Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

We can see an extension in most impulses in the position of motive waves. Generally, an extension is an extended impulse structure with enlarged waves inside, which are almost the same height and length as the other waves of the impulse. So, if a usual impulse has a five-wave structure, an impulse with an extension in one of the motive waves subdivides into nine waves.

It occurs only in the motive waves, so we could find an extension in the first, the third and the fifth wave of an impulse. Most impulses have an extension only in one of the motive waves, most commonly in the third wave. We could, from time to time, face two extensions inside a single impulse, but that’s a pretty rare case. Also, during a long and strong trend, it’s possible to have an extension inside another extension, which is called a multi-extension.

If the third wave an extension forms, then the fifth wave will likely be quite the same as the first wave. If the first and the third waves are about the equal amplitude, the fifth wave could be extended. It’s obvious that it’s just impossible to have an extension in both waves one and five because, in this case, wave three turns out to be the shortest, which violates the main rules.

So, let’s say you try to count a developing extension in the third wave, for example. Because all the motive and corrective waves are nearly the same, you could have a few other wave counts at hand. Sometimes, it’s not easy to choose the best scenario to be the main one. The best thing to do in a moment like this is to just pick a wave scenario with a relatively modest prediction.

As you already know, we could have an extension in the motive waves only. However, sometimes it’s possible to observe something like an extension inside a zigzag. In this case, one of the motive waves (A and C) of the pattern is much longer than another. There’s no mention of an extension inside zigzags in the book ‘Elliott Wave Principle: A Key to Market Behavior’, but sometimes such a disproportion between waves A and C takes place.

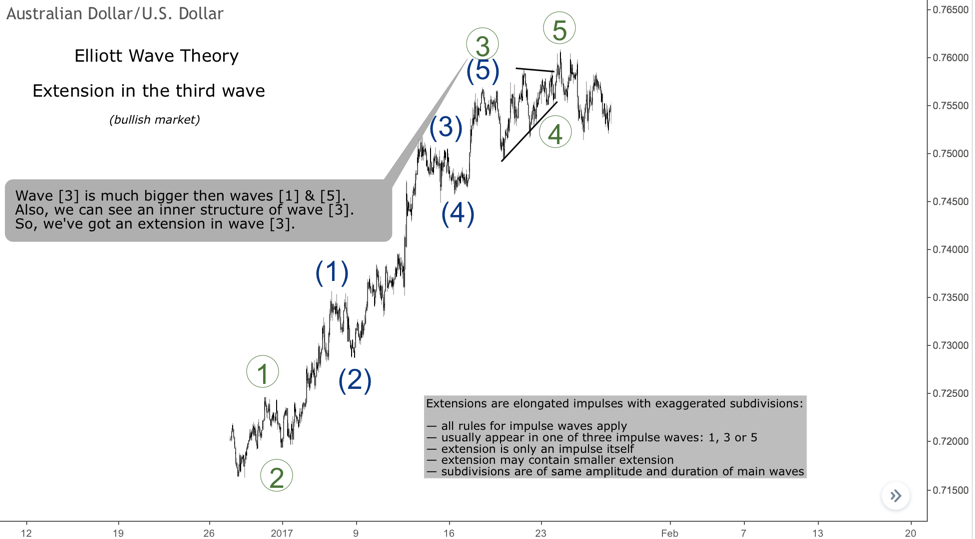

The chart below represents an impulse with a huge extension in wave ((3)), which is subdivided into five waves, which are quite the same as waves ((1)), ((2)) and ((5)). As you can see, after wave ((4)), we had a tiny price movement in the fifth wave. In most cases, it’s likely that if you have wave three more than 1.618 multiple of wave one, there’s a green light for a relatively small wave five.

Sometimes, the fifth wave of an impulse forms an extension, which occurs during massive rallies on the markets. As you can see from the next chart, wave (1) could be wave ((5)) itself, so only a three-wave decline and the subsequent pullback pointed out that the extension started. Moreover, a triangle in the wave (4) confirmed that there’s a developing impulse from the ending of the wave ((4)). Thus, we should be extremely careful with an extension in the fifth wave in the real-time wave counting.

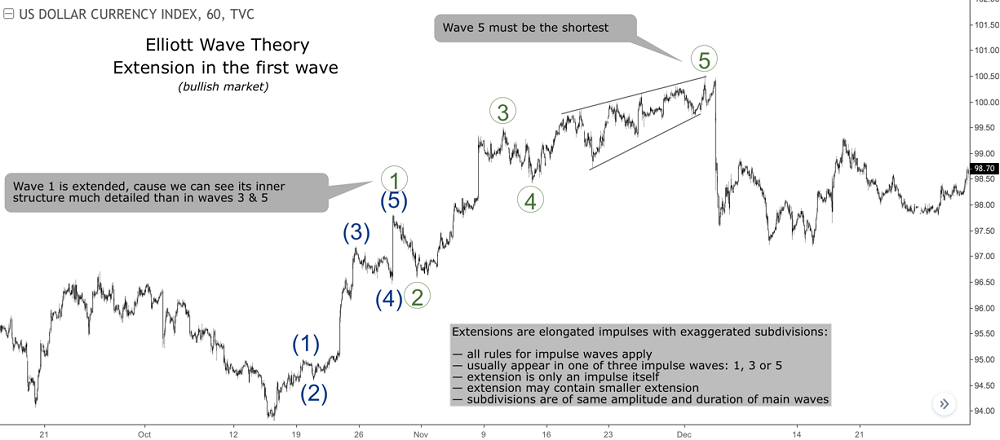

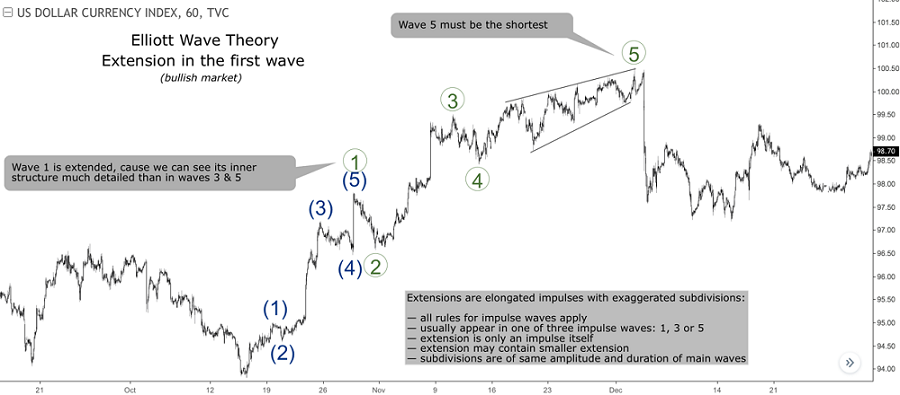

An extension in the first wave doesn’t form often. The next example shows a five-wave advance with the longest wave ((1)). Keep in mind, if wave one is extending, wave three usually is smaller than wave one. In this case, in the absolute majority of cases, an impulse with extended wave one usually has the shortest wave five. The third wave can’t be the shortest, by the way.

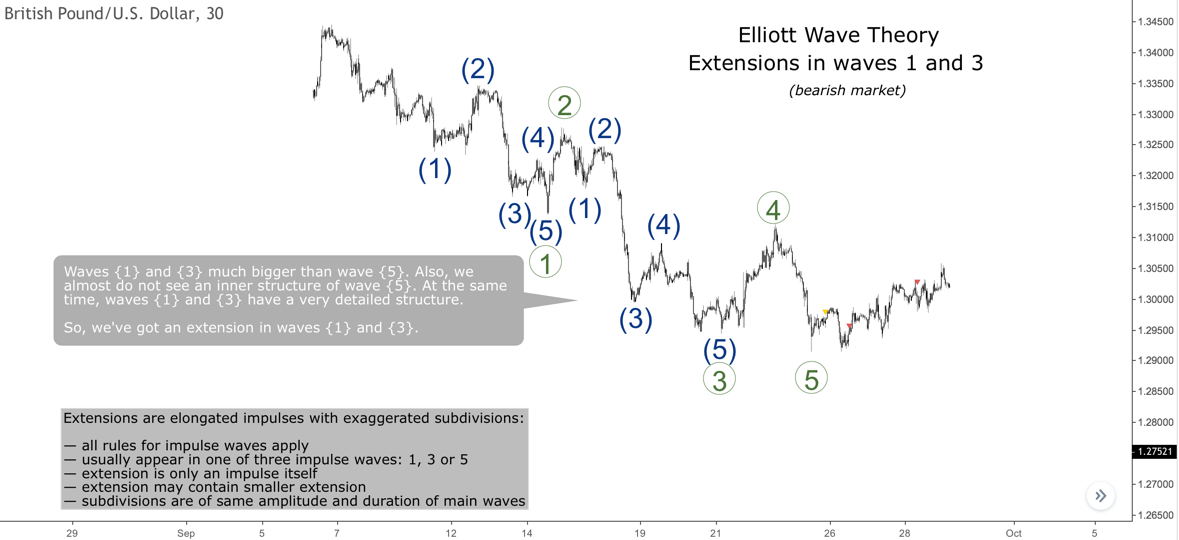

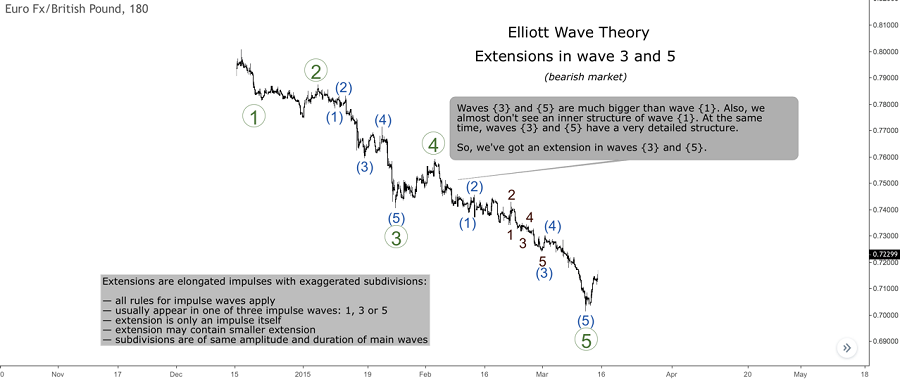

It also possible to have an extension on both waves one and three of an impulse, we can see this situation on the following chart. Waves ((1)) and ((3)) are much bigger than wave ((5)). Also, waves ((1)) and ((3)) have a very detailed structure, but wave ((5)) doesn’t.

Another option is an extension in both waves three and five. It usually happens during a strong and long trend. As shown on the next chart, wave ((1)) is small while waves ((3)) and ((5)) are huge and we can see all subdivisions of these impulses.

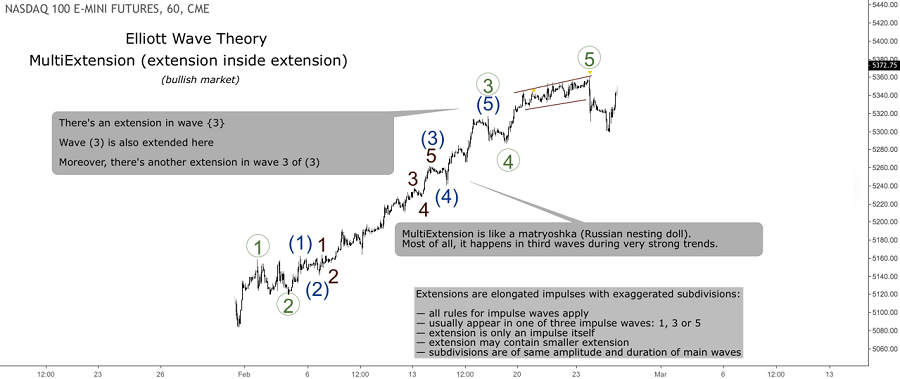

The trickiest type of extension is a multi-extension. It usually forms on the stock market. During a multi-extension, we see a lot of similar waves, so sometimes it’s pretty hard to do a wave count. The key to recognizing a multi-extension is a series of corrections, which form smaller and smaller one after another. If this happens, we could predict a multi-extension, but at the same time, we also should try to find alternate wave counts with fewer expectations. By doing this, we also could find the critical levels, which are supposed to be red lines for a wave count with a multi-extension.

Extensions are an essential part of impulse waves. They happen all the time on all the markets. Moreover, in terms of trading, extensions bring the most interesting opportunities, but we also should always remember to keep risks at a reasonable level.