Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

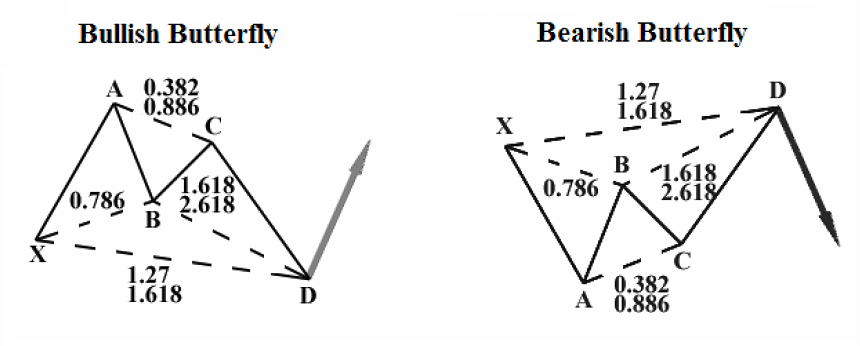

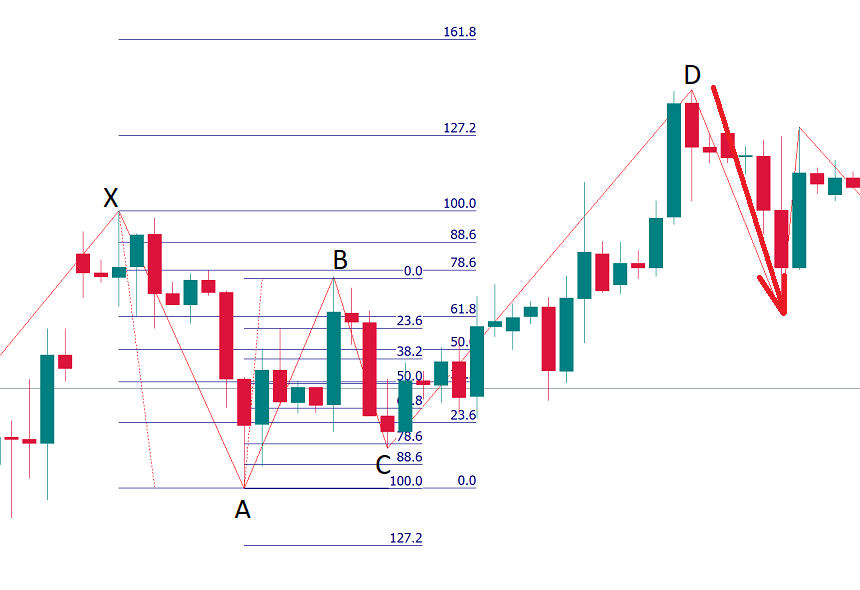

Butterfly is another form of a Gartley pattern. It was discovered by Bryce Gilmore and Larry Pesavento. This pattern usually forms near the extreme lows and highs of the market and foretells a reversal.

The main Butterfly pattern feature is that CD extends beyond XA.

Here are the key parameters of a Butterfly pattern:

Point B is at the 78.6% retracement of XA. Point C is at the 76.8% retracement of AB. Point D is at the 127.2%-161.8% extension of XA.