Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

As you may know, the main role in maintaining the price stability belongs to a central bank. Central banks operate independently of the government. To support price stability, a bank needs to control inflation and create a stable economic environment. These measures could be applied through the monetary policy.

There are two types of monetary policy: restrictive (tight, contractionary) and accommodative (loose, expansionary). The first one is conducted when the amount of money in the economy is huge so the bank increases the interest rate in order to reduce the money supply and encourage a lower level of inflation. On the other hand, the accommodative policy is used when GDP growth is slow. In that case, a central bank increases the money supply and decreases the interest rate. Low interest rates attract investors and are intended to generate more cash inflows into the economy. When the rate is decreased to practically 0% and a central bank still thinks about more supportive measures, it applies quantitative easing.

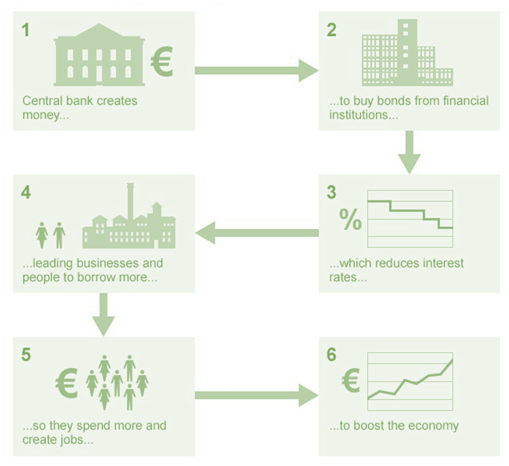

At first, a bank creates electronic money or, as you may have heard, “print money”, although no cash is created.

As a second step, it buys different equities. A classic form of quantitative easing involves buying government bonds, also known as Treasuries, by a central bank. Holders of the bonds receive cash and the bank adds bonds to the balance sheet as assets. However, Treasuries are not the only form of equities a central bank can buy. For example, the European central bank bought private sector bonds. The Fed, in its turn, used to buy mortgage-backed loan products.

Keep in mind, that central banks don’t buy the bonds directly from the government. That case is known as debt monetization (monetary financing) and it’s illegal in monetary policy for big economies. Otherwise, central banks buy bonds, or debt, from large investors, such as banks or investment funds.

When money is "injected" into the economy, it increases the number of usable funds in the financial system. Following the basic economic law, such an inflow of money generates the supply of cheap money, thus, commercial banks and other financial institutions reduce interest rates to encourage businesses and consumers to borrow more. If consumers and investors spend more, it increases the levels of employment and inflation. Therefore, it boosts the economy.

When a central bank stops buying new bonds, it holds on to those in its balance sheet. If these bonds mature (most of the bonds have a maturity date, when the initial investment is repaid to the bond's owner), they are replaced by new ones. In addition, a bank can either let bonds to mature without replacement or sell them to the market.

When a central bank increases the money supply, the price and purchasing power of the currency will fall unless the policy of quantitative easing is conducted by other countries.

There are several reasons why this policy is considered as risky by analysts:

The Bank of Japan (BOJ) started to implement QE in 2001. At that time, the economy faced stagnation and the rise of inflation. As the Japanese economy is doing pretty well, for now, BOJ threw some hints on exiting this program.

The Bank of England and the Federal Reserve applied quantitative easing during the 2008 crisis. The QE in the United States lowered mortgage rates, stabilized inflation, and improved employment situation. On the other side, it devaluated the US dollar.

The European Central Bank began its quantitative easing program in January 2015. The bank decided to stop the policy at the end of 2018, despite the slower economic growth.

There are many pros and cons for the quantitative easing program. From the one side, it definitely supports a stagnating economy. From the other side, there are risks for the currency devaluation and the creation of bubbles. Nevertheless, the effect of the policy can give a boost to economic activity during the time of uncertainties.