Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

There are two things that a trader needs to know about how Forex works before they start trading. These are leverage and margin.

Leverage allows Forex traders to control larger trades while margin is the minimum requirement of capital needed to open a trade. Trading platform will warn you of low margin level, but be aware of stop out. Leverage and margin. How do leverage and margin work on Forex, and how can I use them?

Leverage is essentially borrowed capital. It's a sum of money that your broker provides to you so that you could have greater flexibility when trading on Forex. Since the size of Forex lots can be overwhelmingly large, leverage allows you to trade larger lots and open more positions without having to put all of your equity into one huge trade.

This is easier to understand through an example. For easier calculation, let’s look at the example of 1:100 leverage ratio. Suppose you want to trade using the 1:100 trading leverage. This means that out of the 100% of the money, you provide only 1%, while your broker provides the other 99%.

You probably know that when trading on Forex, you are trading lots. One lot usually is 100 000 monetary units in the base currency of the trade. The minimum trading volume usually equals 0.01 lots or 1000 monetary units of the base currency.

If you are buying EURUSD, the minimum purchase is 1000 euro. It can be a lot for a trader, and they can open only one position with this sum. However, if the trader is using 1:100 leverage, they need to provide 1% or €10 (the broker will provide the remaining €990). Still, the profit or loss will be calculated on the whole leveraged sum.

The change in currency value is measured in pips. Depending on the currency, its volatility, and liquidity, different pairs can have different pips: for EURUSD, one pip equals 0.0001. Suppose some major financial event affects the value of the USD and it declines by 50 pips. If the trader purchases 0.01 lots of the EURUSD, their profit will amount to position size (€1000 for the smallest position available) multiplied by the number of pips (0.0001*50). The profit on the €1000 trade will be $5, or 0.5%.

If the trader has no leverage, they invest €1000 and profit $5 or 0.5%. If the trader uses the 1:100 leverage and conducts the same trade, their own investment will be only €10, but the profit will stay $5, making it a 50% profit.

Forex brokers offer a wide variety of leverage sizes and have different leverage rules. In FBS, the leverage may be accessed through Personal area and changed in the Account settings. You need to choose leverage that is the most suited for your skills.

Now that you know what leverage is, margin is easy: in Forex trading, margin is a sum of money that is required from you to open a position. The €10 the trader provides in case of using 1:100 leverage in the example above is the margin.

The funds that you hold in your trading account is the money you use as margin when trading on Forex. If there is a reason for the trader to expect profits from a trade, they can use a large leverage ratio and smaller margin to control a bigger trade size.

Forex margin requirement will depend on the leverage ratio that the trader chooses as well as the lot size and the instrument. Let us show you examples of different leverage sizes and the margin required to use them:

|

Instrument type

|

Margin requirement

|

Maximum leverage

|

|

Major currency pairs

|

3.33%

|

30:1

|

|

Minor currency pairs, including Spot Gold

|

5%

|

20:1

|

|

Major stock market indices

|

5%

|

20:1

|

|

Minor indices

|

10%

|

10:1

|

|

Commodities (except Spot Gold)

|

10%

|

10:1

|

|

Shares or other underlying assets

|

20%

|

5:1

|

|

Cryptocurrency

|

50%

|

2:1 |

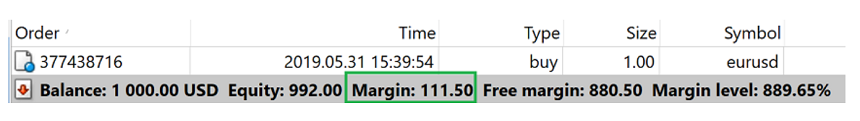

Your trading platform will also show you free margin (or usable margin) and margin level figures. Free margin is the money that you have in your account that can be used to maintain your open positions or open new ones. Margin level is the percentage that shows the trader how much of their funds is not being used at the moment.

If one of your open trades is a losing one, your margin level will be going down, and to avoid losing all of the money, brokers use the so-called margin call. Margin call is a specific margin level (at FBS, it equals 80%) that, once reached by the trader, initiates a warning to make sure the trader either closes the losing trades or deposits more funds into the account.

Once the margin level drops to the minimum allowed level, or stop out level (at FBS, it equals 50%), some of the trades, starting with the most losing ones, will be closed automatically to prevent the trader's negative balance.

Equity, margin level, and free margin change in real-time, so pay close attention to those numbers, especially if you are using a larger leverage ratio. Leverage can lead to big profits with smaller investments. Still, the same formula applies to loss, so be careful when deciding on leverage: sure, your profits will multiply, but in case of a loss, that will multiply as well.