Sometimes a fifth wave could be weak and end without reaching the end of the third wave. A situation like this calls a ‘truncation’, which we could face at the fifth wave of an impulse or ending diagonal. It’s pretty rare if even possible to have a truncation in a position of the fifth wave of a leading diagonal. Usually, a truncation happens after a really strong third wave.

Real Truncation Examples

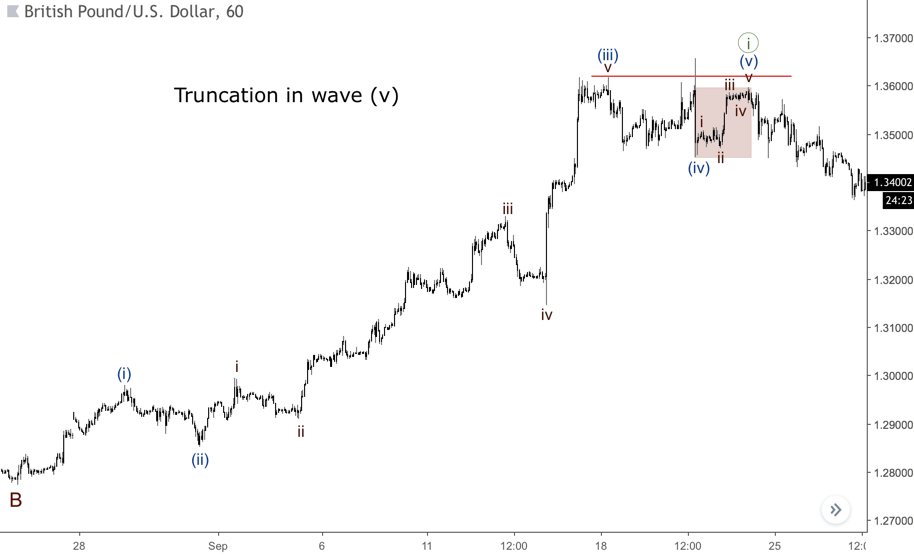

As you can see on the chart below, there’s an upward impulse in wave ((i)) with a huge extension in wave (iii). Wave (iv) finished as a flat pattern (we’re going to examine it in the next articles). There’s also a five-wave price movement from the ending point of wave (iv), which followed by a decline. Thus, the fifth wave of wave ((i)) has turned out to be truncated.

How to recognise truncation

It’s quite challenging to recognise a truncation in the real-time wave counting, so there’re some tips:

- In most cases, a truncation forms in impulses with huge third waves, so if we come to the conclusion that if there’s such a case, we should watch out for a possibility to have a failure in the fifth wave.

- At the same time, there’s always a choice if we have a five-wave price movement from the ending point for the fourth wave, but the market doesn’t move beyond the end of the third wave. In a situation like this, the five-wave price movement could be wave one of the fifth wave or the fifth wave itself. The key point here is what happens after this five-wave price movement after the fourth wave. If we have a local three-wave correction, then it’s likely that the fifth wave is going to be continued. However, if a five-wave price movement forms instead, we should be aware to face a truncation in the fifth wave.

- As we can see on the next chart, sometimes we could face a truncation even if the third wave isn’t huge. Here Wave ((3)) is little more than wave ((1)), but wave ((5)) couldn’t break the low of the third wave. Such a case usually happens when a larger trend is running out of steam. Just to be very clear, it’s so risky to try identifying a truncation in the real time, so we could assume that only when a five-wave price movement forms in the opposite direction.

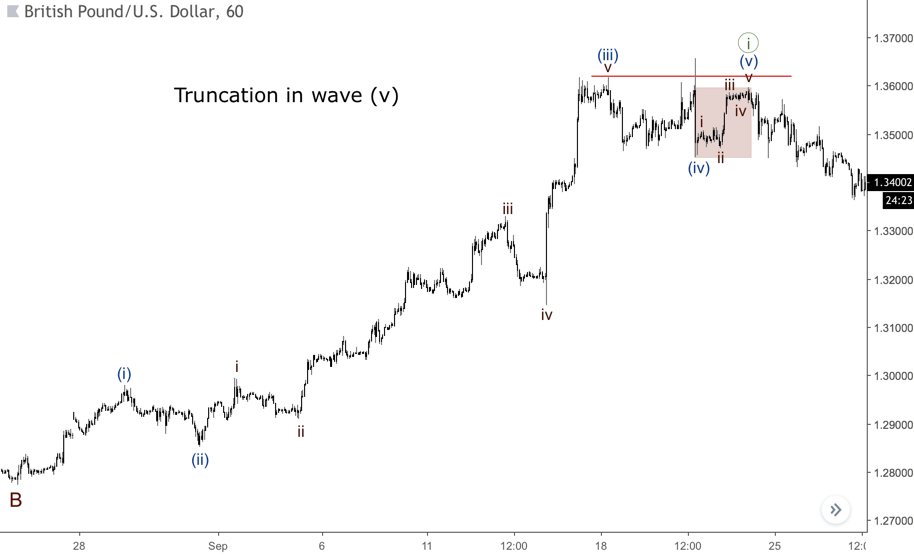

- Let’s move to an example below, which shows a situation with a small truncation. The high of wave ((v)) is narrowly lower than the ending point of wave ((iii)). A five-wave decline arrives afterwards, which confirmed that the truncation has taken place. Pay attention to the fact that wave ((iii)) was so long, which pointed to a possibility to have a truncation. which pointed to a possibility to have a truncation.

- Also, the fifth wave of an ending diagonal pattern could be truncated as well. As you probably already know, in most cases ending diagonals consists from zigzags, so the truncated fifth wave of this pattern could form like a zigzag, not a five-wave price movement like in impulses. It’s common to have a truncation in expanding ending diagonals because there’s the same logic like in impulse waves. The third wave of an expanded diagonal usually longer than the first wave, so the market is exhausted and the fifth wave simply doesn’t have enough strength to reach the ending point of the third wave.

- There’s another tip to recognise a truncation in expanding diagonals. Because the fifth wave is supposed to be a zigzag, wave C of this pattern could be an ending diagonal. Thus, if the ending point of a diagonal in wave C of the fifth wave doesn’t reach the extremum of the third wave, there’s a reasonable chance to have a truncation. An example of this situation is on the chart below. There’s a pullback from the diagonal’s upper side, which led to a massive bearish rally.

The Bottom Line

The fifth wave of impulses and ending diagonals could be truncated, but it doesn’t affect the shape of the fifth wave, which forms like an impulse or diagonal in impulses or like a zigzag in diagonals. A truncation in the fifth wave of leading diagonal is extremely rare. Confirmation of truncation is a five-wave price movement in the opposite direction.