Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

If you entered EUR/USD long at 1.0500 and prices moved higher to 1.0550, it means that you made 50 pips. Congratulations! You’ve earned some money. OK, you might say, but how much? Good question! Let us calculate your profits.

There is a simple formula for this:

1 pip in the decimal form / the current exchange rate of the quote currency to the US Dollar = value per pip.

In our case:

0.0001/ 1 = 0.0001 (rounded up). It means that you will get this sum for every pip of your profitable trade.

As you can see is not a large sum of money. Well, it’s because it is the value of a pip per unit, but traders operate with a bigger number of units — so-called lots.

Calculate the profit using the FBS calculator

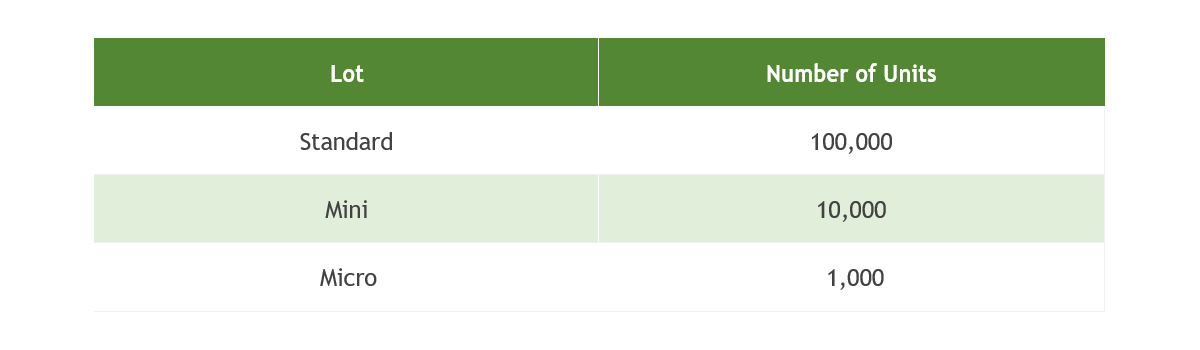

A lot is an order of a certain number of units. Historically, Forex trading was only available in specific amounts of base currency called lots. A standard size of a lot equals to 100,000 units of a base currency. Later on, when Forex market opened for traders with smaller capital, a mini and even a micro lot became available.

You may see that the smallest lot is a micro lot (1,000 units of a base currency, it is often referred to as 1K). You can trade 1,000, 2,000, 3,000 or 124,000 units so long as it can be multiplied by 1K. Each 1K is referred to as a lot.

So, if you as in the last example open a long trade with one standard lot on EUR/USD, you will be buying 100,000 units. In this case, your profit will be not 0.00009478 USD for 1 pip the price goes in your favor, but 0.00009478 USD *(multiplied) 100,000 which is approximately 9.4787 USD. You may also open trade with mini (10,000), or even micro (1,000) lots. In this case, your profits will be something like 0.94786 USD and 0.09478 USD per 1 pip accordingly.

You should remember that the US Dollar is a quote currency in many pairs (EUR/USD, GBP/USD etc.). It means that the exchange rate of the quote currency to USD equals to 1.

100,000 * 0.0001 / 1 = $10 (pip value for EUR/USD)

100,000 * 0.0001 / 1.0195 = $9.8 (pip value for USD/CHF)

100,000 * 0.01 / 120.65 = $8,28 (pip value for USD/JPY)