Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

The Stochastic indicator was developed by George C. Lane at the end of the 1950s and has been actively used among traders all over the world ever since. It evaluates the market’s momentum and compares the closing price to a price over a certain period of time. The idea behind the indicator is that in a bullish market, prices will close near the high, and in a bearish market, prices close near the low.

The Stochastics can show when the asset you trade is overbought or oversold. It signals when the market’s momentum is slowing down. This, in turn, means that a change in trend is likely. As a result, the observation of the indicator may provide you with trade signals and ideas.

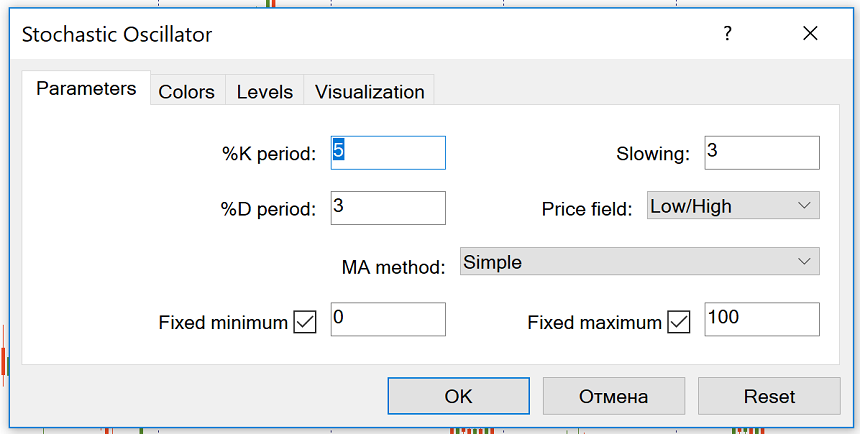

The Stochastics is preinstalled in the default set of MetaTrader. You can add it to the chart by clicking ‘Insert’ – ‘Indicators’ – ‘Oscillators’ and then choosing ‘Stochastic Oscillator’.

The Stochastic Oscillator can be used on all timeframes. The default settings are 5, 3, 3. Other commonly used settings for Stochastics include 14, 3, 3 and 21, 5, 5. Stochastics is often referred to as Fast Stochastics with a setting of 5, 4, Slow Stochastics with a setting of 14, 3 and Full Stochastics with the settings of 14, 3, 3.

Fast Stochastics responds more quickly to the changes in the market price, while Slow Stochastics reduces the number of false crossovers and thus filters out some of the false signals. It’s up to you to choose the parameters you want.

The Stochastic is measured in % from 0 to 100. The indicator is represented by 2 lines: the fast one, also called %K (solid green line), and the slow one, which is referred to as %D (red dashed line). Line %D is the moving average of %K.

These lines intersect when the momentum changes. The signal is to buy when % K (green) crosses % D (red) from the bottom up. Sell when % K crosses % D top down.

Like any other indicator, Stochastics doesn’t give the signals that are 100% profitable. There are two ways to make the signals of this indicator more precise:

In addition, as with , pay attention to the situations when the Stochastic Oscillator is in divergence with the price chart. A sell signal occurs when the price makes a higher high but the Stochastic forms a lower high (bearish divergence). A buy signal appears when the new low of the price is not confirmed by the oscillator.

It’s also recommended to use the Stochastic Oscillator in combination with other technical analysis tools, such as Moving Averages, Heiken Ashi, Alligator, etc.

The Stochastic Oscillator is a powerful tool of technical analysis. It has several purposes and can be the basis of a good trading system.