Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

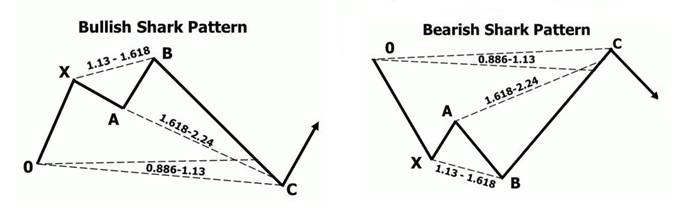

Shark pattern was discovered in 2011 by Scott Carney. The swing points on this pattern are marked with 0, X, A, B, C.

Notice that in all the patterns we studied before (Gartley, Bat, Crab, Butterfly), the second top in a bullish pattern and the second bottom in a bearish pattern were lower/higher than the first one. In a bullish Shark pattern, however, the second top is higher than the first one. In addition, it combines Fibonacci with Elliott waves theory and some new ratios like 113% are used.

Here are the key parameters of a Shark pattern:

The approach to trading a Shark pattern is a bit different from that we designed for other patterns. The entry is at 88.6% of 0X. The Take Profit can be at 50%-61.8% of BC. The Stop Loss should be at point C.

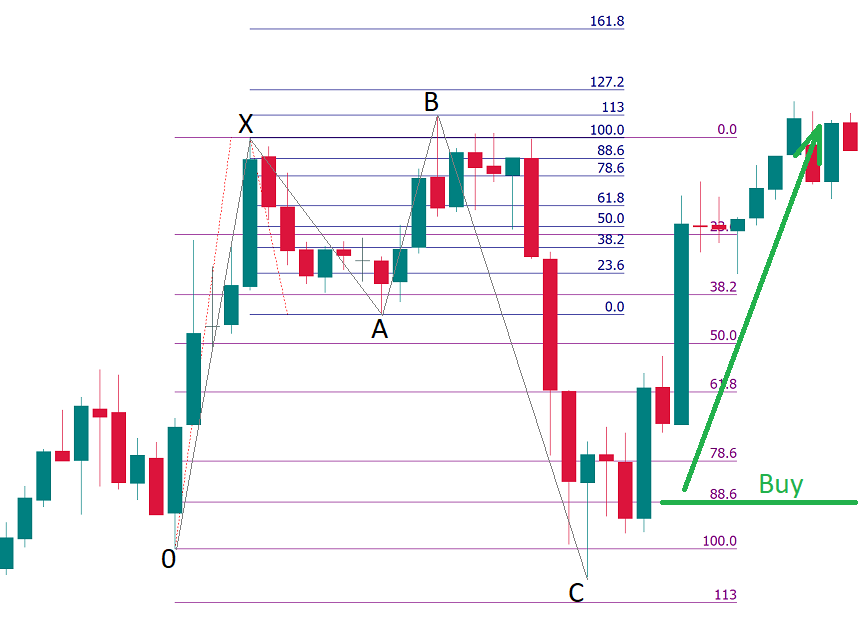

Here’s what a bullish Shark pattern looks like on the chart. Point B is at the 113% extension of XA. Point C is near the 113% extension of 0X. The entry to a buy trade is at the 88.6% retracement of 0X. Stop Loss is at point C.