Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

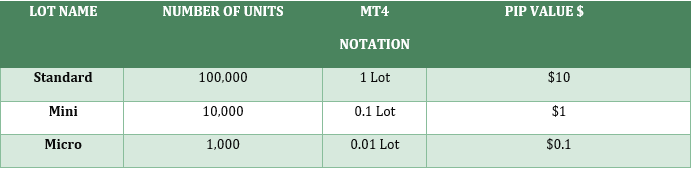

A lot is a number of currency units. A standard lot equal to 100,000 units of a base currency/your account currency. It means that if you want to trade EUR/USD, you will need $100,000. There are two other well-known lot sizes. They are a mini lot (equal to 10,000) and a micro lot (equal to 1,000 units).

To open a trade, you will need to decide how much money to put into it. The term ‘lot’ is closely linked to such notions as ‘leverage’ and ‘pip’. Let’s get deeper into this topic.

A great benefit of trading at the Forex market is leverage. As we already said, a standard lot is $100,000, but it doesn’t mean that you have to invest this huge amount of money by yourself. Your broker can help you. For easier calculation, let’s look at the example of 1:100 leverage ratio. It means that if you want to trade one standard lot of the pair, you have to deposit just $1,000. Your broker will invest the remaining $99,000. There are various of leverage depending on a broke. You can check the leverages provided by FBS: FBS Leverage.

When reading analytical articles or news you will definitely come across the phrase “the currency increased/declined by … pips”. You may ask, what is a pip and how does it affect the amount of money you make or lose?

A pip means “Percentage in Point”. It represents the smallest change a currency pair can make. Usually, a pair is counted in four decimal points, for example, a quote of GBP/USD is given like this: 1.3463. However, there are some pairs that have 2 decimal points. For example, the US dollar/Japanese yen is quoted like 109.70. A pip is represented by the last decimal of a price/quotation.

If EUR/USD changed from 1.0800 to 1.0805, this would be a change of 5 pips. If USD/JPY changed from 120.00 to 120.13, this would be a change of 13 pips.

Note that some Forex brokers also count the 5th and the 3rd decimal places respectively. They are called “pipettes” and make the spread calculation more flexible.

Let’s learn how to count the value of one pip.

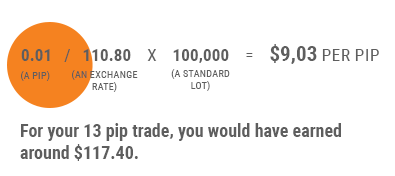

We will use the USD/JPY pair as an example. The exchange rate is 110.80.

(0.01 (a pip)/110.80(an exchange rate) X 100,000 (a standard lot) = $9,03 per pip

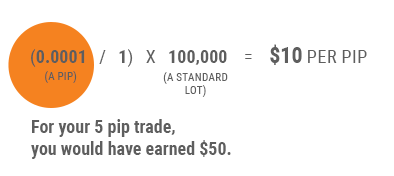

Let’s count a pair where the USD is not a base currency. For example, EUR/USD. The exchange rate is 1.15.

(0.0001/1) X 100,000 = $10 per pip

You have learned what leverage, lot, and pip are. Now it’s time to use your knowledge.

Imagine you trade the EUR/USD pair with 100,000 lot size. You deposited $1,000. Your leverage is 1:100. You made a buy trade at 1.15, the pair went up and you closed your position at 1.1550. It means you earned 50 pips.

Above we have calculated that for EUR/USD 1 pip = $10.

You earned 50 pips, so it means that your profit would be $500.

However, you should remember that the amount of your profit will depend on a lot size, a number of lots you trade, a currency pair and your account currency.

Imagine you traded without a leverage. You deposited $1,000. 0.0001 X 1,000 = 0.1 per pip

As a result, you would earn just $5.

Now you know how leverage, lot, and pip are linked. And you even can calculate your profit. It’s time to practice your knowledge: open your own account