Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

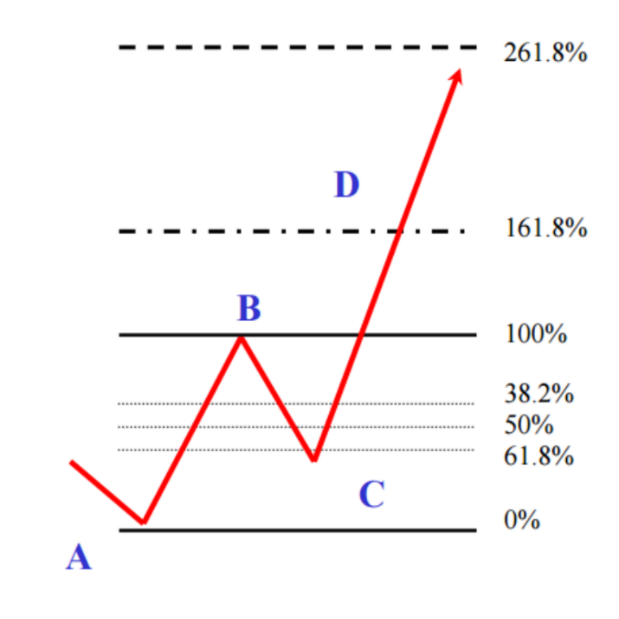

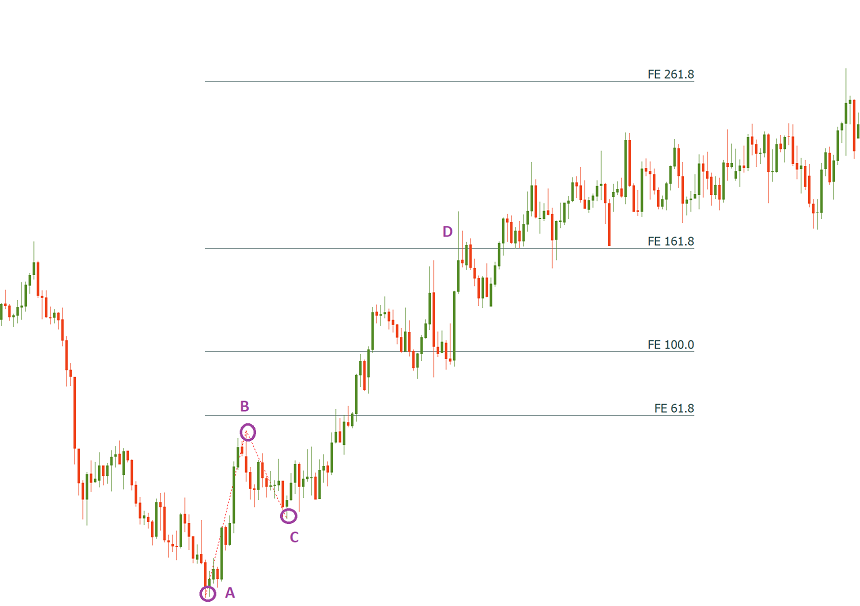

Fibonacci expansion tool will help you pick useful targets when trend trading.

While plotting Fibonacci expansion, you have to take two price waves into account.

Fibonacci expansion tool is used to find the third wave location (check Elliott wave theory).

To put it simply, you will need 3 points on the chart to apply the tool. Look for the start of a new trend: formation of a higher low after a downtrend (the first low, the interim high and the lower low will be used to project the expansions to the upside) or lower high after an uptrend (the first high, the interim low and the lower high will be used to project the expansions to the downside).

Choose the Fibonacci expansion tool in MetaTrader and connect the first 2 points with a line (points A and B on the chart below). Then select the instrument once again by clicking on the baseline you see on the chart and drag the third edge of the instrument to the third top or bottom (point C) without releasing the mouse. Adjust the line so that all 3 points are connected correctly (check that you placed the lines at candlesticks’ wicks).

There are 2 logical places where you can enter the market:

Point D is where you put your Take Profit level. It’s located at the 161.8% expansion. If the trend is strong, the price may move further to the upside, so the 261.8% expansion is also a potential target.