Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

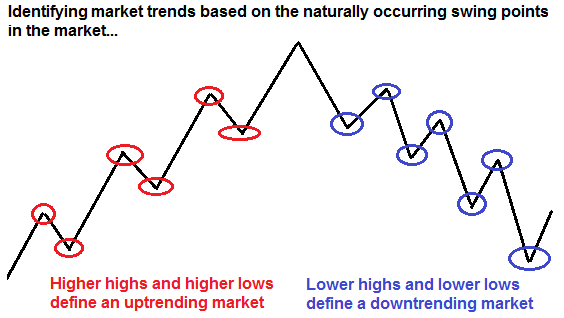

Trends can be bullish (rising trends, uptrends) or bearish (falling trends, downtrends). When a currency pair gets above the previous high, a new higher maximum is formed. When the prices get below the previous minimum, a lower low is formed. Higher highs and higher lows mean that it’s an uptrend. Lower highs and lower lows point at the downtrend.

Trendlines represent one of the most popular tools of technical analysis. Don’t disregard this instrument in favor of more complicated tools, as trendlines can be very helpful for your trading.

The main benefit of drawing trendlines is that they make the picture on the chart clearer. To succeed in trading, you should be able to find useful information on the chart, separate it from the useless info and project it to future. Analyzing the trendline will help to find other formations and, consequently, make right trading decisions.

It’s possible to draw many trendlines on one chart, but too many lines will confuse you. The goal is to choose the most evident lines and draw them. If a trendline is obvious, then many traders, including large speculators, will notice it. As a result, the odds that such line will hold the movement of a currency pair are higher.

A trendline has 2 characteristics:

The more times the price touches the trendline, the stronger is this trend. Pay attention to the angle of the trendline. If it’s less than 30 degrees, a trend is too steep and unstable. It’s better when the trend’s angle exceeds 45 degrees. In other words, the second point through which we draw the trendline should be 20-30 candles away from the first one.

Trendlines may be used on any timeframe, but it’s better if the chart period is greater than M15.

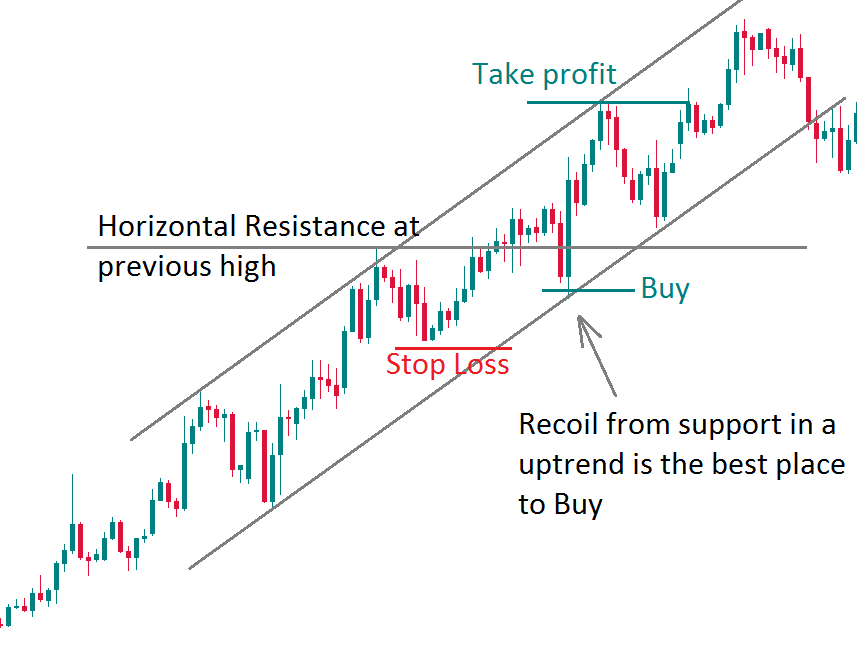

Sometimes you can clone and move the trendline, so that the cloned line is parallel to the first one and limits the trend from the other side so that one line going through the pair’s highs and the other one connects its lows. This is called a trend channel.

Note that the main line during an uptrend is the one that connects the lows (support line), while in the downtrend the focus is on the line, which connects the price’s highs (resistance line). Channels help traders to orient themselves inside the trend.

During the rising/falling trend, it's recommended to open positions in direction of the trend. As traders often say, a trend is your friend. In other words, if the pair reaches support line during an uptrend, the odds are that it will recoil upwards and run towards resistance, so trendline support is a good place to open bullish positions. Buying in uptrend and selling in a downtrend is called trend trading.

The goal is to enter the trend at an early stage in order to get the maximum profit from trading the trend.

Remember that trading counter the trend is riskier and requires professional skills and a vast Forex experience.

If the currency pair went below support line during an uptrend, it will be better if the break is confirmed by one of these conditions:

- Draw trendlines.

- Analyze the trend on multiple timeframes.

- Monitor overbought/oversold condition of the market.

- Don’t hurry to open position. Wait for a proper entry time (see the “Course of actions” section above).

- Look for the patterns – chart, candlestick.

- Don't change your Take Profit order.

- Use Trailing Stop on the basis of the chart’s history.