Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

The decision to buy or sell the currency pair depends on your expectations of the future price. If you think that EUR/USD will rise, you buy the pair or, in other words, open a long position on this pair. If you think that the EUR/USD will fall, you sell the pair or, as traders say, open a short position on this pair. As some time passes and the price of EUR/USD changes, you close the position and get the profit if the price changed in line with your expectations. If the price moved in the opposite way, you have a loss on this transaction.

To perform these operations, you need to place orders – to give your broker special commands in the trading terminal. There are several different types of orders, the main are market orders, pending orders, take profit orders and stop loss orders. Let’s see what their functions are.

Market orders – buy and sell – are designed to open positions at the current market price. The position will be opened immediately after you place such an order. Pending orders, on the other hand, allow you to choose entry levels in advance. In this case, the trade will automatically open once the price level that you have chosen is reached, and you won’t need to be in front of the monitor when it happens.

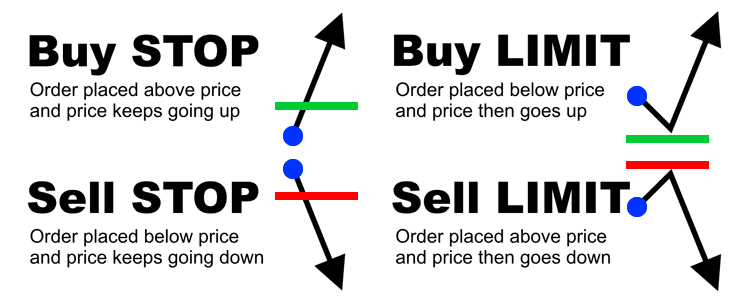

If you think that the price of the currency pair will rise and then reverse to the downside, place Sell Limit above the current price. If you expect the currency pair to decline and then switch to the upside, place Buy Limit below the current price. If you think that selling will intensify once the price breaks a certain level on the downside, place Sell Stop below the current price. If you expect that buying will intensify once the price breaks a certain level on the upside, place Buy Stop above the current price.

To close profitable positions, use an order type called Take Profit. To close unprofitable position – use Stop Loss order. For example, you enter a stop order 50 pips away from your entry point. As soon as the market moved 50 pips against you, your stop order would automatically close you out of that trade to protect you from losing more than 50 pips.