Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

Unlike motive waves, corrections are more complicated and tricky structures. There're simple and complex correction patterns:

The first two (a zigzag and a flat) are simple patterns, which are bricks of complex corrections. In this article we’re going to examine zigzag and flat patterns.

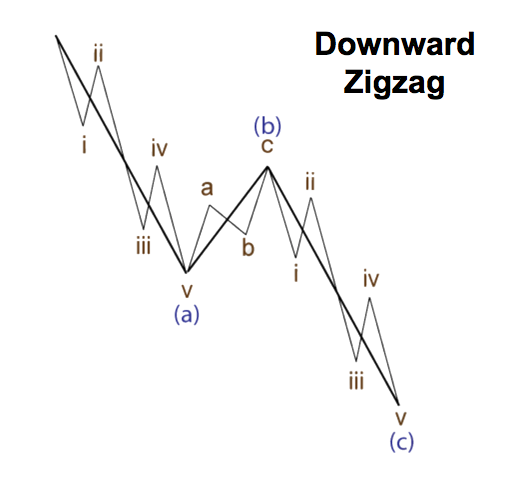

Like most correction patterns, zigzag subdivides into three waves, which are marked as A-B-C.

The main rules for zigzags:

Another simple correction is a flat pattern, it also subdivides into three waves and is marked as A-B-C, but the structure is different.

The main rules for flats:

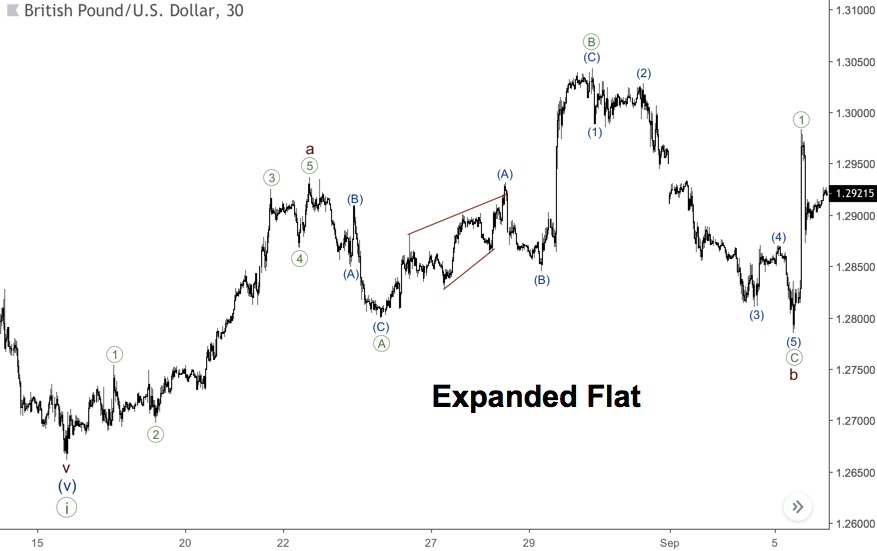

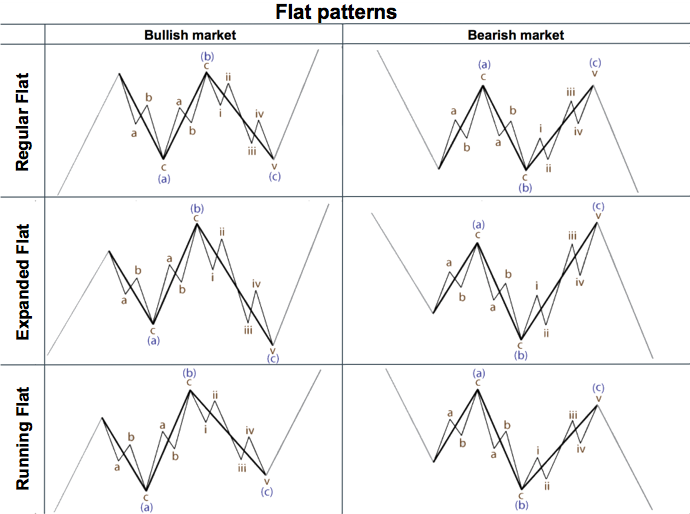

As you can see from the chart below, there’re three types of the flat pattern depending on the length of waves B and C.

Regular Flat: Wave B is almost equal to wave A (at least 90%), while wave C tends to be equal to wave B.

Expanded Flat: Wave B is longer than wave A and wave C is longer than wave B.

Running Flat: Wave B is longer than wave A, but wave C is shorter than wave B.

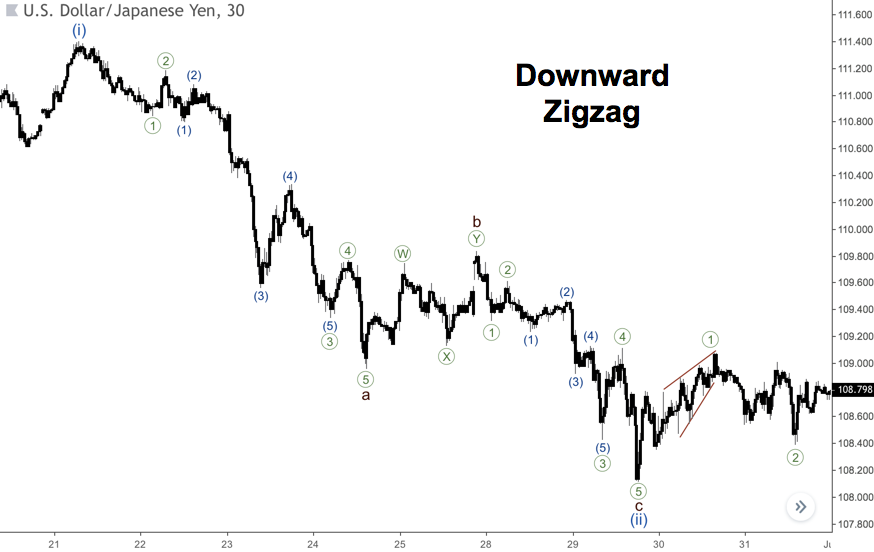

The chart shows a simple zigzag in wave (ii) with impulses in waves a and c. This is the most common structure of zigzags. Also, pay attention to a leading diagonal, which has formed after wave (ii). The pattern confirmed the ending of the zigzag.

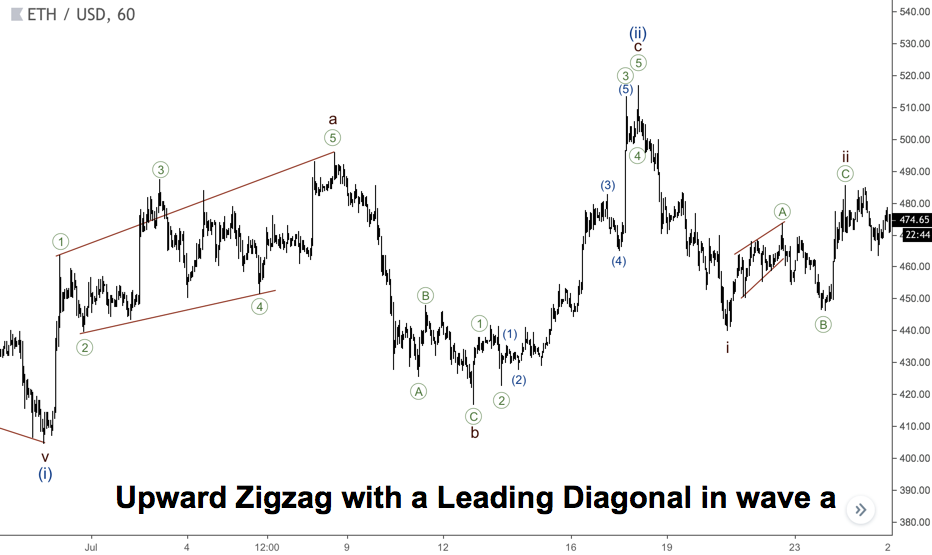

Elliott wave patterns form on all markets, including cryptocurrencies. There’s an Ethereum chart below, where we could find three zigzags. The biggest one is wave (ii). As you can see, the wave (a) of (ii) is a leading diagonal pattern. Wave ii (on the right) is a zigzag with the same structure (wave ((A)) is a leading diagonal). Another zigzag is wave b (in the middle of the chart); its wave ((A)) is far longer than wave ((C)). Sometimes such a disproportion happens, so now you know what you can face with.

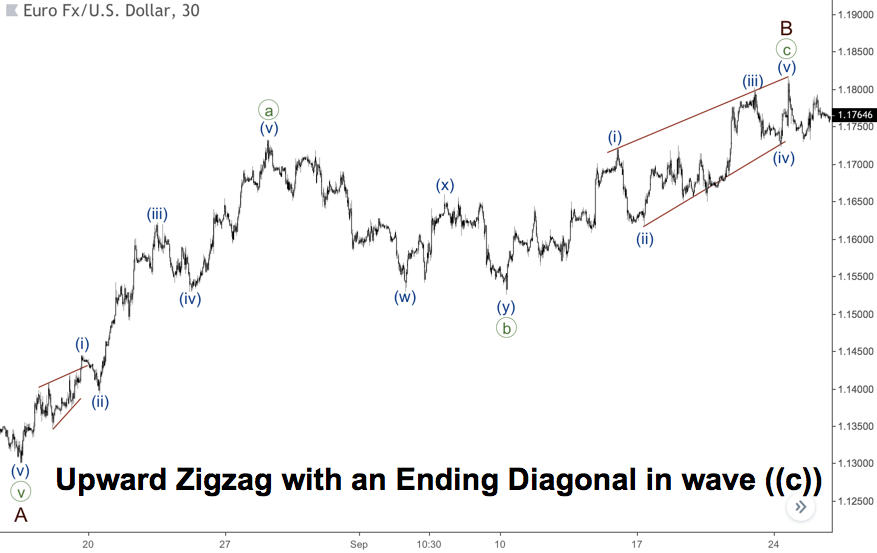

It’s also possible to have a zigzag with an ending diagonal in wave C, you can see this case on the next chart. Wave ((a)) here is an impulse, but after wave ((b)), there’s an ending diagonal in wave ((c)). As you already know, an ending diagonal could form in a position of the last wave of a motive wave (wave five of an impulse or wave C of a zigzag).

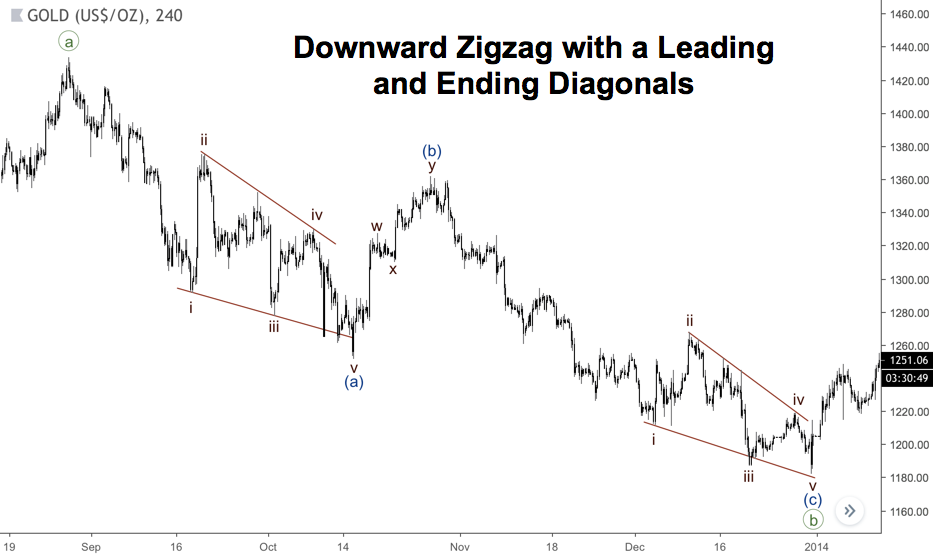

The chart below represents such a rare case when motive waves of a zigzag are formed like a leading and an ending diagonals. Contracting diagonals are more common, but we also could face a structure with expanding ones.

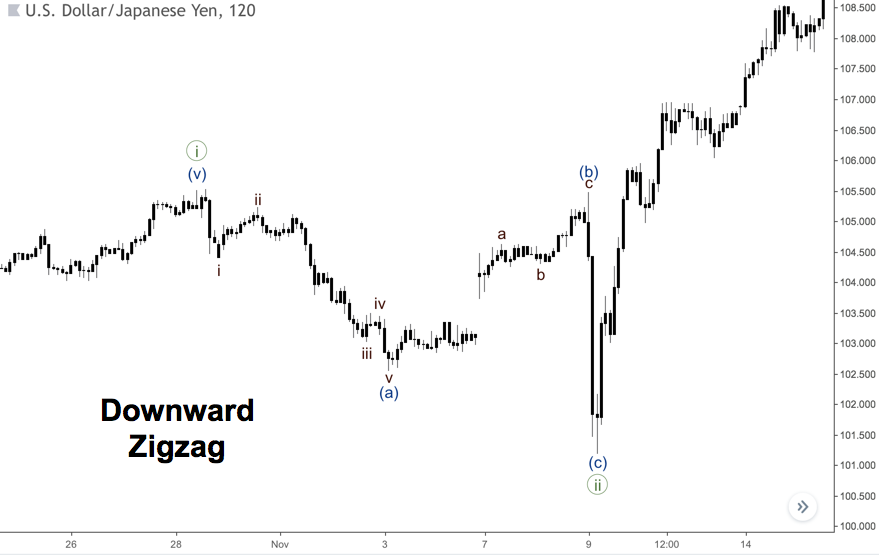

Sometimes wave C of a zigzag could be fast-moving, as you can see on the next chart. There’s a plain and clear structure of wave (a), but wave (c) consists of only three bars. This usually happens when news or political events influence the price movement.

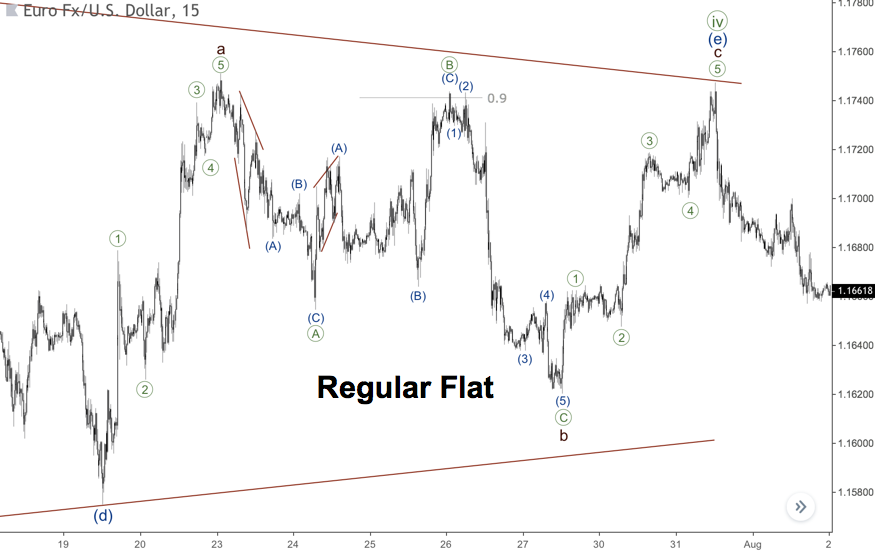

There’s a flat pattern in wave b on the chart below. This is a regular flat because wave ((B)) is about 0.9 of the wave’s ((A)) length. However, the wave ((C)) is pretty fast. There’s one more interesting thing. There’re two zigzags in waves ((A)) and ((B)). The first pattern has wave (A) as an expanding leading diagonal, which is quite rare. The next zigzag has a contracting leading diagonal in wave (A) of ((B)), which is more common.

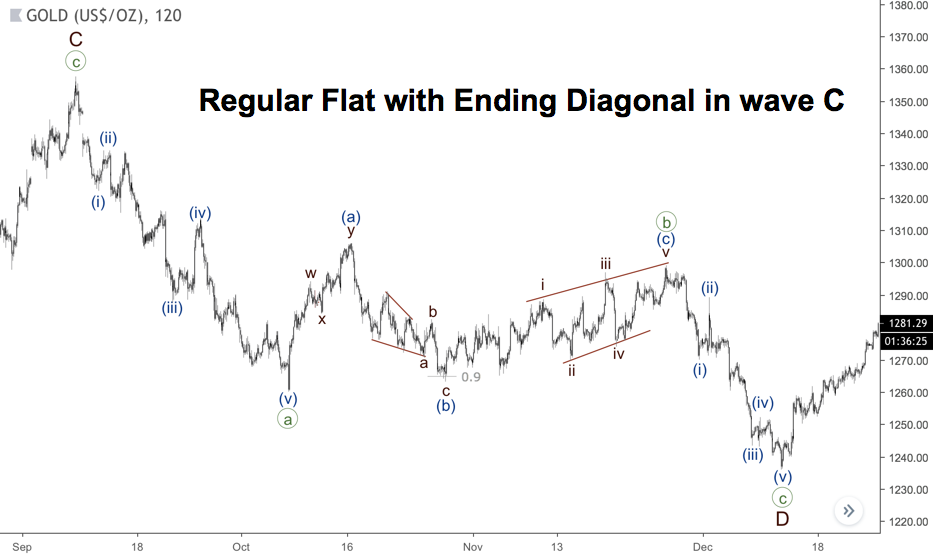

Wave C of a flat pattern could also be an ending diagonal, as shown on the next chart. Wave (b) is shorter than wave (a), so it’s a regular flat. However, an ending diagonal in wave (c) finishes below the high of wave (a). That is how running flats ends. As you can see, there’re some variations in each type of flat patterns in the real market.

The last chart shows a perfect example of an expanded flat pattern. Wave ((B)) is far longer than wave ((A)) and the ending of wave ((C)) breaks the low of wave ((B)). The subsequent bullish impulse in wave ((1)) confirms that a flat pattern is over.