategies will help you understand how trading works and provide you with a plan of action.

You will be surprised by how much just one candlestick may tell you about the market. Notice that this strategy is about Japanese candlesticks.

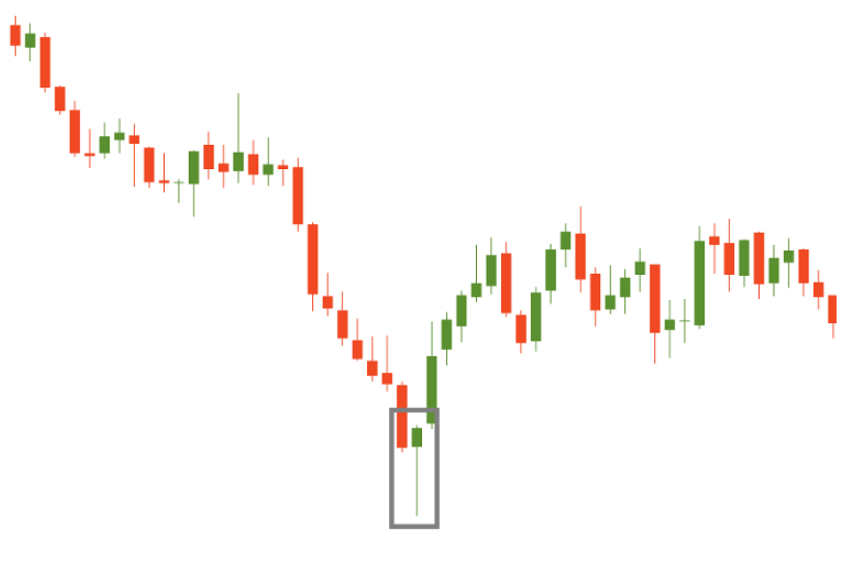

The best example is the so-called ‘hammer’ pattern. It can signal an end of a downtrend, a bottom or a support level. It’s really easy to spot this pattern on a chart as it looks like a real hammer: a long handle and a head. A handle or a candlestick’s shadow should be at least twice the length of the real body. Look for such candlestick after price’s decline – this is an important condition. Wait for the hammer candlestick to close: until it does, the shape of a candlestick may change and it may not be a hammer after all.

Buy when the following candle starts forming or, if you want further confirmation, when the following candlestick closes above the opening price of the candlestick on the left of the hammer. The color of a hammer doesn’t matter, though if it’s green, the signal to buy is stronger.

Here’s how a hammer looks like on the real chart:

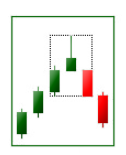

A ‘shooting star’ is quite similar to a hammer. It’s a one-candle pattern too. The candlestick’s body is also small and the shadow exceeds the body at least twice. However, unlike a hammer, a shooting star has a shadow above the body and is a signal to sell. The candle may be of any color, though if it’s red, the sell signal is stronger.

Here’s how a shooting star looks on the real chart:

The previous strategy was about candlestick patterns. Now let’s proceed to simple yet efficient chart patterns.

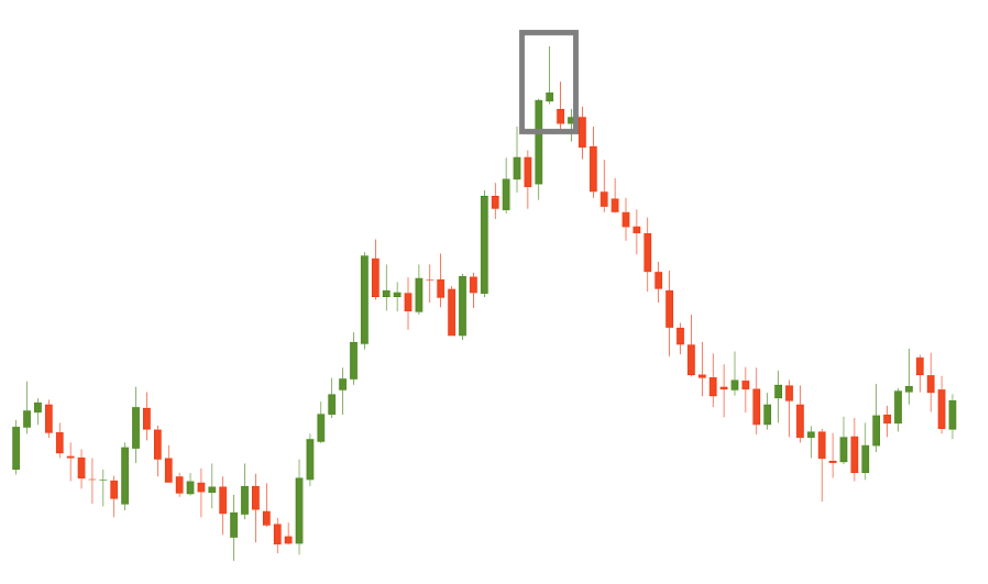

A ‘head-and-shoulders’ pattern occurs at the end of an uptrend. It consists of a head (the second and the highest peak), two shoulders (lower peaks) and a neckline (the line that connects the lowest points of the two troughs and represents a support level). The neckline may be either horizontal or sloping up/down. The signal is more reliable when the slope is down rather than up.

The pattern is confirmed when the price breaks below the neckline after forming the second shoulder. The odds are that after this the price starts a downtrend. As a result, a sell order is put below the neckline. Measure the distance between the highest point of the head and the neckline. This distance is approximately how far the price will move after breaking below the neckline.

Notice that prices tend to return to the neckline after the initial breakout. In this case, the neckline, which used to be a support, often acts as resistance.

An ‘inverse head-and-shoulders’ pattern is the exact opposite of the head-and-shoulders. It occurs at the end of a downtrend and indicates a bullish (upward) reversal.

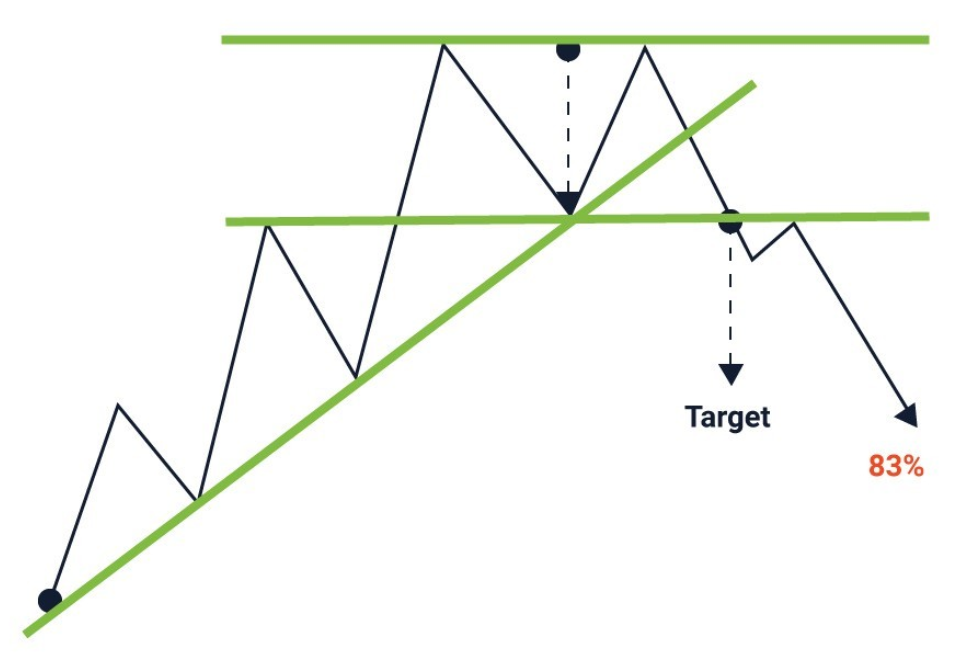

A ‘double top’ also usually forms at the end of an uptrend. Traders use it really often. The pattern consists of two consecutive peaks of similar (or almost) height with a moderate trough between them. The neckline is drawn horizontally through the lowest point of a trough.

The pattern is confirmed when the price breaks below the neckline after forming the second shoulder. Once it happens, the currency pair should start a downtrend. Put a sell order below the neckline. Measure the distance between the peaks and the neckline – this distance is approximately how far the price will move after it breaks the neckline. After the breakout, the price may return to the neckline for a short time before it resumes its slide – this is s good opportunity to open a sell order at a higher price.

A ‘double bottom’ is the exact opposite of a ‘double top’. It occurs at the end of a downtrend and indicates a bullish (upward) reversal.

The similar patterns with three peaks/troughs are called ‘Triple top’/’bottom’. The logic of trading is the same.

In the previous strategies, we used nothing but the price chart itself. Now it’s time to apply a technical indicator called ‘Moving Average’, MA for short.

Moving average is a trend indicator. MA shows the average price for a period, so its fluctuations are smoother than those of the price chart itself. For example, if we have a 10-day MA, we calculate a sum of the last 10 prices and divide it by 10. As new candlesticks appear on the chart, the oldest one isn’t counted anymore.

There are four types of MAs: simple, exponential, linear weighted, and smoothed. We recommend starting with the simple one.

In the top menu, go to “Insert” – find “Indicators” – go to “Trend” – and choose Moving Average. It’s more important to apply correct settings.

A period is a number of candlesticks that will be taken into consideration for calculating. The bigger the period is, the smoother the MA. The smaller the period, the closer the MA will be to the price.

Traders prefer MAs with 50, 100, and 200 periods for big timeframes and 9, 12, and 26 for smaller timeframes.

There are several options. It can be close, open, high, low, median, typical and weighed close prices. However, usually, traders use the close price.

This setting is used to pull the indicator forth and back on the time scale. As a result, the MA will move to the right or to the left.

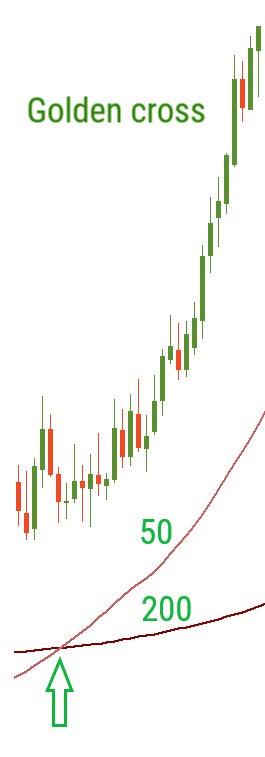

You can use MA as a trend indicator: if it goes down, it’s a downtrend; if it goes up, it’s an uptrend. Moreover, a Moving Average crossover may help a trader to decide when to enter and exit the market. A moving average crossover happens when two different MAs cross each other. There are two types of crossovers: golden and dead.

When a MA with a smaller period crosses a MA with a bigger period bottom up, it’s a signal to buy.

When a MA with a smaller period crosses a MA with a bigger period upside down, it’s a signal to sell.

Note the golden cross usually works when the price is above the MA, or in case of the dead one – below the MA.

Let’s sum up what you’ve learned today:

Awesome! Now you are able to use all these trading strategies. But, as everybody knows, the best way to digest information is to practice.