Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

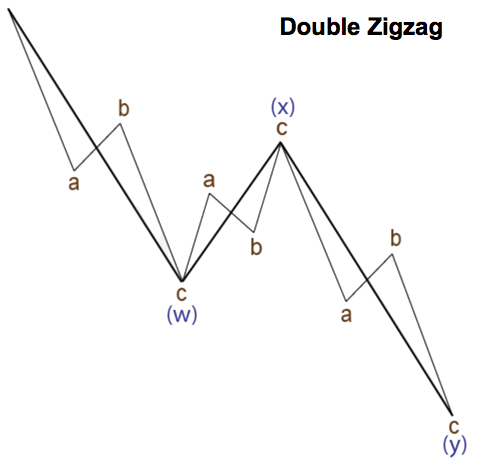

As you can guess from the title, this pattern consists of two zigzags and correction between them. This is the first complex correction pattern we’re going to examine.

It’s not easy to recognise a double zigzag in real-time. Usually, this pattern forms when the first zigzag is far smaller from the expecting correction, so after a break, the second zigzag arrives. In other words, if the first zigzag isn’t enough to be a correction itself, the second zigzag takes place.

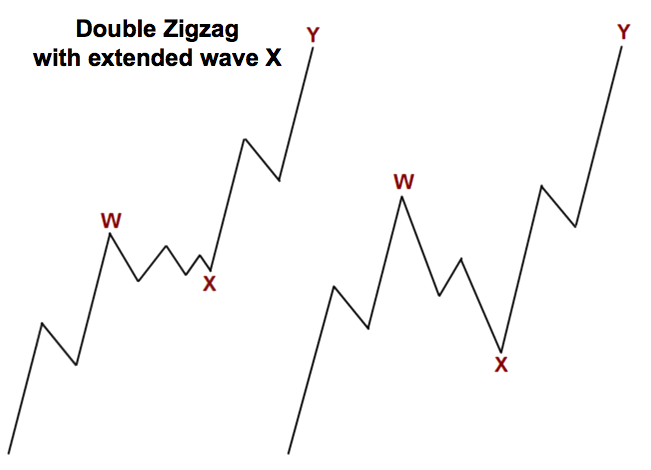

Usually, as shown in the chart below, wave X is longer than corrections inside waves W and Y. If a pattern forms in this shape, it’s pretty easy to label it. Remember, we can say that one or another pattern forms only when the whole structure ends. Until then, we should be careful.

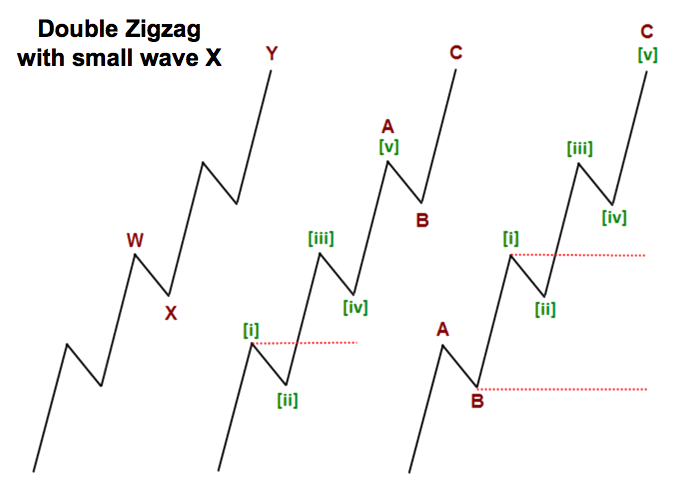

However, sometimes wave X of a double zigzag could be relatively small. In this case, we could count this part of a chart as a single zigzag with extended waves A or C (depending on wave relations because the third wave can’t be the shortest).

Also, if we have a possible count with the longest wave C (this example is on the right on the chart below), we should also consider an option with a developing impulse (in this case, wave C turns out to be the third wave). So, it’s safer to have a double zigzag with long wave X (see the chart above), while a wave count with small wave X could also have some alternatives.

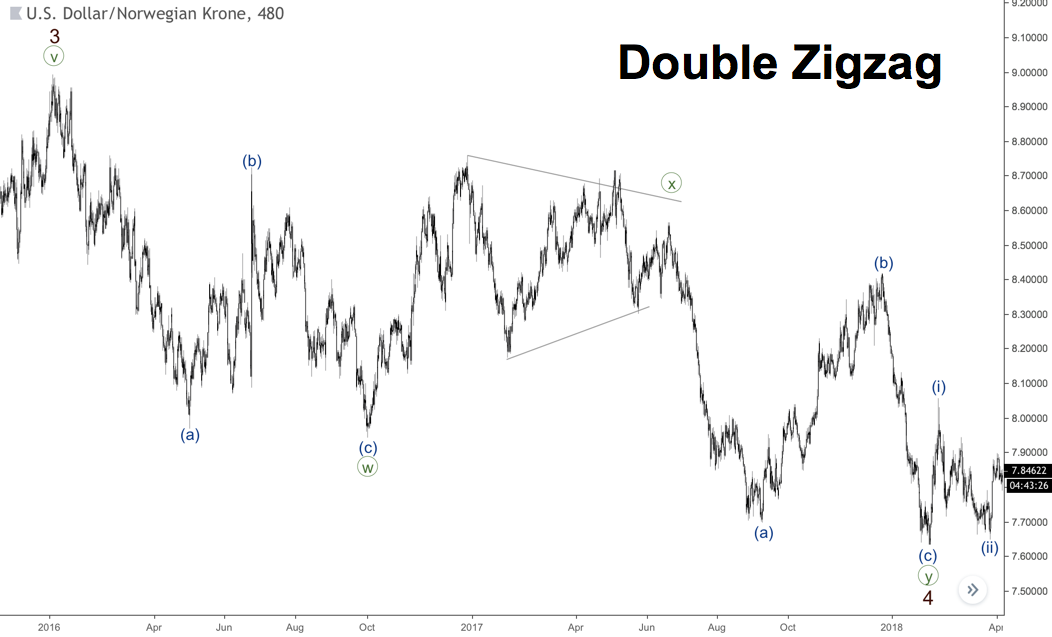

Real examples

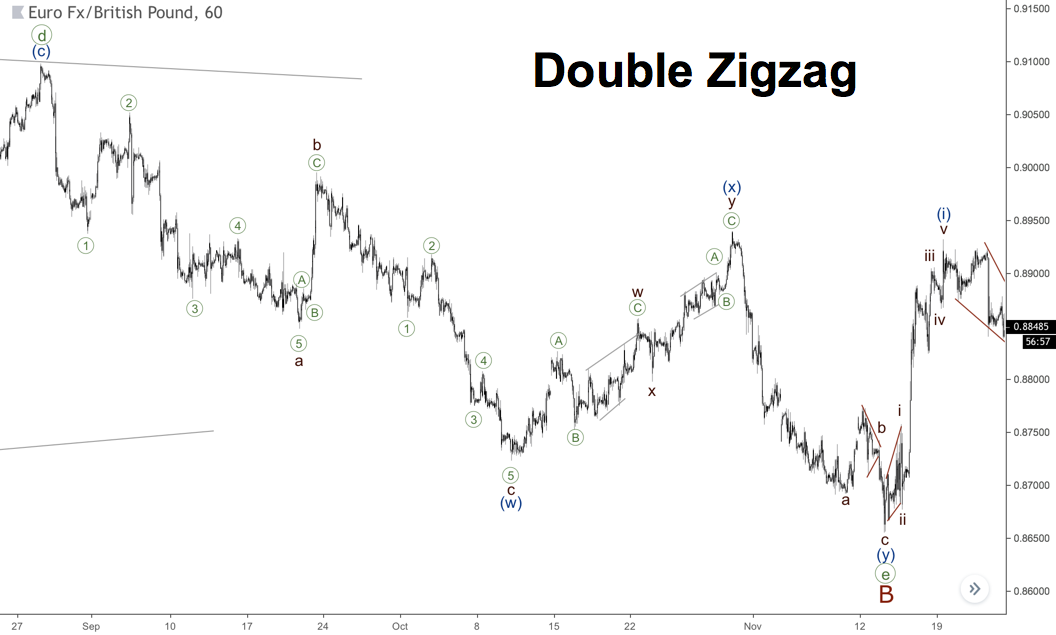

Let’s have a look at the chart below. There’s a downward double zigzag with a triangle in wave ((x)) (we’re going to examine this pattern in the next articles). Waves (a) and (c) of waves ((w)) and ((y)) are impulses (sometimes we could face leading or ending diagonals as well). An impulse in wave (i) confirms the ending of the double zigzag.

The next chart shows a double zigzag with an extended wave ((X)), so it’s easy to count two zigzags in the motive waves ((W)) and ((Y)), which both have longer waves (A). Also, note that an ending diagonal in wave (C) of ((Y)) highlights the ending of the whole pattern.

Two more examples of a double zigzag are shown below. There’s a downward pattern with impulses in all motive waves. Also, there’s another double zigzag in wave (x) with a pretty rare combination of diagonals. An ending diagonal in wave ((C)) of (w) is the final wave of the first zigzag and the second one started by wave ((A)) of (y) as a leading diagonal.

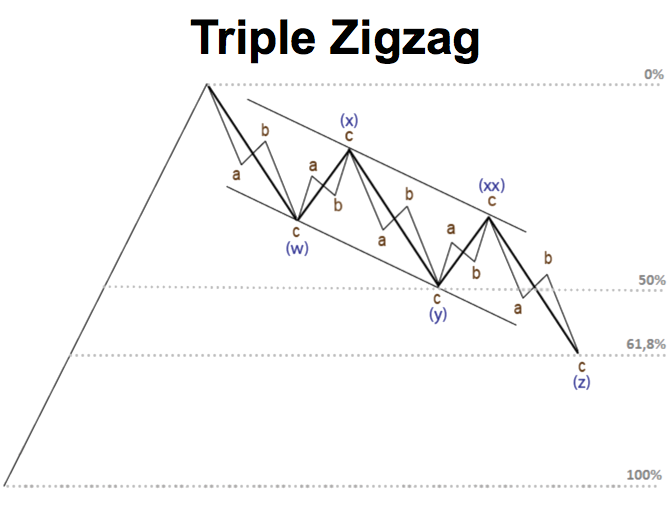

A pattern with three zigzags in a row calls a triple zigzag. Firstly, they’re the main rules for this pattern:

As you can see, the main difference from Double Zigzags is that Triple Zigzags consist of five waves as well as impulses and diagonal. However, Triple Zigzags are corrective waves while impulses and diagonal are motive ones.

To be honest, this pattern is rare. Moreover, it’s extremely rare. In this case, we should avoid using this pattern in real-time wave counting because, in most cases, we’ll be wrong sooner or later. If you think there’s a Triple Zigzag, the first thing you should do is to check if there’s another wave count possible. More often, a simpler wave count is available.

Real example

It’s pretty hard to find an example, but there’s one on the next chart. All motive waves here are zigzags. The first wave X is a zigzag and the second one is a double zigzag. Keep in mind, that the second corrective wave of a triple zigzag could be marked as X or XX.