Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaInformation is not investment advice

It’s a price movement, which is subdivided into five waves. Three of them are motive waves (1, 3, and 5), and they move in the direction of a trend. Two of these five impulse waves are corrective waves (2 and 4), so they move against a trend.

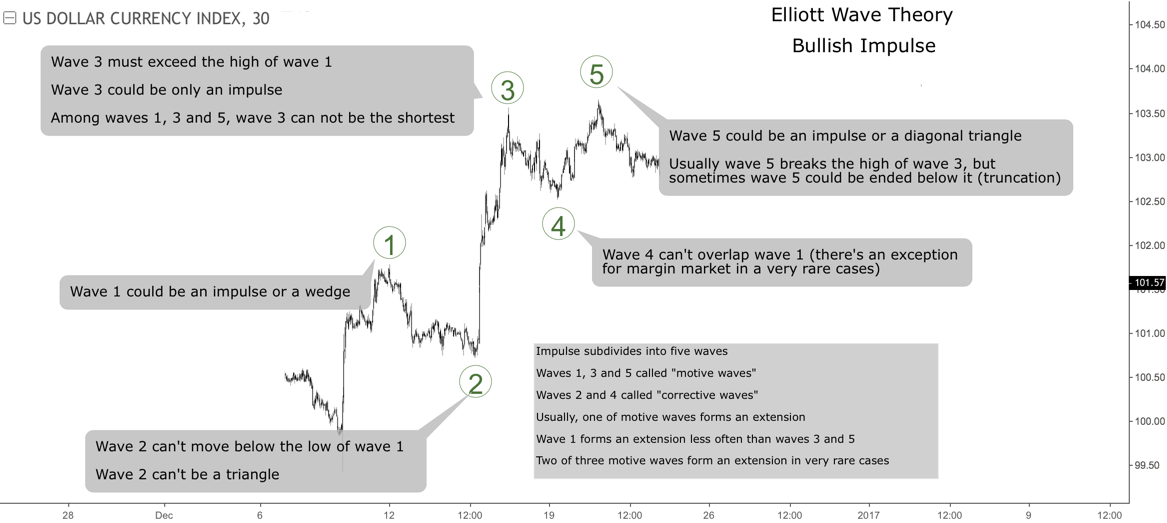

Let’s study a few examples of impulse waves. Here’s a bullish impulse:

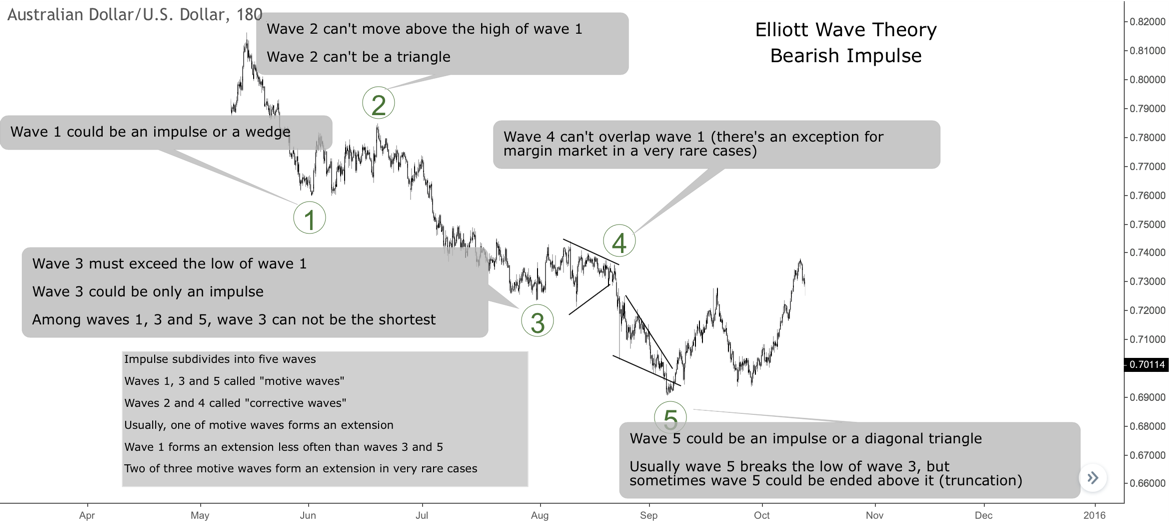

And there’s a bearish impulse:

So, as you can see, we could have bullish (upward) and bearish (downward) impulse waves. In addition, there are certain rules for impulse waves. If a price movement doesn’t fit these following rules, we should label it differently.

It’s just the main rules, but there are also some guidelines as well, which we’re going to examine later. As you can see, the two examples above fully fit the rules, so these price movements were labelled as impulses.

As we know from the rules stated above, wave 4 can’t touch the ending point of wave 1. However, there’s an exception from this rule for margin markets like Forex. So, from time to time, you can see a really short-term overlap between waves 4 and 1. It’s important to understand that this exception is pretty rare, so we shouldn’t label it on a daily basis on every other wave count.

When the fifth wave ends, it’s time for a correction or even for a new trend in a different direction. Actually, it’s all about the context. It’s essential to find out the place of an impulse in a bigger picture, i.e. in the whole wave count.

As we know, the Elliott wave principle works like a Russian nesting doll (Matryoshka), so each impulse is built of smaller impulses. Let’s imagine that we have an impulse, which is supposed to be the first wave of a bigger impulse. In this case, it’s logical to expect just a correction, which could be the second wave.

If we have an impulse as the fifth wave, then it could be a moment for a bigger correction in some form and fashion. So, that’s why ‘it’s all about the context’.

There are two more terms to explain. Sometimes, one or even two (which is quite rare) motive waves (1, 3 or 5) could form an extension. If a wave is extended, it means that it is much longer than the others, so we can observe the inner structure of an extended wave, but we usually can’t do so for not extended waves.

Truncation is related only to wave 5. It simply means that wave 5 can’t reach the ending point of wave 3. This occurs especially when wave 3 forms a huge extension with a massive rally at the end.

As you can see from the chart below, there are a few impulses form different wave degrees on the same chart. So, let’s play this ‘Wave Matryoshka’ game. There’s a huge upward impulse, which labelled as 1-2-3-4-5. Inside wave 3 we could count another impulse like ((i))-((ii))-((iii))-((iv))-((v)). Moreover, we could observe another impulse in wave ((iii)), which is counted like (i)-(ii)-(iii)-(iv)-(v).

There’s an impulse in wave (iii) of ((iii)) of 3 in the chart above (the price movement in orange). Below you can see the 30-minute chart, so we can examine this structure in greater detail and find an impulse i-ii-iii-iv-v inside the wave (iii). At the same time, there’s another impulse ((1))-((2))-((3))-((4))-((5)) of wave iii. Finally, wave ((3)) also subdivides into five waves like (1)-(2)-(3)-(4)-(5).

Now you see that impulses develop other bigger impulses, brick by brick. Sometimes you can find a beautiful impulse structure. Sometimes you also have to deal with ugly impulses as well. However, these structures, from the really beautiful to extremely ugly ones, in most cases follow the main rules and are parts of a wave count for the particular market.

In the next articles, we’re going to find out more about extensions in impulse waves.