Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

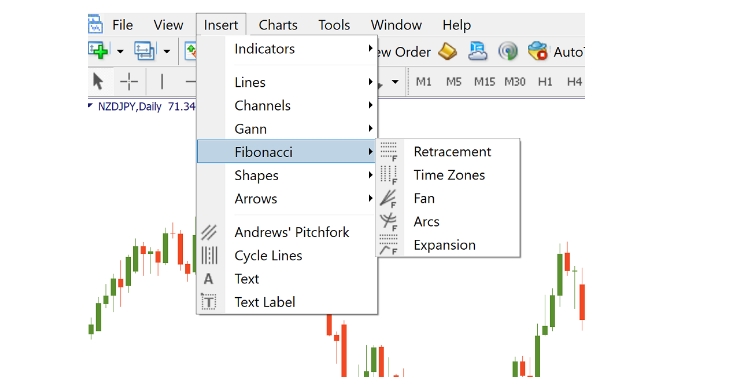

Fibonacci tools are constantly used by Forex traders. To apply them to your charts in MetaTrader, you need to click the ‘Insert’ button of the menu and then choose ‘Fibonacci’. You can find several Fibonacci tools in your trading terminal: retracement, expansion, fan, arcs and time zones. All of these tools are based on the Fibo ratios.

Let’s study the logic behind the Fibonacci instruments.

In the 13th century, mathematician Leonardo Fibonacci researched a series of numbers (0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, etc.). Every number in this sequence is the sum of the two preceding ones. It turned out that the ratios of these numbers correspond to the natural proportions of the things in the universe. For example, tree branches form or split in line with Fibo numbers, seed pods on a pinecone are arranged in a Fibonacci spiral pattern, etc.

Financial markets are no exception: different market movements are often consistent with Fibonacci ratios as well.

The fibonacci sequence has some constant ratios. The most important Fibo ratios are:

Among the Fibonacci tools, we have mentioned the most useful for traders are Fibo retracement levels and Fibo expansions, but fan, arcs and time zones can also be quite helpful.

Fibonacci ratios also play an important role in the Elliott wave theory and harmonic patterns.